I've analyzed validator sets for enough proof-of-stake chains to recognize patterns instantly. Most projects claiming decentralization have 60-70% of nodes clustered in three data centers, usually AWS, Hetzner, and OVH. Geographic distribution maps look impressive in marketing materials until you realize half the "independent" operators are running identical VPS instances in the same Frankfurt facility. It's decentralization theater—technically distributed but functionally centralized because one facility outage kills consensus.

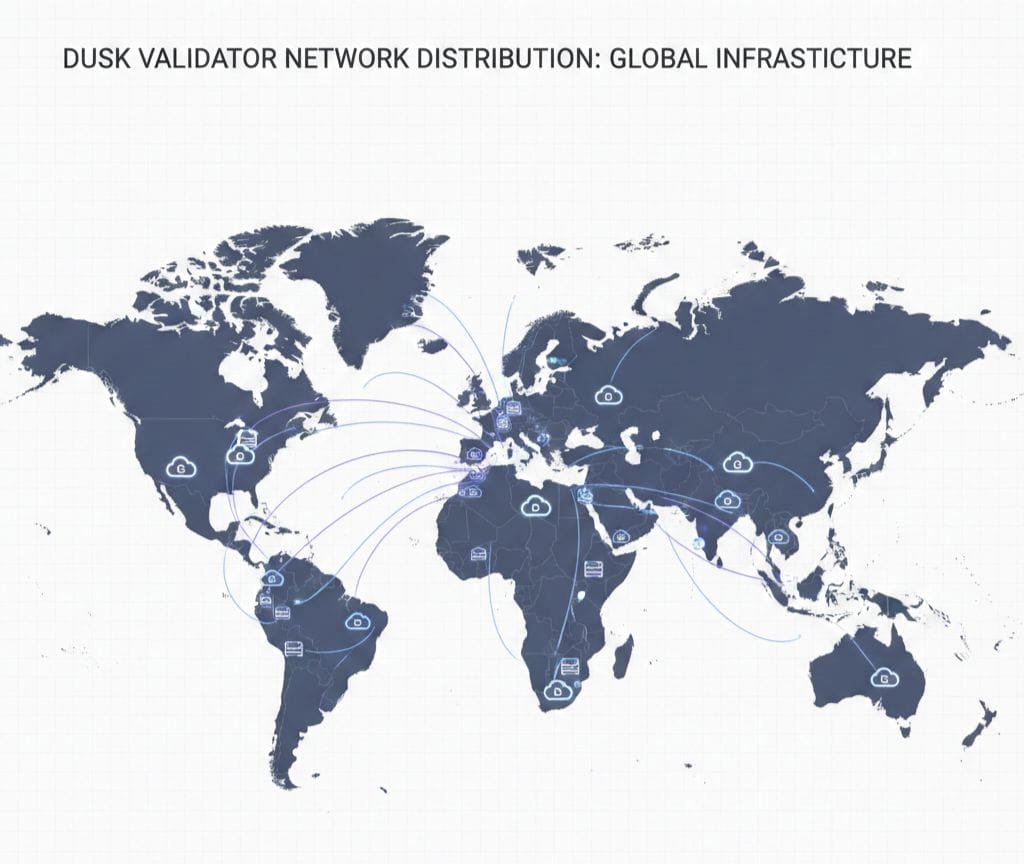

When I started mapping where Dusk's 270+ node operators are actually running infrastructure, I expected the same clustering. Operators choosing cheap reliable hosting in major data centers because that's rational behavior when you're trying to maximize uptime while minimizing costs. Instead, Dusk's validator distribution looks deliberately inefficient in ways that suggest operators care more about resilience than cost optimization.

That behavior doesn't match normal economic incentives, and I can't figure out why Dusk operators are choosing harder operational models unless they're planning for scenarios most validators ignore.

