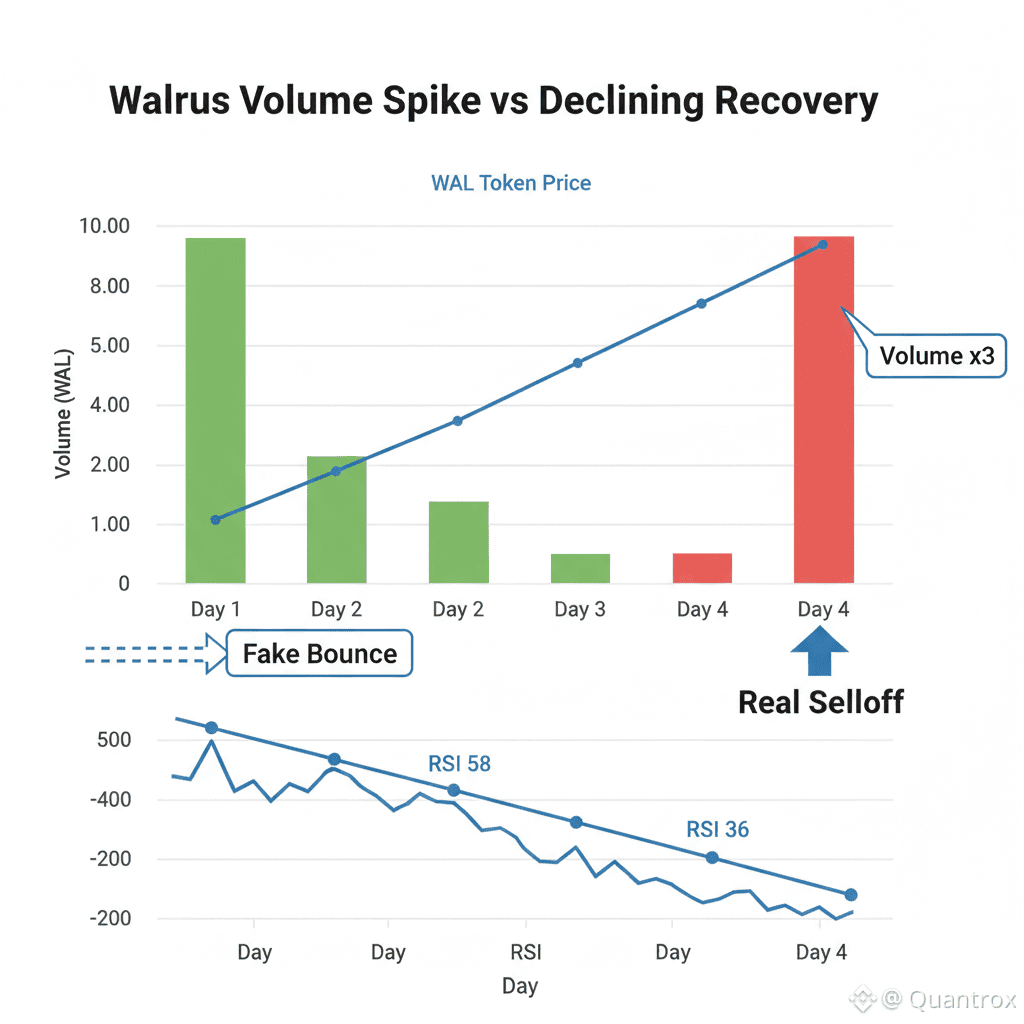

I've been tracking Walrus volume patterns for weeks and today's spike tells you everything about market structure that price alone misses. WAL sits at $0.1231, down 3.38% with volume hitting 16.01 million tokens compared to yesterday's 4.59 million. That's a 3.5x increase in participation happening during a selloff. When volume finally shows up and it's all selling, that's not noise. That's the market showing you where conviction actually lives.

Volume patterns reveal what price movements obscure. High volume confirms trends. Low volume suggests uncertainty or exhaustion. Walrus just gave us the clearest signal in weeks.

