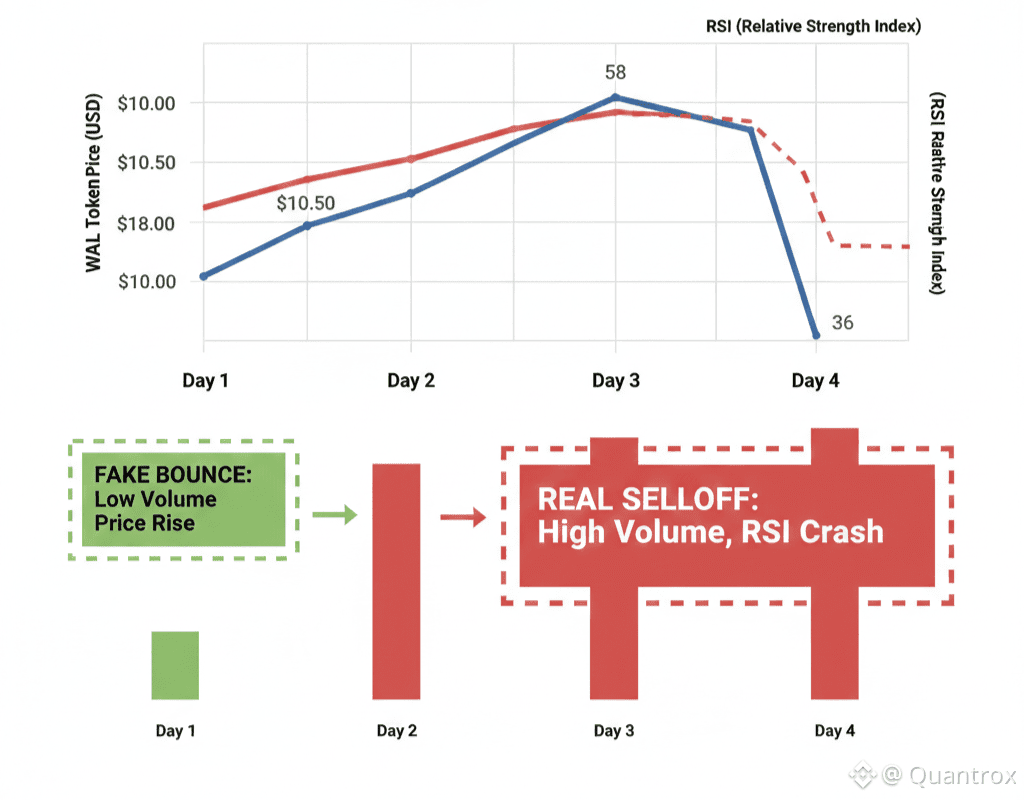

I've been saying the two-day recovery looked suspicious and today confirmed it. WAL sits at $0.1231, down 3.38% with volume exploding to 16.01 million tokens. RSI collapsed from 58.62 yesterday to 36.77 today. The bounce everyone celebrated for two days got completely erased with triple the volume of the recovery. That's not random volatility. That's the market telling you the green days were noise and the selloff is real.

The pattern is brutally clear when you look at the numbers instead of hoping.

Yesterday Walrus traded 4.59 million WAL while going up 0.39%. Day before was 6.08 million WAL on a 3.10% gain. Two consecutive green days on declining volume. I said at the time it looked like seller exhaustion rather than buyer arrival. Today proved it with 16.01 million WAL changing hands as price crashed back down.

Here's what caught my attention. The recovery took two days with combined volume under 11 million WAL. The reversal took one day with 16 million WAL. More tokens moved during the selloff than during the entire bounce. That's not how real bottoms work. Real recoveries build volume as they strengthen. Walrus did the opposite—volume disappeared during green days then exploded during red.

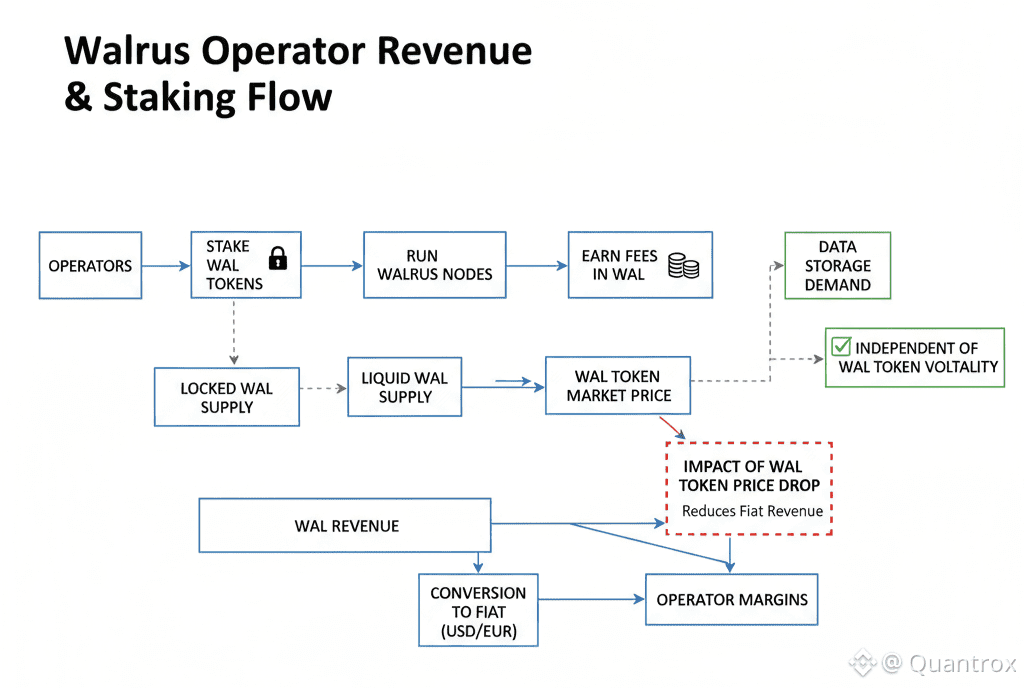

The 105 operators running Walrus infrastructure didn't cause this. They're just running nodes, processing storage, earning fees. But the token dynamics happening in the tradeable float are revealing who actually controls price discovery and it's not committed long-term holders. It's whoever had 16 million WAL to dump today.

