Insurance and risk markets are among the largest but most complex sectors in global finance. Traditional insurance involves many intermediaries, extensive documentation, manual claims processing, and tight regulatory scrutiny. This complexity leads to high costs, slow settlement, and inefficiency especially in global or cross-border contexts. One of the most promising ways to modernize this system is through tokenization: representing policies, premiums, and payouts on a blockchain. But tokenizing risk is not as simple as tokenizing a currency or share; it requires privacy, compliance, and flexible rules that fit diverse regulatory environments. This is where privacy-focused blockchains like Dusk can play a critical role.

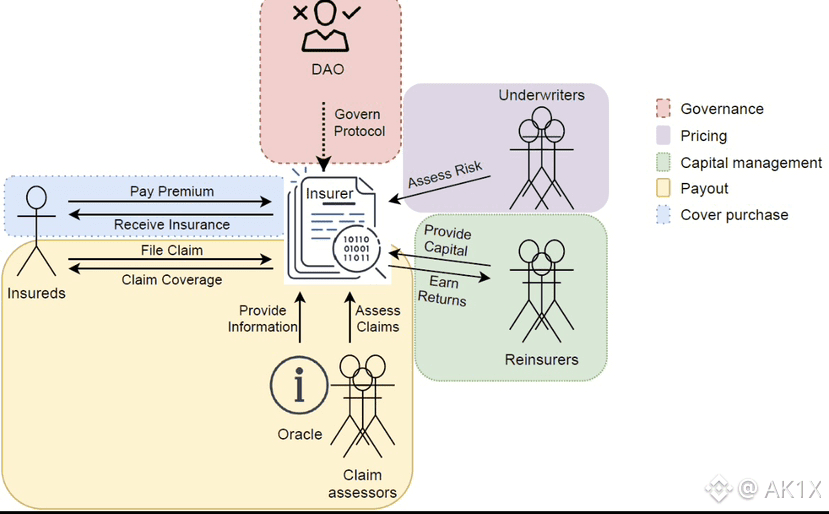

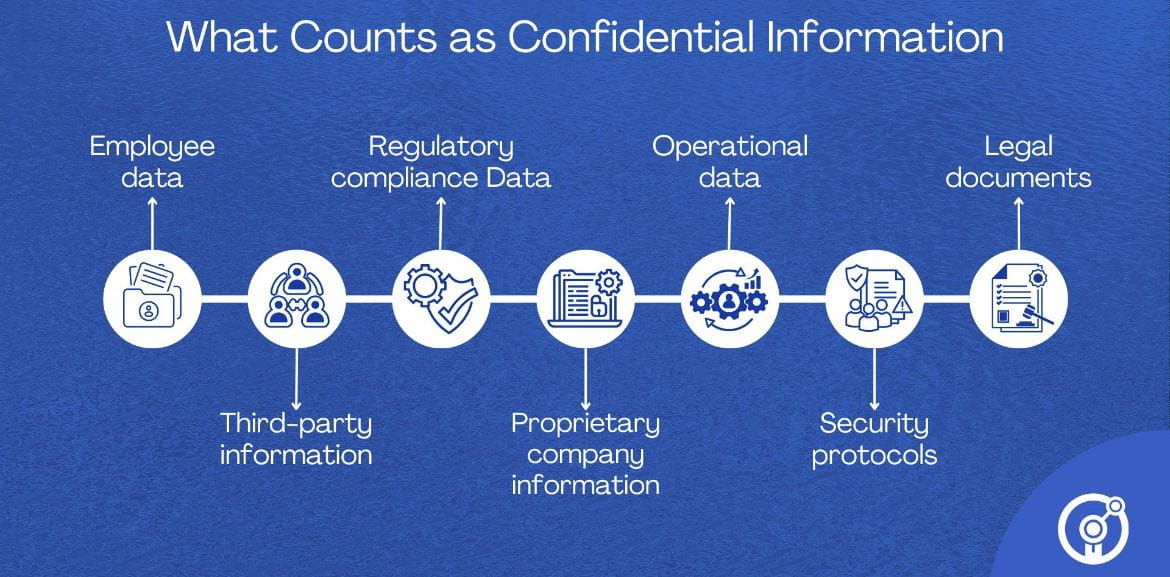

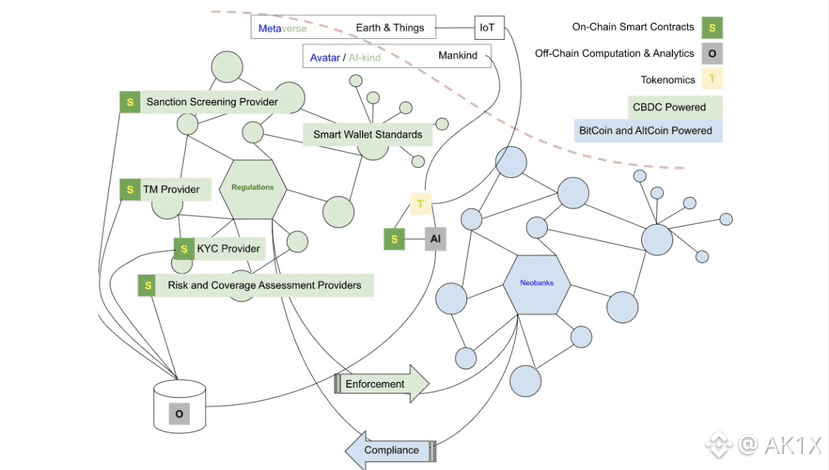

Unlike fully transparent networks, privacy-centric protocols allow risk data such as individual claim histories, policy terms, or proprietary actuarial models to remain confidential while still providing verifiable proof of compliance and correctness. For industries like insurance where sensitive personal or corporate data cannot be public, this balance is essential. Regulators must be able to audit activity, but they should not see raw customer information. Tokenized insurance contracts can issue and settle claims automatically, yet only share necessary proofs with authorized parties.

