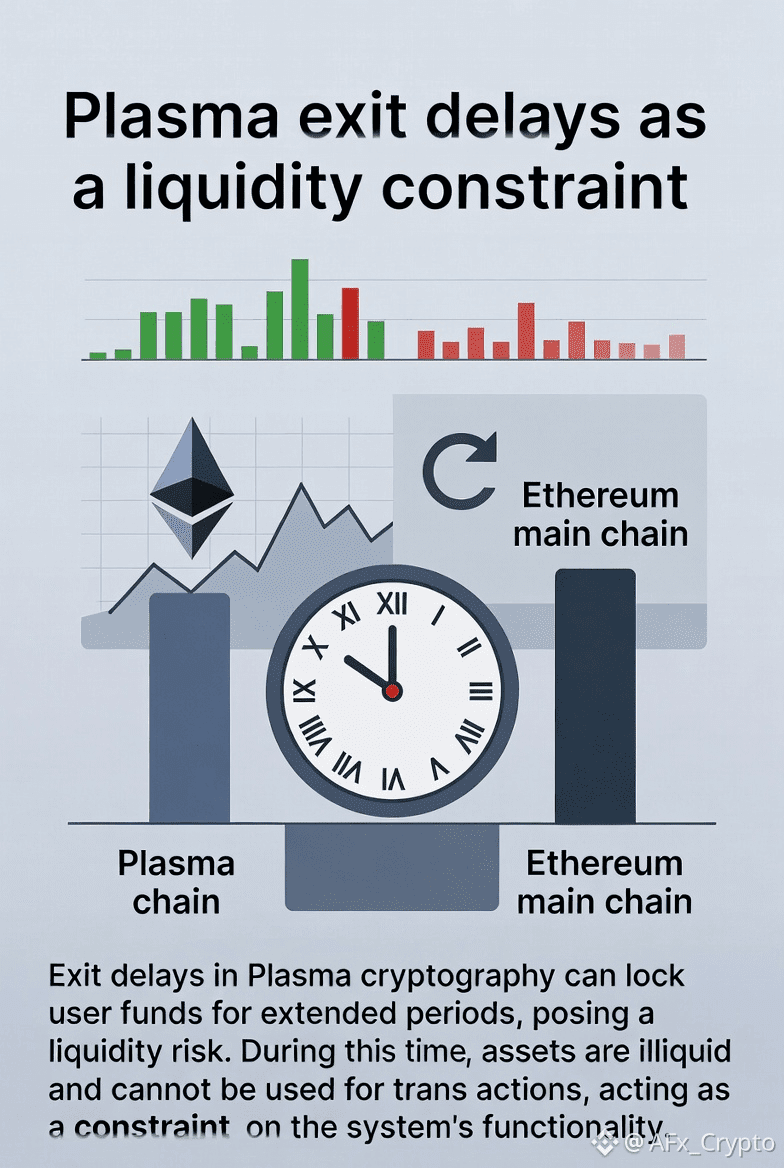

Plasma chains were originally designed to scale blockchains by moving transactions off the main chain while preserving security through fraud proofs. One of their defining features is the delayed exit mechanism, where users must wait through a challenge period before withdrawing funds back to the base layer. While this delay strengthens security guarantees, it introduces important economic side effects that become most visible during periods of market volatility.

In calm market conditions, exit delays are largely ignored. Capital is not under pressure, and users rarely test withdrawal paths. However, when volatility increases, timing becomes a critical variable. At that point, exit latency stops being a technical detail and starts acting as a liquidity constraint.

Exit Latency as a Liquidity Cost

Plasma exit delays exist to allow disputes and fraud proofs to be submitted. This protects users from invalid state transitions, but it also means that liquidity is not instantly accessible. During sharp price movements, users may want to sell, hedge, or reallocate capital quickly. Funds locked behind a multi-day exit window cannot respond to real-time market signals.

As volatility rises, the opportunity cost of delayed exits increases non-linearly. What would otherwise be a manageable delay becomes a source of financial risk. Users are forced to hold exposure longer than intended, potentially amplifying losses during rapid drawdowns.