The recovery days had declining volume. 7.41 million WAL on the first green day, 6.08 million on the second, 4.59 million yesterday. Each successive session saw less participation even as price stayed positive. That's classic distribution—insiders selling into optimism while retail celebrates green candles. Volume drying up during rallies is bearish, not bullish.

Here's what caught my attention. The moment real volume returned, price collapsed. 16.01 million WAL traded today with WAL down 3.38%. Three times yesterday's volume, all of it selling pressure. That's not random. That's holders who were waiting for the bounce to finish so they could exit at better prices than the panic lows.

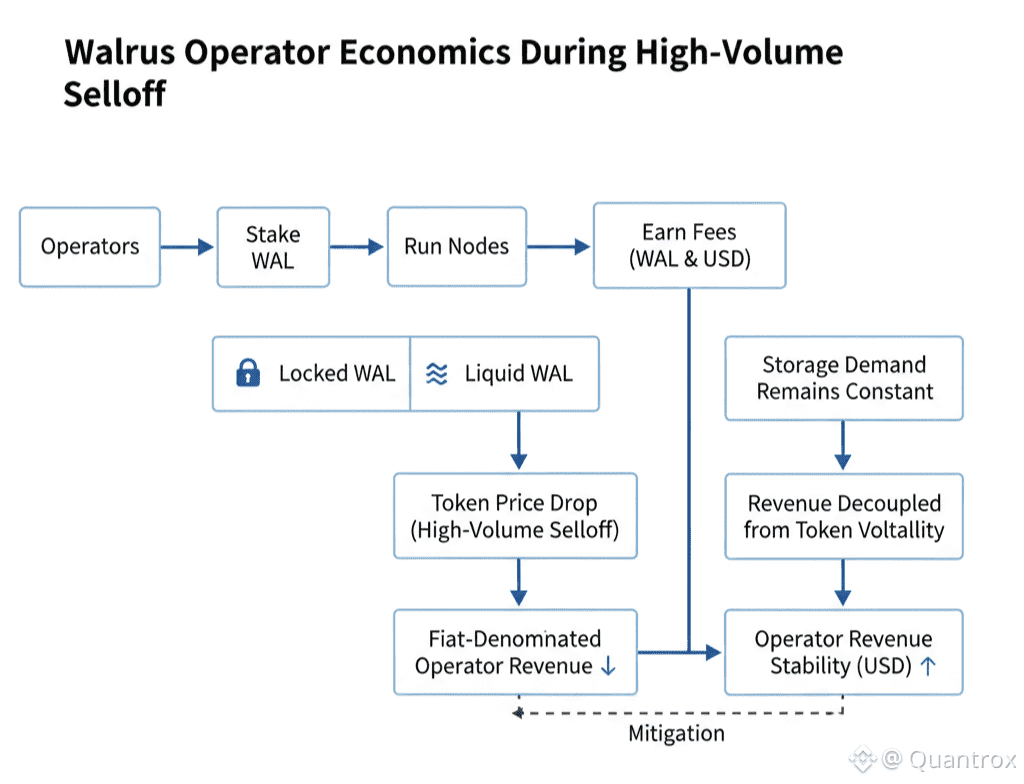

The 105 operators running Walrus storage nodes aren't participating in this volume. They've got WAL locked in stakes with unbonding periods. They can't just decide to sell 16 million tokens on a random Saturday. This volume is coming from the liquid float—the minority of supply that's actually tradeable on short notice.

Operators have to stake WAL to run infrastructure. They earn fees in WAL. They get slashed in WAL if they fail. Their entire economic model is denominated in the token regardless of fiat value. Today's 3.38% drop doesn't change their operations. But the volume pattern revealing where market conviction sits should concern anyone thinking about joining as a new operator.

Volume of 16.01 million WAL in USDT terms is $2.07 million. Compare that to yesterday's $581k. The selling pressure today was 3.5x higher than yesterday's entire trading activity. That's not marginal profit-taking. That's real distribution happening with size behind it.

