I've watched enough altcoin pumps to know what real demand looks like. Token rallies 21% in a day, volume should explode as everyone rushes in. Order books should get aggressive. Buying pressure should sustain for hours. Volume typically spikes 5-10x normal as FOMO takes over and momentum feeds on itself.

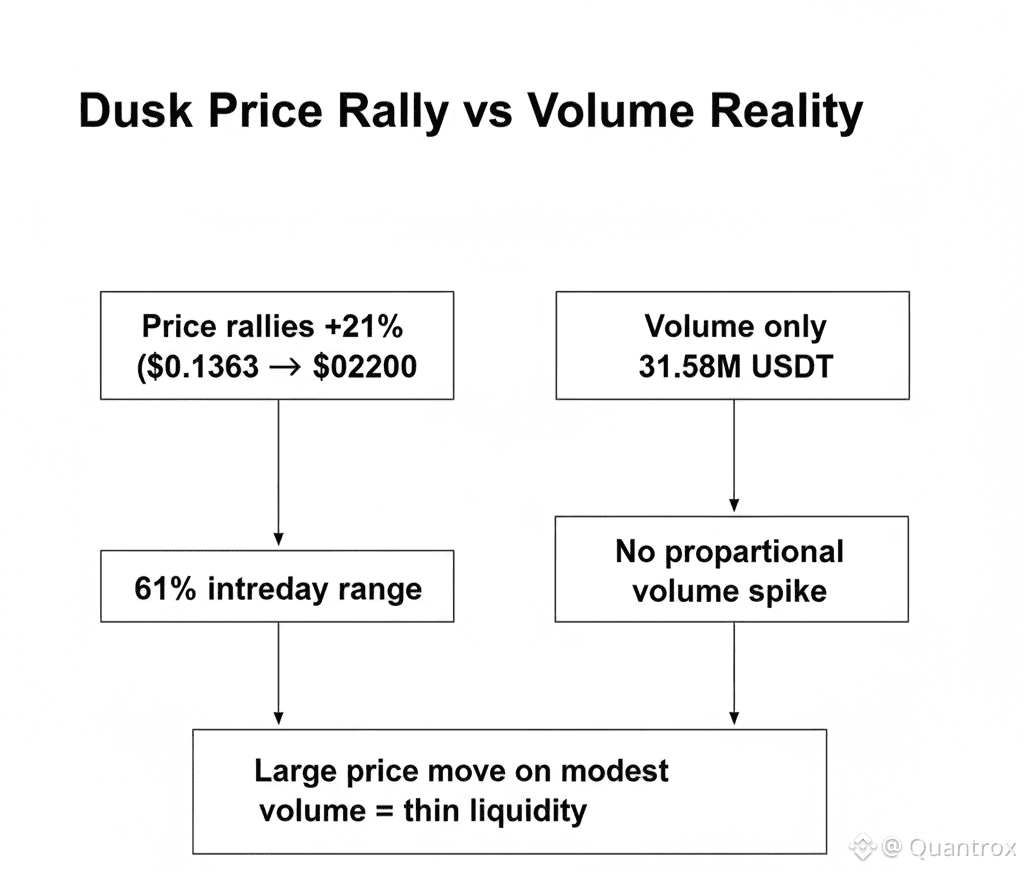

When Dusk jumped 21.42% today from $0.1363 to $0.2200 before settling at $0.1655, I expected exactly that volume explosion. Instead, Dusk traded just 31.58 million USDT on 174.94 million tokens. That's barely higher than recent days when price was dropping. A 21% rally on volume that didn't increase proportionally doesn't add up unless something weird is happening with Dusk's liquidity.

Dusk sits at $0.1655 right now with RSI at 47.34, neutral after the spike. MACD turned positive at 0.0028 for the first time in days. EMA(20) at 0.1714 sits just above price, meaning the rally brought Dusk back into short-term uptrend territory. The 24-hour range from $0.1363 to $0.2200 is 61% intraday volatility on what should be massive volume but isn't.

Normal market mechanics say big price moves need big volume. Buyers need to overwhelm sellers decisively to push price 21% in hours. That volume should show up clearly in the data. But Dusk's 31.58 million USDT today isn't dramatically different from the 8.93 million USDT yesterday when price dropped 15%. We're seeing wild swings on consistent volume, which screams thin liquidity and concentrated holdings.