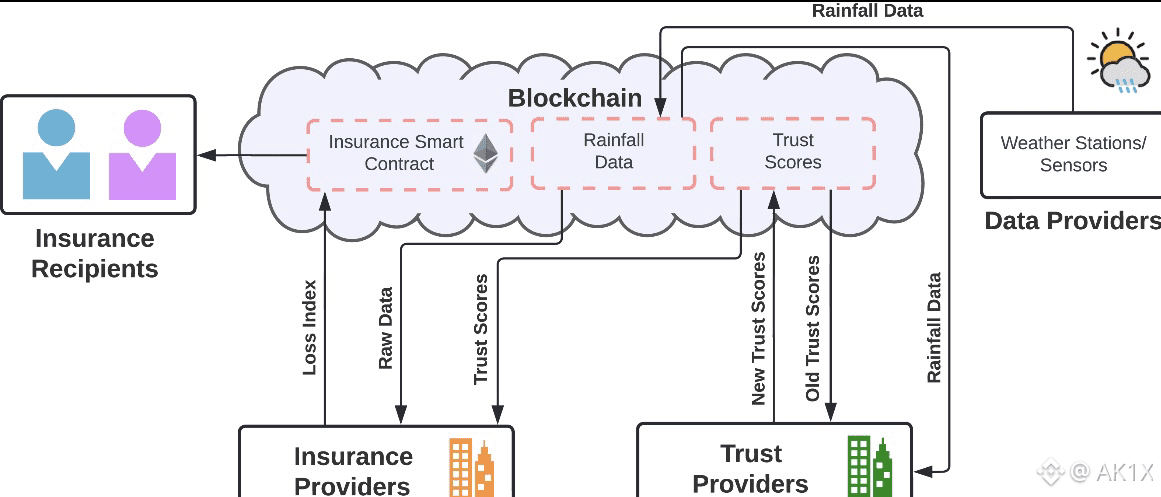

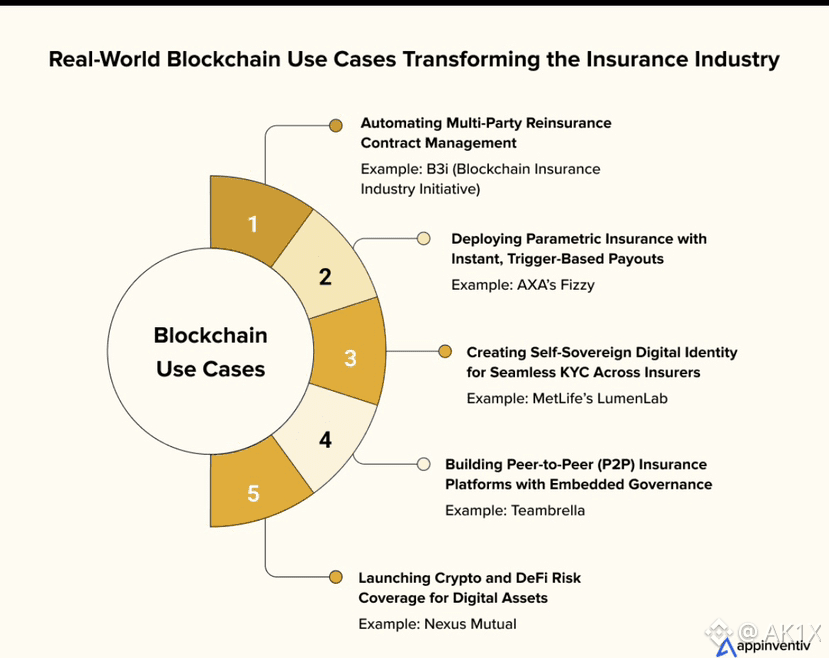

Risk markets such as reinsurance, catastrophe bonds, and parametric insurance are especially suited to tokenization on privacy-aware infrastructure. Parametric insurance, for example, pays out automatically when specific conditions (like weather events) are met. A privacy-focused blockchain can encode these workflows so that the payout condition is provable without exposing detailed data about each policyholder. This reduces friction, removes intermediaries, and improves settlement speed.

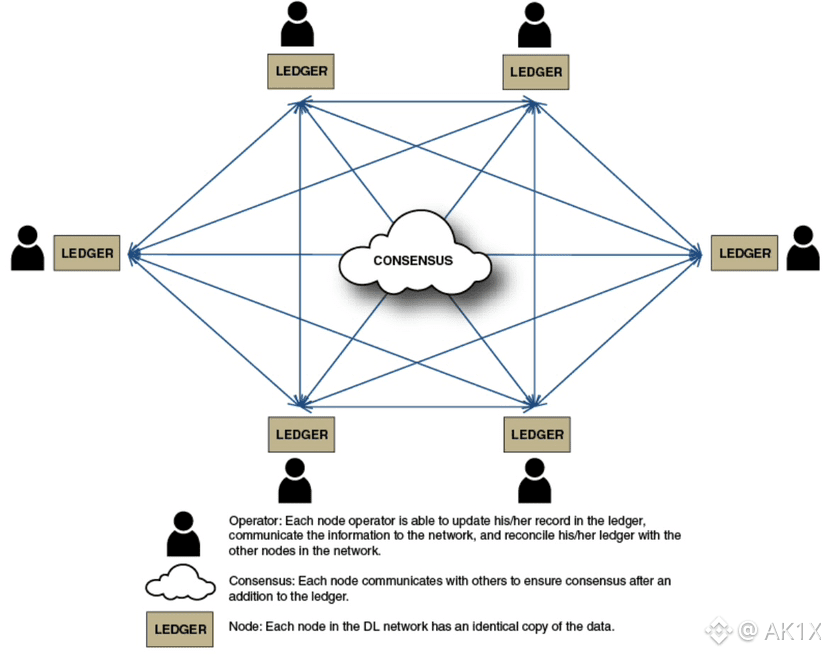

In reinsurance, multiple carriers share portions of a risk portfolio. Data about exposures and claims is typically siloed and confidential. A blockchain that can verify compliance and payout conditions without revealing proprietary datasets allows carriers to participate in shared risk pools with greater trust and lower operational costs.

Another advantage of tokenized insurance on privacy-focused chains is programmable compliance. Legal and regulatory requirements can be encoded as part of the contract logic. This means claims and settlements can be executed not just on objective events, but also in ways that automatically respect jurisdictional rules without manual intervention.

In summary, integrating tokenized insurance and risk markets with privacy-focused blockchain infrastructure creates a framework where confidentiality, transparency, and automation coexist. This blend could significantly lower costs, speed up settlement, and open new opportunities for global risk sharing ushering in a new era of efficient, trustable, and compliant risk finance.