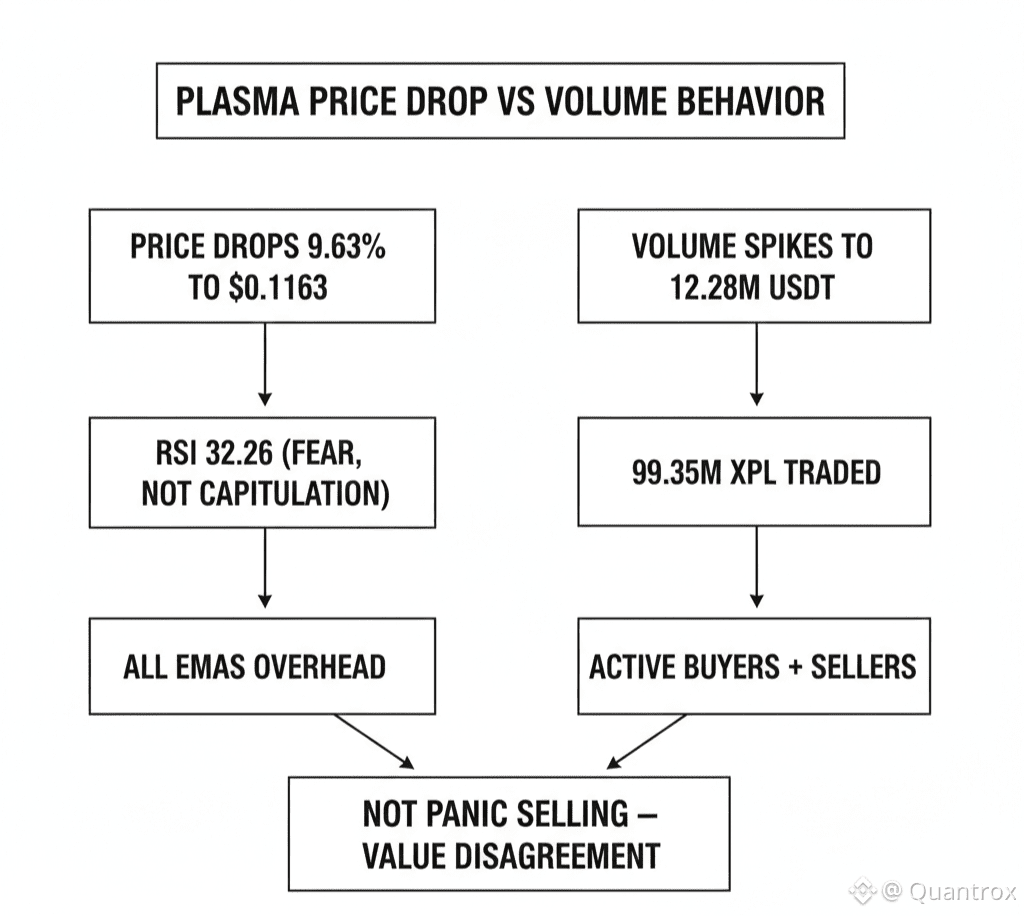

I've been in crypto long enough to recognize panic selling when I see it. Sharp drops on heavy volume usually mean someone big decided to exit, or leverage liquidations cascaded, or some news hit that I haven't seen yet. When Plasma dropped 9.63% today down to $0.1163, my first instinct was to check if something broke. Some exploit or rug pull or team drama that would explain the sudden move.

But nothing obvious showed up. No announcements about hacks. No team members dumping tokens publicly. No protocol failures. Just Plasma ($XPL) getting hit hard on volume that's actually higher than normal, which is the weird part that doesn't fit the usual panic selling pattern.

XPL is trading at $0.1163 right now, down 9.63% on the day with volume sitting at 12.28M USDT. That's higher volume than we've seen in weeks. The 24-hour range went from $0.1158 to $0.1310, which is a pretty violent swing for what's usually a relatively stable trading range. RSI crashed to 32.26, which puts it approaching oversold territory but not quite there yet. Below 30 would be extreme fear. At 32 it's just regular fear.

Looking at the 4-hour chart of XPL, price is sitting well below every moving average that matters. EMA(20) is at $0.1252, EMA(50) at $0.1307, EMA(200) way up at $0.1529. Technically this looks terrible. MACD at -0.0004, DIF at -0.0017, DEA at -0.0014, all negative and pointing down.