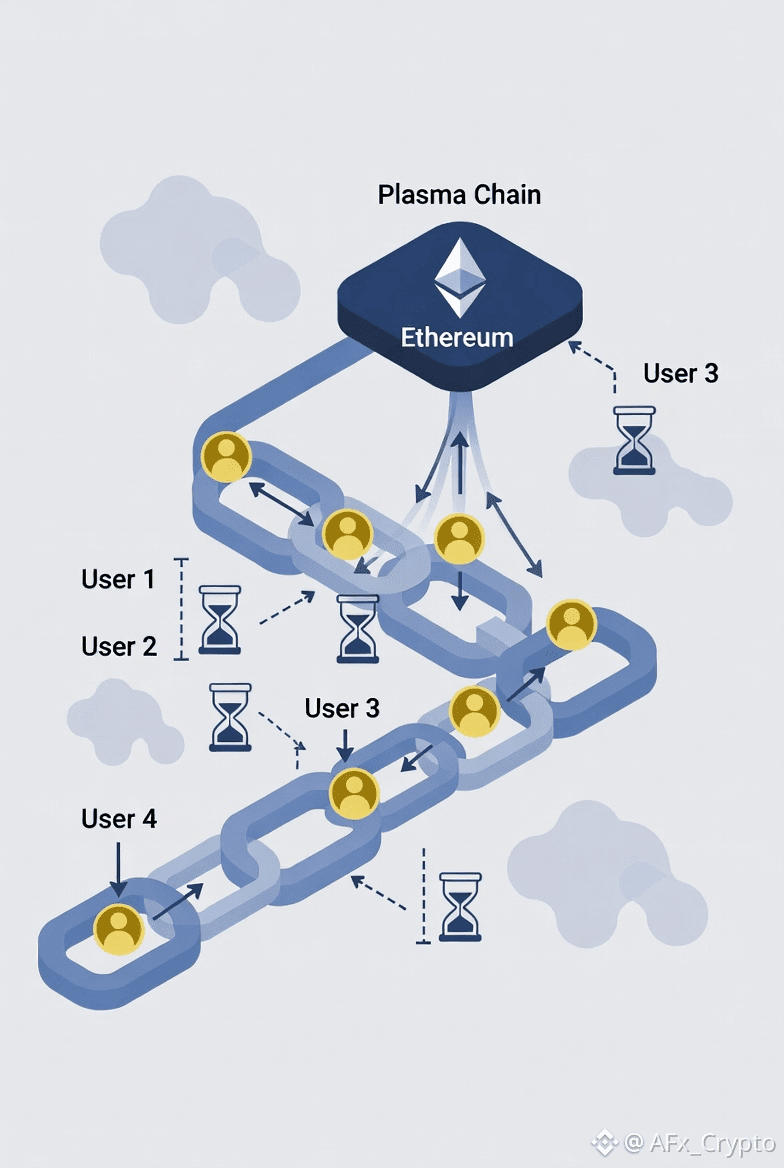

The Mass Exit Coordination Problem

A more systemic issue emerges when confidence in a Plasma chain weakens. If users suspect operator failure, censorship, or malicious behavior, incentives shift abruptly toward exiting as early as possible. This can trigger coordinated withdrawal attempts, commonly referred to as mass exits.

Mass exits place heavy stress on both the Plasma chain and the underlying base layer. In extreme cases, large portions of Plasma state must be published on Ethereum to resolve disputes, significantly increasing gas costs and settlement time. Liquidity that users assumed was available becomes effectively trapped at the moment demand for it is highest.

This dynamic creates reflexivity: fear of illiquidity increases exit pressure, which in turn worsens congestion and delays, reinforcing the original fear.

Impact on Liquidity Providers

For liquidity providers in DeFi protocols, exit timing is an essential part of risk management. LPs continuously balance trading fee income against impermanent loss. When volatility spikes, withdrawing or rebalancing liquidity is often the rational response.