Dusk trades at $0.1655 today, up 21.42% with the 24-hour high hitting $0.2200 before pulling back. Volume is 31.58 million USDT on 174.94 million tokens, which is modest for the size of the price movement. RSI sits at 47.34, neutral after the rally. MACD positive at 0.0028 shows momentum shifting bullish. Normal post-spike consolidation happening while the underlying infrastructure keeps running regardless of price action.

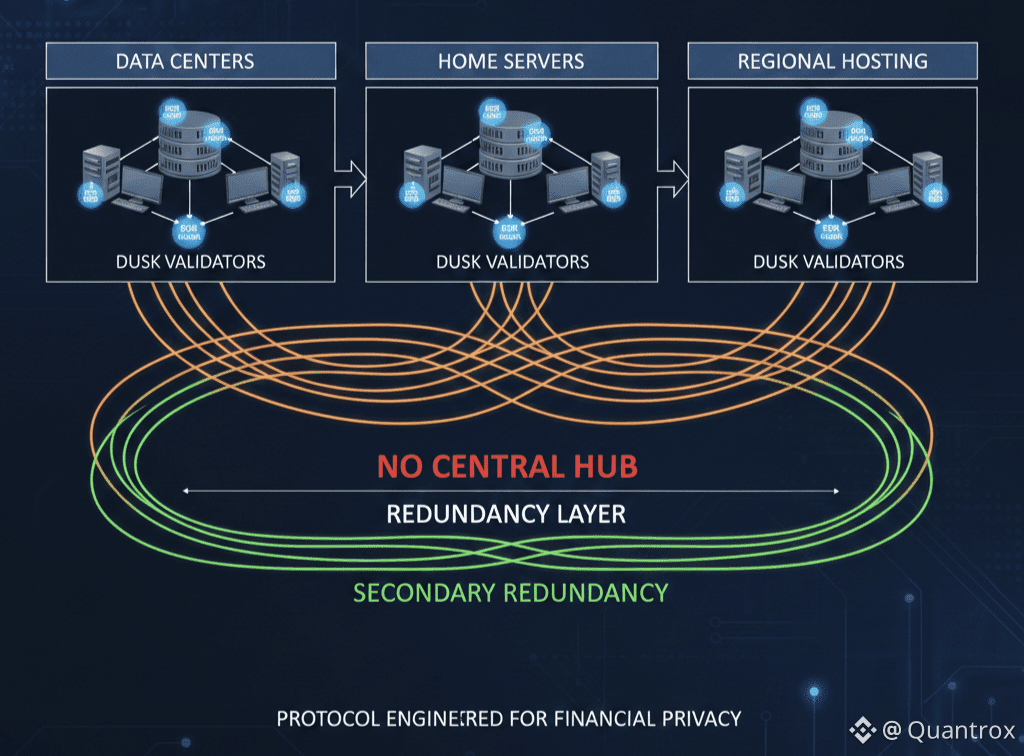

What's unusual is how Dusk operators are distributed geographically and across hosting providers. You've got nodes in North America, Europe, Asia, with meaningful numbers in each region instead of concentration in one timezone. Different hosting providers—not just the big three that everyone defaults to. Mix of cloud infrastructure and bare metal servers. Some operators running from home connections with proper failover, which is insane from a cost perspective but makes sense if you genuinely care about avoiding single points of failure.

That diversity costs real money and operational complexity. Coordinating infrastructure across multiple regions means dealing with different providers, different network characteristics, different regulatory environments. It's objectively harder than spinning up twenty identical instances in the same AWS region and calling it decentralized. Dusk operators are choosing the harder path deliberately.

My gut says they're preparing for adversarial scenarios most validators don't think about. Government pressure on data centers. Provider-level censorship. Regional internet outages. The kind of failure modes that only matter if you believe Dusk will eventually process transactions that powerful entities might want to stop.