But here's what bothers me about this selloff. Volume on Plasma spiked to 12.28M USDT, which is significantly higher than the 9.04M we saw yesterday or the typical 8-10M range. Usually when price drops this hard, volume comes from forced liquidations or panic selling where people just want out at any price. That volume disappears as fast as it showed up once the selling exhausts itself.

This volume feels different though. The 24-hour XPL volume hit 99.35M tokens, which suggests actual trading activity not just people dumping into thin order books. Someone was buying while others were selling. That's not panic. That's disagreement about value, which is way more interesting than coordinated exits.

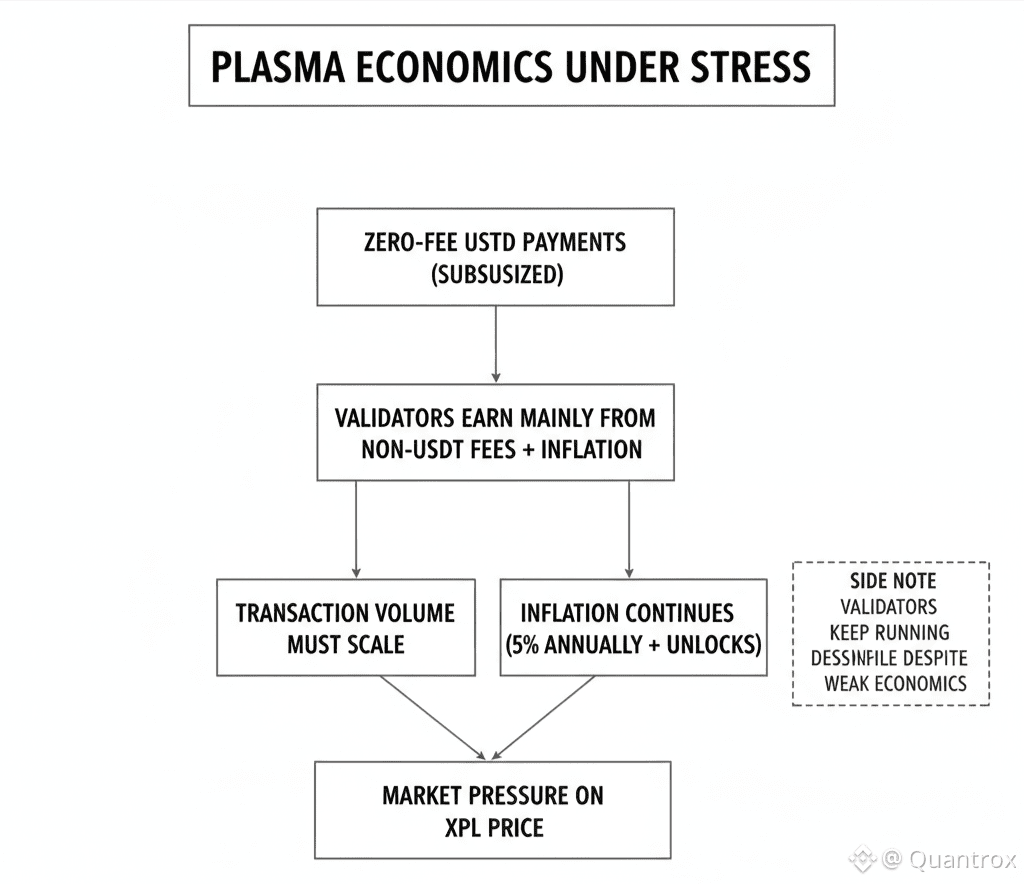

Plasma launched with this whole zero-fee USDT transfer narrative that sounded great until you thought about the economics for more than five minutes. Subsidizing your main product only works if you're making enough money elsewhere to cover the subsidy forever. The model depends on fees from non-USDT transactions getting burned through EIP-1559 to offset the 5% annual inflation from validator rewards.

The math only works if Plasma processes massive transaction volume. Not just DeFi leverage on Aave. Actual payment transactions from merchants, remittances, payroll, real economic activity that generates fees. Without that, the protocol just slowly bleeds value as inflation outpaces burn rate. At $0.1163, the market is clearly saying it doesn't believe volume will scale enough.

