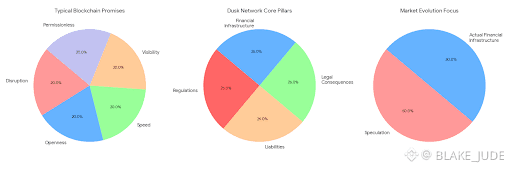

Most blockchains announce themselves loudly. They promise disruption openness speed and a future where everything is visible and permissionless. Dusk took a different route. It emerged in 2018 with a far less glamorous question in mind. What happens when real finance with its regulations liabilities and legal consequences tries to live on a public ledger. That question does not trend well on social media but it sits at the center of whether blockchain technology can move beyond speculation and into actual financial infrastructure.

The uncomfortable truth is that transparency while powerful is not universally desirable. In capital markets opacity is often a feature not a flaw. Positions are protected. Counterparties are shielded. Sensitive data is shared only with those who are legally entitled to see it. When everything is exposed markets do not become fairer. They become brittle. Dusk starts from that premise and builds outward treating privacy not as a moral stance but as an operational necessity.

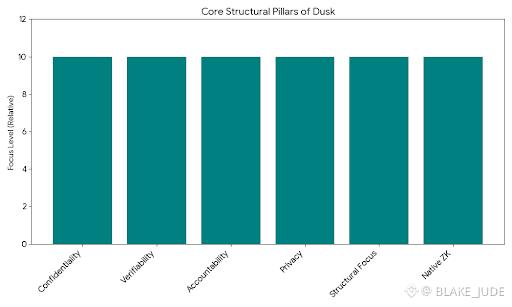

Rather than asking institutions to accept public blockchains as they are Dusk reshapes the blockchain to resemble the financial systems institutions already trust. This does not mean recreating legacy rails on chain. It means preserving the essential mechanics of finance confidentiality verifiability accountability while replacing intermediaries with cryptographic guarantees. The result is a system that feels less like a crypto experiment and more like a settlement layer that happens to be decentralized.

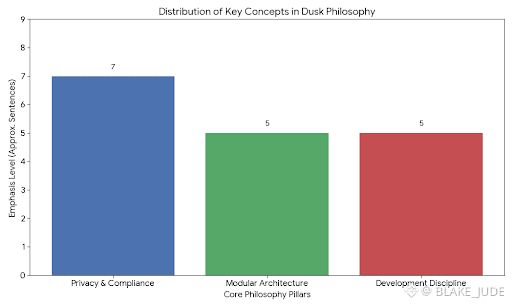

The most striking aspect of Dusk is how deliberately it avoids spectacle. There is no obsession with throughput bragging rights or consumer facing gimmicks. The focus is structural. Transactions are designed so that their validity can be proven without exposing their contents. Ownership can change without broadcasting wealth. Rules can be enforced without revealing who triggered them. This is achieved through native zero knowledge techniques that sit at the protocol level not as optional add ons bolted onto an otherwise transparent chain.

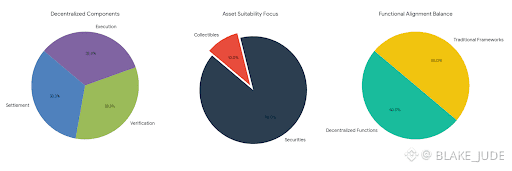

That design choice reshapes what smart contracts can be used for. On many blockchains smart contracts excel at open coordination but fail under regulatory scrutiny. Dusk Confidential Security Contracts flip that equation. These contracts are engineered specifically for regulated assets allowing issuers to encode compliance logic directly into the asset lifecycle. Transfers can be restricted. Eligibility can be verified. Audit trails can exist without becoming public exhibits. It is not abstract theory. It is a framework meant for securities not collectibles.

This is where tokenized real world assets stop being a buzzword and start resembling an industry. Tokenizing a bond or equity instrument is not difficult from a purely technical standpoint. The difficulty lies in preserving investor protections and legal enforceability. Dusk does not pretend those constraints are temporary. It embraces them. By allowing assets to remain confidential while still being provably compliant it removes one of the biggest blockers to institutional tokenization. The fear of leaking sensitive financial data onto a public network.

