I've lost money on proof-of-stake lockups enough times to know exactly when people give up. You tell someone their tokens are frozen for two weeks earning nothing while price might crash, they immediately look for alternatives. I've watched it happen on every chain that tried implementing maturity periods—retail validators see the lockup, do the math on opportunity cost, and choose networks where rewards start day one.

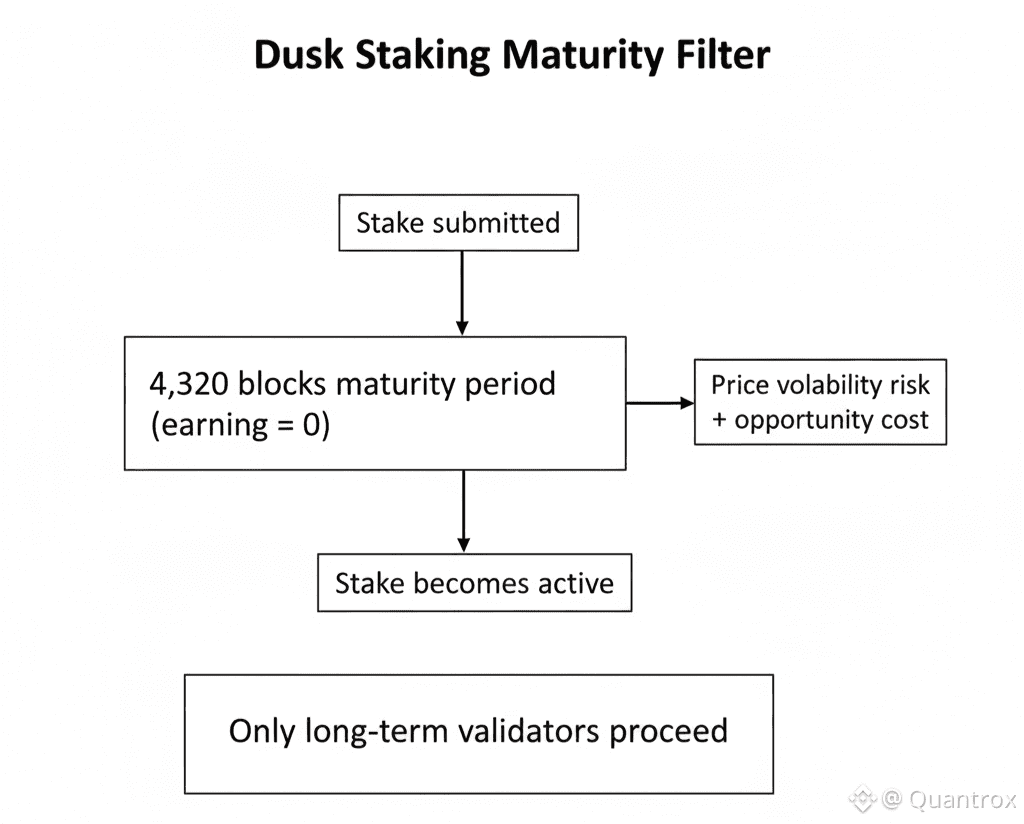

When I found out Dusk makes you wait 4,320 blocks before your stake even becomes active, I thought that was suicide for validator growth. Two full epochs sitting there earning zero while watching price potentially move against you? Nobody accepts that friction when Ethereum lets you start earning within hours, Solana within epochs that last two days. Why would anyone choose Dusk knowing they're forfeiting weeks of potential rewards just to participate?

Yet here we are. Dusk has 270+ validators running nodes, all of whom accepted that maturity wait. Either these people don't understand basic economics, or they know something about what's coming that makes the wait worthwhile.

Dusk sits at $0.1655 today after rallying 21.42% from yesterday's $0.1363 low. Hit $0.2200 at the peak before settling back down. That's 61% intraday volatility—imagine having your capital locked in maturity during that kind of price action, unable to react either direction. Volume was 31.58 million USDT on 174.94 million tokens. RSI at 47.34 neutral, MACD just turned positive at 0.0028. The price recovered but my question remains: who accepts Dusk's maturity period when it's pure economic disadvantage compared to instant-stake alternatives?

Those 4,320 blocks translate to real calendar time where your DUSK sits doing nothing. Price could tank during that period and you're just watching. Better opportunities could appear and you can't pivot. You're bleeding opportunity cost every day while earning zero. Everything about rational profit-seeking says avoid this friction.

But Dusk validators took that deal anyway. Which tells me they're not playing the short-term yield-farming game most validators are playing. They're positioned for something that makes two epochs of zero rewards irrelevant in the bigger picture.

My read is the maturity period filters out everyone except operators genuinely committed to Dusk long-term. If you're willing to lock capital for 4,320 blocks before earning anything, you've already decided this isn't a trade you're exiting in a month. You're here for a year minimum, probably longer.