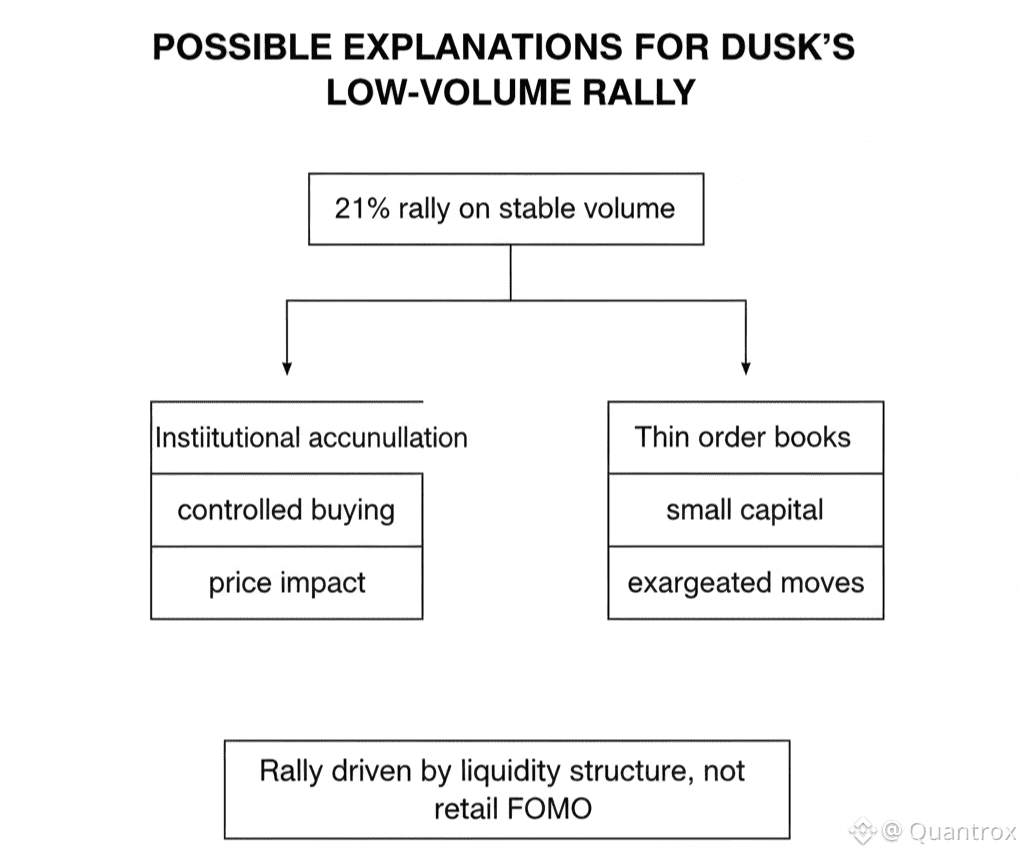

Either very few people control enough Dusk to move price without much capital, or buy orders are hitting books so thin that small amounts create huge price impact. Both scenarios matter for whether this rally sustains and who's actually driving it.

My guess is institutional accumulation, not retail FOMO. Retail rallies look completely different—volume surges as everyone piles in, social media explodes with posts, order books stay aggressive for hours. Dusk's rally was sharp but volume stayed controlled, like larger players executing specific positions instead of crowd mania.

The timing makes this interpretation interesting. DuskTrade waitlist opened recently. DuskEVM launched in January. Hedger Alpha went live. All the infrastructure pieces are operational now that weren't six months ago. If institutions waited for tech readiness before positioning, this is exactly when accumulation would start.

But accumulating on thin books creates exactly what we're seeing—sharp moves on modest volume as big orders walk through available liquidity. Institutions can't buy hundreds of millions without moving markets when total daily volume is only 31.58 million USDT. They either accept slippage or accumulate slowly over weeks.

The 174.94 million DUSK tokens versus 31.58 million USDT gives you average price around $0.1807, well above the current $0.1655. Most volume happened during the spike toward $0.2200, with relatively little trading on the way down. Buyers hit resistance at $0.22, couldn't push through, and price settled without much selling volume either.

Maybe I'm reading too much into one day. Could be a whale repositioning for reasons unrelated to Dusk fundamentals. Could be bots hitting stops and creating cascading buys that weren't sustainable. Could be exchange games on low liquidity making moves look bigger than real demand justifies.

But Dusk rallied when broader markets were flat to down. No Bitcoin move lifting altcoins. No sector momentum in infrastructure tokens. Dusk moved independently, suggesting the catalyst was Dusk-specific rather than macro improvement.

The NPEX partnership preparing DuskTrade for 2026 creates the narrative that could justify institutional positioning now. If you believe €300 million in tokenized securities flows through Dusk infrastructure, getting positioned at $0.16 before adoption happens makes sense strategically. Waiting for announcements means paying higher prices when everyone knows.

Dusk's current dynamics—wild swings on modest volume—continue until liquidity improves or larger holders finish repositioning. For traders that creates opportunity and risk simultaneously. Moves happen fast on thin books. For institutions accumulating, thin liquidity is frustrating because building positions quickly telegraphs intentions through price impact.

What keeps bothering me is how unusual a 21% rally without proportional volume increase is. Most pumps that size need 3-5x normal volume as momentum builds. Dusk did it on volume barely above consolidation levels. That's either extremely efficient buying from sophisticated actors accumulating without driving price, or low liquidity creating false demand signals that won't sustain.

Node count staying above 270 operators through yesterday's drop and today's rally shows underlying infrastructure commitment isn't trading around volatility. Operators positioned long-term regardless of daily moves. That stability provides foundation for whatever's happening with trading.

Whether today's rally starts sustained momentum or just a liquidity squeeze that reverses won't be clear yet. Right now, Dusk moved 21% on volume that doesn't scream retail FOMO or obvious manipulation. Looks more like strategic positioning by players who can't accumulate without some price impact but accept that cost.

Whether they know something about developments coming or just speculating on NPEX narrative won't be clear until we see if rallies sustain or collapse. The infrastructure is operational. DuskEVM processes contracts. Hedger provides privacy. DuskTrade launches 2026. Someone's betting those pieces matter enough to position now despite thin liquidity making it difficult. That's either very early adoption or expensive speculation. The volume pattern suggests commitment either way.