Delayed exits interfere with this strategy. Even if an LP identifies rising risk early, the inability to withdraw immediately can lock capital into deteriorating market conditions. Losses accumulate not because of poor judgment, but because infrastructure prevents timely action. This reduces the attractiveness of Plasma-based environments for active liquidity provision under stress.

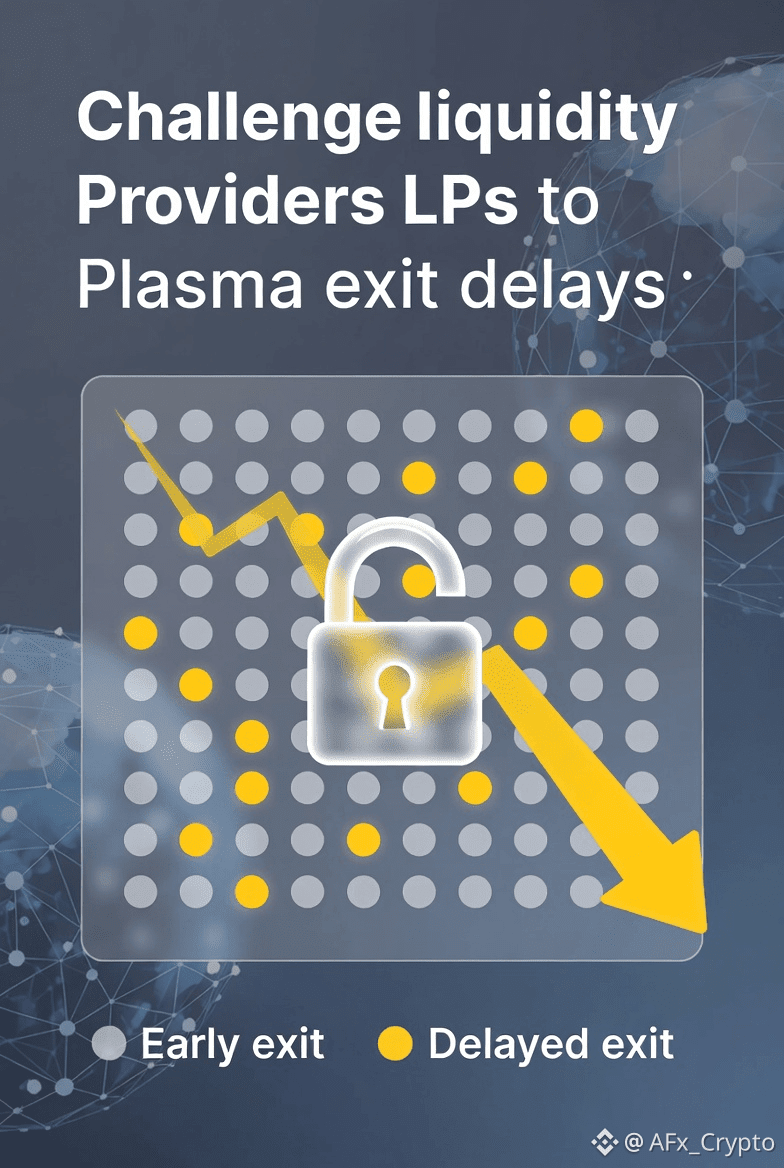

Unequal Outcomes and Exit Asymmetry

Delayed exits can also produce asymmetric outcomes among users. Those who initiate withdrawals early may successfully exit before congestion worsens, while others face extended delays. During downturns, this creates uneven economic results driven by timing rather than intent or strategy.

In practice, delayed exit mechanics can resemble an “exit liquidity” dynamic, where late movers bear disproportionate downside simply because their capital remains locked longer. Security remains intact, but economic fairness becomes less predictable during stress events.

Structural Trade-offs in Plasma Design

Delayed exits highlight the fundamental trade-off Plasma chains make between security and capital efficiency. Challenge periods are effective at preventing fraud, but they impose rigidity on liquidity. In stable markets, this rigidity is invisible. In volatile markets, it becomes a defining limitation.

As users and protocols increasingly demand real-time composability and fast settlement, exit latency is no longer just a security parameter. It is a liquidity risk factor that must be priced, managed, and understood at the infrastructure level.