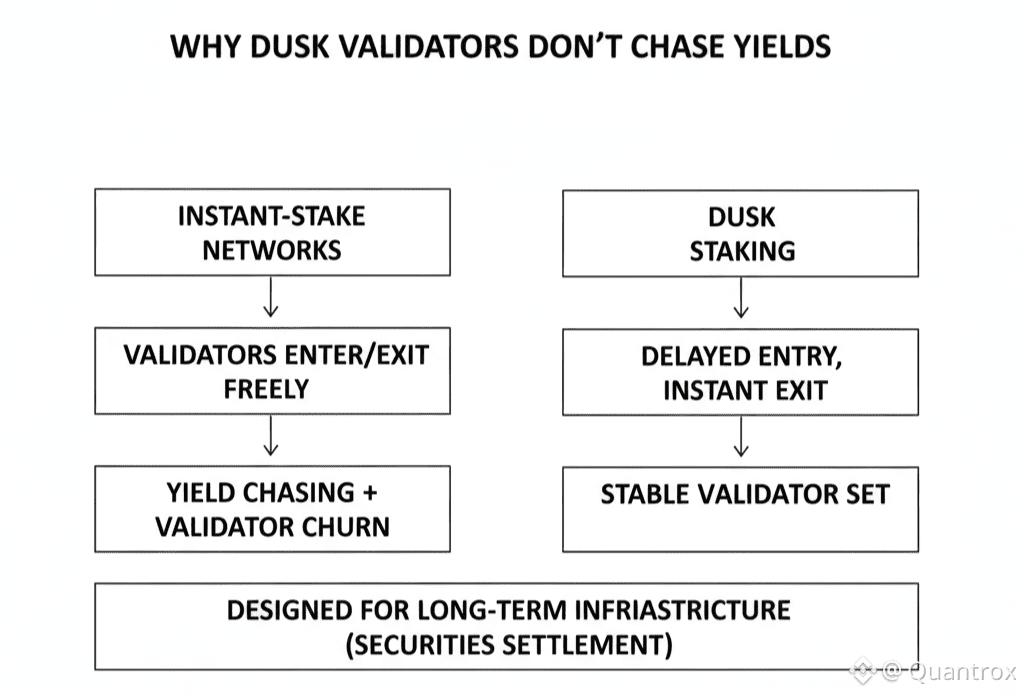

That creates completely different validator dynamics than instant-stake networks. On chains where you can come and go freely, operators chase yields. Highest APY this week gets the stake, next week they move elsewhere. Validator sets fluctuate constantly based on relative returns and token price. Total mercenary behavior but economically rational.

Dusk's maturity requirement makes mercenary validation impossible. By the time your stake matures and starts earning, you've already committed weeks of dead capital. Unstaking at that point means you wasted the entire maturity period for nothing. The only rational move once you've paid that sunk cost is staying long enough to recoup it.

Look at what happened yesterday and today. Dusk dropped 15% yesterday, rallied 21% today. On instant-stake chains, validators would be unstaking during the drop, restaking during the rally, constantly repositioning around volatility. Dusk validators can't play that game. The maturity period locked them into positions before the volatility hit.

That forced stability is exactly what you'd want if Dusk is building securities settlement infrastructure. You can't process regulated financial transactions on a network where validators are constantly churning in and out based on which way price moved today. Settlement finality needs stable consensus from operators who aren't disappearing when APY drops temporarily.

Traditional finance figured this out decades ago. Clearinghouses don't let random participants join and quit whenever they feel like it. Settlement infrastructure requires committed participants who understand their obligations and won't vanish mid-transaction. Dusk's maturity period creates similar commitment by making validation an actual decision rather than casual yield farming.

Maybe I'm overthinking this. Could be Dusk's maturity period is just bad UX that accidentally filters validators when better design wouldn't need filtering at all. Could be there's no grand strategy, just technical limitations that create unfortunate economics.

Except here's the thing. Unstaking from Dusk has zero lockup. Once your stake is mature and active, you can unstake instantly with no penalties or waiting periods. That asymmetry—long wait to enter, instant exit—only makes sense if the point is filtering who gets in while keeping exits flexible.

If Dusk wanted capital locked for security, they'd lock both directions. Instead they're specifically making entry hard while keeping exits easy. That screams intentional filtering for serious validators, not accidental friction.

Those 270+ validators who accepted Dusk's maturity wait are betting on specific outcomes. They're betting DuskTrade generates enough fee revenue from securities settlement that two epochs of zero rewards becomes irrelevant. They're betting stable validator sets matter more than flexibility to chase yields. They're betting on institutional adoption measured in years, not trading cycles measured in weeks.

Whether those bets work depends entirely on DuskTrade launching and processing actual volume. If NPEX's €300 million in assets flows through Dusk infrastructure starting 2026, validators who positioned early through the maturity friction will look smart. If DuskTrade delays or launches without volume, they sacrificed opportunity cost for nothing.

What gets me is how unusual it is that 270+ validators accepted this friction when alternatives don't require it. That's not casual participation. That's deliberate positioning by operators who looked at the tradeoffs and decided long-term potential justified short-term pain.

The maturity period also creates weird growth dynamics. New Dusk validators can't join instantly even if the network desperately needs more security during an attack. That inflexibility could be dangerous. But it also means validator growth happens gradually and deliberately instead of reactively spiking during crises.

Time will tell if Dusk's maturity requirement was brilliant or stupid. Right now, operators who accepted it are running through volatility—15% drops, 21% rallies—that would trigger exits on networks where leaving is easy. They're committed by design, not trapped by penalties.

That's either vision about what securities settlement infrastructure requires, or it's stubborn refusal to cut losses on bad positioning. The 4,320 blocks keep ticking for new stakes. Operators wait without earning while price swings 21% in a day. They stay anyway, betting what comes after maturity justifies what they gave up during it.

Whether that calculation works won't be clear until DuskTrade launches eighteen months from now and we see if institutions actually show up or if this was just another partnership that went nowhere. The validators making that bet are locked in either way.