Securities trading is the obvious candidate. If Dusk becomes infrastructure for €300 million in tokenized assets through DuskTrade and NPEX, suddenly the network isn't just another DeFi protocol. It's financial infrastructure that regulators care about, that issuers depend on, that could face pressure from entities who don't like specific transactions happening.

Geographic and provider diversity protects against those scenarios. You can't pressure all the operators simultaneously when they're spread across different jurisdictions under different legal frameworks. You can't compel a hosting provider to shut down the network when no single provider hosts majority consensus. That redundancy only matters if you expect attacks sophisticated enough to target infrastructure providers rather than just the protocol itself.

Maybe I'm reading too much into deployment patterns. Could be coincidence that Dusk operators happen to be geographically distributed. Could be early adopters from different countries who independently decided to run nodes without coordinating distribution deliberately. Could be Dusk team encouraged diversity without operators understanding why it matters beyond vague decentralization principles.

But here's what doesn't fit those explanations. The distribution isn't random. It's strategic enough to avoid concentration in ways that suggest planning. Multiple operators in different jurisdictions running redundant setups that cost more than necessary unless you're specifically avoiding single points of failure.

Traditional finance already provides the blueprint for why this matters. Clearinghouses and settlement infrastructure maintain geographic redundancy specifically because they process transactions that can't go down under any circumstances. If Euroclear's primary facility fails, backup systems in different locations maintain operations. That redundancy costs enormous amounts but it's non-negotiable for critical financial infrastructure.

Dusk operators building similar redundancy before any securities are flowing through the system suggests they understand the infrastructure they're building isn't just another blockchain. It's attempting to become settlement infrastructure for regulated finance, which has completely different resilience requirements than DeFi protocols where downtime is annoying but not catastrophic.

The 270+ operators maintaining this distribution through yesterday's 15% selloff and today's 21% rally demonstrates commitment beyond just trading around volatility. If operators were mercenary, they'd shut down during selloffs when staking rewards don't justify operational costs. Instead they're running through volatility that would normally trigger exits.

Dusk's Succinct Attestation consensus requires operators to participate actively in block generation, validation, and ratification. Missing duties reduces selection weight and income. That penalty structure means operators can't just set up infrastructure and ignore it. They need active monitoring and maintenance to stay profitable.

Maintaining that operational burden across distributed geographic infrastructure is harder than centralized setups. But it also means Dusk is less vulnerable to coordinated attacks or regulatory pressure than networks where majority consensus lives in three data centers that could be simultaneously pressured.

What I keep coming back to is opportunity cost. Every Dusk operator running expensive distributed infrastructure could instead run cheaper centralized setups and pocket the difference in costs. They're choosing resilience over profit maximization, which suggests they're planning for long-term scenarios where that resilience matters more than quarterly returns.

DuskTrade launching in 2026 with NPEX's €300 million in assets creates the timeline where distributed infrastructure becomes critical. You can't process regulated securities trading on infrastructure that's vulnerable to single points of failure. Institutions evaluating Dusk for real asset settlement will audit validator distribution as part of technical due diligence.

Whether Dusk's current geographic diversity is sufficient for institutional requirements remains uncertain. Traditional finance demands redundancy that crypto rarely achieves. But the fact that Dusk operators are building toward that standard before institutions require it suggests someone understands what's coming.

Time will tell if distributed infrastructure matters or if I'm projecting sophistication onto operators who are just enthusiastic about privacy tech. For now, Dusk validators are spread across regions and providers in ways that don't match normal cost optimization. That's either unnecessary complexity that adds friction without benefit, or it's preparation for infrastructure that will eventually process transactions important enough that powerful entities might try to stop them.

The nodes keep running either way, distributed across enough geographic and provider diversity that shutting down Dusk would require coordinated action across multiple jurisdictions simultaneously. Whether that resilience matters depends on whether DuskTrade becomes real financial infrastructure or just another partnership that doesn't materialize. The infrastructure is positioned for the former scenario even if the latter proves true.