There’s a specific kind of discomfort I’ve felt on public chains for years: not because I’m doing anything wrong, but because “being legible by default” slowly changes how you behave. When every transfer is a breadcrumb trail, money stops feeling like a personal tool and starts feeling like a public broadcast. And once that clicks, privacy stops sounding like a niche crypto debate… it starts sounding like basic safety.

That’s why #Dusk keeps pulling me back in a way most L1s don’t.

January 2026 didn’t feel like hype — it felt like a switch flipping

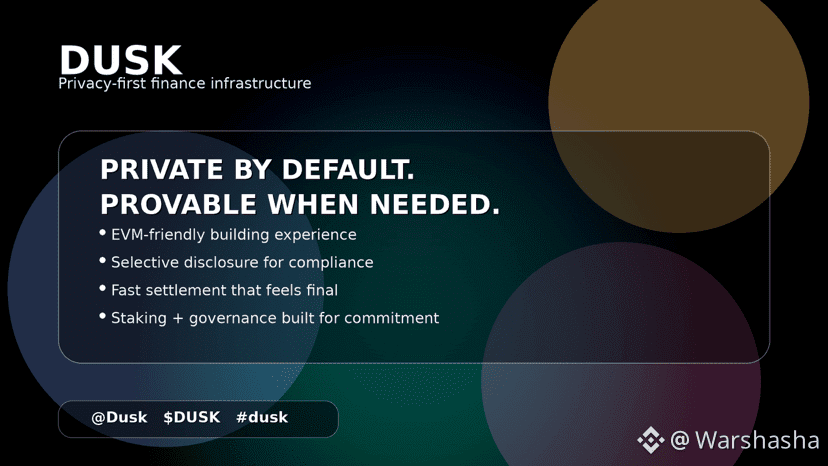

A lot of networks launch and immediately start selling a story. Dusk’s recent momentum feels different because it’s attached to actual infrastructure milestones landing close together: the push around EVM execution, privacy tooling, staking mechanics you can compose, and a product-layer narrative through tokenized assets. This is the first time in a while I’ve looked at a “privacy chain” and thought: okay, this is starting to look usable for builders who don’t want to reinvent everything.

DuskEVM is the “quiet onboarding” move

I’m not impressed by chains that force developers to learn a brand-new universe just to get started. What I like here is the opposite approach: keep Solidity workflows familiar, but let the underlying network specialize in regulated, privacy-aware settlement. That’s not a marketing trick — it’s a very intentional way to reduce friction for teams who already ship on EVM and don’t want to swap their entire toolchain just to add privacy and compliance guardrails.

And from an adoption perspective, that matters more than any slogan.

Privacy with receipts, not privacy with excuses

The most interesting direction (to me) is the idea that privacy shouldn’t mean “trust me bro.” In regulated finance, privacy only survives if there’s still a way to prove things when it actually matters — audits, disputes, oversight, compliance reviews. Dusk’s positioning around privacy plus verifiability is what makes it feel “finance-native” instead of “privacy-maxi.”

Because let’s be real: serious money doesn’t move into systems that can’t explain themselves under pressure.

Hyperstaking turns “patience” into a network primitive

Staking is usually framed like passive yield. But when staking becomes programmable, it starts behaving like infrastructure — something apps can plug into, automate, or design around. I keep thinking about how that changes user behavior over time: fewer tourists, more long-horizon participants, and governance influence drifting toward people who actually show up.

That kind of token behavior doesn’t create fireworks every day… but it does build a sturdier base.

The RWA layer is where things either get real or get exposed

I’m watching the “real markets” angle closely — not because RWAs are trendy, but because regulated issuance and trading is where protocols get stress-tested by reality: legal requirements, data integrity, jurisdiction rules, compliance flows, operational risk. Dusk leaning into tokenized assets and the broader product narrative (like a trading gateway) is the type of move that either becomes a breakout chapter… or reveals what’s still missing.

The underrated signal: how a network handles operational risk

One thing I always take seriously is operational maturity. When teams detect issues, communicate, and harden systems instead of pretending nothing happened — that’s a different kind of credibility. Institutions don’t just evaluate tech; they evaluate whether a network behaves like infrastructure when something goes wrong.

And that’s the standard $DUSK is implicitly inviting.

What I’m watching next

Not price. Not memes. Not short attention.

I’m watching:

whether DuskEVM developer activity grows into real production apps (not just demos),

whether privacy + audit flows become normal UX (not a research paper),

whether tokenized assets actually onboard with clean settlement + compliance paths,

and whether staking/governance dynamics continue pulling supply into long-term alignment.

If Dusk succeeds, it won’t be because it went viral. It’ll be because it made privacy feel normal again — and made compliance feel programmable instead of bureaucratic.