There is a subtle but important shift here. Dusk is not trying to decentralize everything. It is trying to decentralize the parts that benefit from it settlement verification and execution while allowing governance oversight and legal authority to exist where they already do. This balance is what makes the platform interesting to regulated entities. It does not force ideological alignment. It offers functional alignment.

As the network evolved this philosophy extended into its architecture. Instead of cramming all responsibilities into a single layer Dusk moved toward a modular structure. Execution settlement and compliance tooling can evolve independently while remaining cryptographically linked. This makes the system adaptable without being fragile. For institutions adaptability without unpredictability is critical. Change must be possible but never chaotic.

Privacy however raises immediate concerns. Regulators do not tolerate black boxes. Dusk addresses this through selective transparency. Proof replaces exposure. A regulator does not need to see every transaction to know rules were followed. An auditor does not need full access to balances to confirm solvency. Cryptography becomes a lens that reveals only what is required nothing more. This is not about hiding wrongdoing. It is about minimizing unnecessary disclosure.

From a builder perspective this environment demands a different mindset. Development is slower more deliberate and more constrained. That is intentional. Financial software should be boring in the best way possible. Dusk provides standardized primitives so teams do not have to invent privacy systems from scratch but it still expects discipline. Mistakes in regulated finance do not just cause bugs. They cause lawsuits.

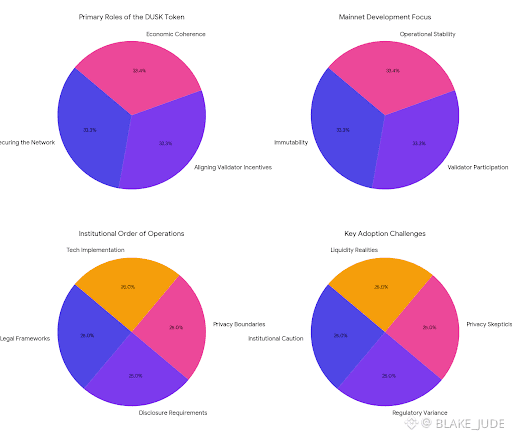

The DUSK token plays a quiet but essential role in this ecosystem. It secures the network aligns validator incentives and maintains economic coherence across layers. The emphasis has always been on reliability rather than hype. Mainnet progress focused on immutability validator participation and operational stability. The kinds of milestones that matter deeply to institutions and barely register elsewhere.

None of this guarantees rapid adoption. In fact it almost ensures the opposite. Institutional finance moves cautiously often frustratingly so. Regulatory clarity varies by jurisdiction. Privacy technology attracts skepticism. Liquidity does not magically appear around private assets. Dusk does not escape these realities. What it offers instead is a system that does not collapse under them.

For teams evaluating Dusk the real work begins before a single line of code is written. Legal frameworks must be understood. Disclosure requirements must be mapped. Privacy boundaries must be defined with precision. Only then does the technology come into play. This order of operations feels backward in crypto but it mirrors how financial infrastructure is actually built.

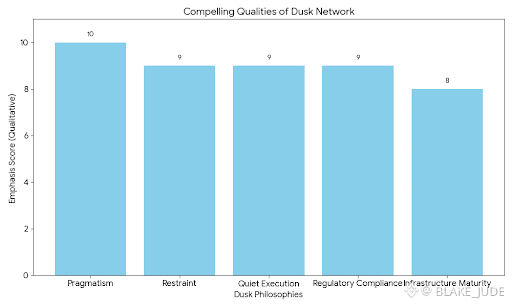

What makes Dusk compelling is not ambition. It is restraint. It does not assume that decentralization alone fixes finance. It assumes finance is complex regulated and risk averse and designs accordingly. In a space dominated by maximalism Dusk is quietly pragmatic.

If blockchains are to mature into systems that move trillions rather than millions they will need to look a lot less like social experiments and a lot more like dependable infrastructure. Dusk does not shout about that future. It simply builds for it.