Operators have to stake WAL to participate. That stake is locked up with unbonding periods and slashing risks. They can't easily participate in daily trading. The volume we're seeing—both the low volume recovery and high volume selloff—is coming from the minority of supply that's actually liquid. Maybe 20-30% of circulating tokens at most.

Volume of 16.01 million WAL means roughly 1% of circulating supply changed hands in one day. Doesn't sound like much until you remember most supply is locked. Of the tokens that can actually trade, a meaningful percentage just sold. This wasn't minor profit-taking. This was real distribution happening with conviction.

The circulating supply of 1.58 billion WAL includes all those locked tokens. If you only count freely tradeable float—the WAL that's not staked, not delegated, not locked in long-term holds—16 million is a much bigger percentage. Maybe 5-7% of truly liquid supply moved today. That's substantial.

Here's what makes this particularly damaging. The bounce to $0.1298 yesterday created hope that the worst was over. RSI above 50, two green days, narrative shifting toward recovery. Then today wiped all that out with authority. Not just giving back gains but breaking below previous support levels. The $0.1220 low today is lower than the $0.1230 low from the previous selloff.

My gut says whoever was selling today waited for the bounce to finish. Let the price recover a bit, let RSI climb into neutral territory, let volume dry up completely. Then dump into that low-liquidity environment knowing there's no real buy support. Classic distribution pattern where sellers use bounces to exit at better prices than they'd get during panic.

The RSI collapse from 58.62 to 36.77 is a 22-point drop in one session. That's violent momentum reversal. Yesterday I wrote about how RSI breaking 50 might not mean much in a thin market with locked supply. Today confirmed that skepticism. The RSI surge was meaningless. First real selling pressure came back and momentum collapsed immediately.

Epochs on Walrus last two weeks. We're mid-epoch right now. Storage pricing was set days ago and won't change until the next boundary. Applications that paid for capacity aren't affected by today's price action. They've got storage through the epoch regardless of what WAL does. But the disconnect between stable infrastructure and volatile token price is getting harder to ignore.

The pricing mechanism where operators vote at 66.67th percentile doesn't change with daily price moves. Storage costs stay locked for the epoch. But operator revenue in fiat terms just dropped 3.38% today. Every storage fee earned in WAL is worth less in real money. That doesn't break operations short-term but it chips away at sustainability if the trend continues.

Walrus processed over 12 terabytes during testnet and now handles 333+ terabytes on mainnet. That growth happened while the token collapsed from $0.16 highs to current $0.1231. Applications using Walrus clearly aren't stopping because of price. But new applications evaluating the protocol might hesitate when they see this kind of volatility in the payment token.

The 17 countries where Walrus operators run infrastructure create geographic decentralization. But that distribution doesn't help token stability. Nodes in every region are earning revenue in WAL that's losing value. Hardware costs are in fiat. Bandwidth costs are in fiat. Operator margins compress when WAL falls regardless of how decentralized the infrastructure is.

What you'd want to know is whether today's volume spike represents final capitulation or just the beginning of larger selling. 16 million WAL is a lot for one day but it's not crazy relative to circulating supply. If there's more to come—more holders deciding to exit, more unlocks hitting the market, more distribution happening—this could continue for a while.

Walrus infrastructure keeps running regardless. Storage nodes don't shut down because the token dropped 3.38% in a day. Applications don't stop storing data because RSI fell into oversold. The operational layer is independent of trading dynamics. But the economic sustainability depends on WAL maintaining enough value to make operator economics work. There's some floor where it stops making sense to run expensive infrastructure for revenue in a collapsing token.

We're not there yet. Operators who invested in hardware months ago are committed for the medium term regardless. But new operators evaluating whether to join Walrus are watching this price action and doing math. If the trend continues, operator count might stop growing or even decline as marginal participants quit.

The bet Walrus operators made is that storage demand grows faster than token price falls. Today tested that thesis hard. Demand side is invisible—we can't easily track storage growth in real-time. Supply side is very visible—16 million WAL sold with conviction. The imbalance is showing up in price because demand isn't obviously overwhelming selling pressure.

Here's the uncomfortable reality. The two green days everyone celebrated were fake. Low volume, declining participation, momentum on life support. Today was real. High volume, actual conviction, sellers showing up with size. The market told you which move mattered and it wasn't the bounce.

Time will tell whether Walrus finds support here or continues lower. The RSI at 36.77 is oversold but oversold can get more oversold. Volume at 16.01 million is high but could go higher. The infrastructure keeps operating but token dynamics are working independently of actual network usage. That disconnect creates space for volatility to run without fundamental justification either direction.

For now the fake bounce got exposed. The volume that was missing during recovery showed up for the selloff. That's about as clear a signal as markets give you about which direction has conviction behind it.