The circulating supply of 1.58 billion WAL means today's volume was about 1% of total circulating tokens. Sounds small until you remember maybe 70-80% of supply is locked. Of the tokens that can actually trade freely, today moved a meaningful chunk. Maybe 4-5% of truly liquid supply changed hands. That's material reallocation.

Here's what makes this volume spike particularly meaningful. It broke the pattern. For days, volume had been declining steadily. Markets don't bottom on declining volume—they bottom on volume spikes that exhaust sellers. Walrus hasn't had that volume spike at the lows. Instead, volume spiked during a move down. That's continuation pattern, not reversal.

My gut says more volume is coming and it's probably not buyers. The holders who wanted to exit at $0.13 got their chance during the bounce. The holders who wanted to exit at $0.12 are getting it now. But there are probably holders who'll want to exit at $0.11 if we get there. Volume begets volume in one direction until something fundamental changes.

The RSI dropped from 58.62 to 36.77 today. That's a massive momentum shift. But the volume context makes it more significant. RSI can fall on low volume and mean nothing. RSI falling on 3.5x normal volume means real selling pressure, not just thin market volatility. The momentum collapse is confirmed by participation increase.

Epochs on Walrus last two weeks. Storage pricing gets set at boundaries and doesn't change mid-epoch. Today's price action doesn't affect applications that already paid for capacity. They're covered through the epoch regardless. But the volume pattern revealing persistent selling pressure might affect decisions at the next epoch boundary about whether to renew.

The pricing mechanism where operators vote at 66.67th percentile assumes some stability in WAL value. When volume triples and it's all selling, that assumption gets tested. Operators voting on next epoch pricing have to account for the possibility that WAL keeps falling. If they vote too low, they don't cover costs. If they vote too high, applications might not renew.

Walrus processed over 12 terabytes during testnet when volume was zero because there was no token. Now processing 333+ terabytes on mainnet while volume spikes reveal selling conviction. The infrastructure usage doesn't correlate with trading dynamics. Applications storing data aren't checking volume patterns before uploading files. They're evaluating technical capability and pricing.

The 17 countries where Walrus nodes operate create distributed infrastructure. But distribution doesn't help when volume concentration shows selling pressure. Doesn't matter if nodes are spread globally if the token holders are all trying to exit through the same narrow liquidity window. Geographic decentralization of infrastructure doesn't translate to token stability.

What you'd want to know is whether today's volume spike exhausted sellers or just marked the beginning. 16 million WAL is high for recent activity but not extreme in absolute terms. If there's an overhang of holders wanting to exit, today might have been 20% of the distribution or 80%. Hard to know without seeing how next sessions develop.

Walrus infrastructure keeps operating through all of this. Storage nodes don't care about volume patterns. They process availability challenges, serve data, collect fees. The operational layer is insulated from trading dynamics short-term. But operator economics depend on WAL maintaining some minimum value. If selling continues and volume keeps confirming downward momentum, eventually the token price affects whether running infrastructure makes financial sense.

The bet operators made when joining Walrus was that network usage would grow enough to offset token volatility. Today's volume pattern tested that bet. Usage growth is hard to track in real-time. Selling pressure just announced itself with 16 million WAL worth of conviction. The imbalance is visible even if we can't see both sides clearly.

Here's what's clear though. Volume spoke today after being absent for days. What it said was unambiguous—selling pressure dominates. Not in thin, low-conviction trading. In 3.5x normal volume with clear directional intent. That's a market telling you something if you're willing to listen.

The two green days that preceded today had volume dying. Participation declining. Momentum fading. Classic signs of a failing rally. Then real volume returned and confirmed the rally was fake. The volume increase happened during selling, not buying. That's trend confirmation, not reversal signal.

Time will tell whether this volume spike marks capitulation or just the start of larger distribution. What's certain is that when Walrus finally got meaningful volume after days of declining participation, it came with selling conviction. Price fell 3.38% on triple the participation. That's not ambiguous. That's the market showing you where real conviction sits—with sellers, not buyers.