Maybe the market's right. Most blockchain payment projects never get adoption beyond speculation. The ones that claim millions of transactions usually turn out to be wash trading or bot activity that disappears when you look closely. Real payment adoption requires convincing merchants to accept crypto, consumers to spend it, and both sides to deal with volatility and complexity that traditional payments don't have.

But Plasma did launch with $2 billion in stablecoin deposits on day one. Aave deployment hit $5.9 billion within 48 hours and still holds over $1.5 billion in active borrowing. Ethena put USDe and sUSDe on Plasma with a billion in capacity. These weren't token partnerships for marketing purposes. Real protocols deployed real liquidity because they saw something worth building on.

The question is whether DeFi liquidity means anything for payment adoption. Probably not directly. Someone borrowing USDT on Aave to leverage trade doesn't care about Plasma's payment infrastructure. They care about yields and leverage ratios. The DeFi users and payment users are mostly different people with different needs.

What Plasma DeFi activity does prove is that the infrastructure works at scale. Validators can secure billions in value. The network handles high transaction throughput without breaking. Smart contracts execute reliably. That's necessary foundation for payments but nowhere near sufficient.

The Plasma Card thing they announced is more relevant to actual payment adoption. Currently 30 people using it internally with over $10k daily volume. That's tiny scale, basically testing phase, but at least it's a real payment product instead of just blockchain infrastructure that nobody uses. Whether it works depends on competing with credit cards that already function everywhere and don't require explaining anything about blockchain to users.

Staking launches Q1 2026 which creates new utility for XPL beyond transaction fees. Validators will compete for delegated stake based on uptime and commission structures. That competition should improve service quality but it also means validators need to market themselves to attract delegators. Adds operational overhead beyond just running nodes efficiently.

More importantly, staking locks supply which might help with the catastrophic unlock hitting July 2026. That's 25% of total supply potentially dumping on markets. For context, XPL already lost 85% of its value between October and January when supply only increased 4.33% from smaller unlocks. If minor dilution caused that damage, July could be absolutely devastating for Plasma unless staking demand absorbs a massive chunk of that supply.

Next unlock is January 25, just days away. Releasing 88.89 million XPL for ecosystem development, worth about $10.34 million at current $0.1163 price. That's 0.89% of total supply. Not huge individually but it's part of steady monthly dilution that keeps compounding. Models suggest approximately 106 million XPL unlocking every month starting mid-2026.

Today's 9.63% drop to $0.1163 puts XPL down 84% from the $0.73 launch price in September. That's brutal even by crypto standards. The question is whether this is capitulation before recovery or just another step down in a slow death spiral. The technical indicators don't help much because they're all lagging. RSI at 32.26 suggests oversold conditions where contrarian buyers might step in, but it could easily drop to 20 or lower if selling continues.

What I keep coming back to is the volume. 12.28M USDT is elevated compared to recent averages. The 5-day MA for volume is 18.74M and the 10-day MA is 13.72M, so today's volume is right in that range but on the higher end. That means real activity, not just token slowly bleeding on no volume. Someone's actively trading Plasma even as it crashes, which suggests disagreement about where this goes next.

Competition for Plasma hasn't gotten any easier. Tron still dominates cheap USDT transfers with infrastructure that just works. Ethereum has the deepest liquidity despite expensive gas. Solana keeps attracting new stablecoin projects. The window for Plasma to establish itself keeps narrowing as more specialized payment chains launch with similar value propositions.

Plasma's edge is supposed to be the zero-fee USDT model if the economics actually work long-term. Bitcoin security integration when it launches could provide censorship resistance for use cases that need it. Institutional backing from Tether and Bitfinex means they probably don't run out of funding during bear markets. But none of that matters unless Plasma converts advantages into measurable adoption.

The crash to $0.1163 today hurts but Plasma infrastructure keeps functioning. Validators keep running nodes. Aave keeps processing loans. The network hasn't death spiraled where falling price triggers validator exits which kills security which causes more panic selling. That resilience suggests something real underneath the price chaos, though it could also just mean validators are locked in with nowhere else to go.

Whether Plasma survives depends entirely on the next six months. Can staking lock enough supply to handle July unlocks? Does the Plasma Card get real users beyond internal testing? Do payment applications actually launch and process meaningful volume? Those questions don't have answers yet based on today's price action.

For now Plasma keeps running and validators keep staking despite economics that don't obviously favor them yet. That's more than most payment blockchain projects manage. Whether it's enough to build something lasting or just delays the inevitable remains to be seen.