Stablecoins are increasingly playing a significant role in modern financial systems.

Their value derives not from speculation but from reliable settlement.

For institutions, settlement must be fast, predictable and reliable every single day.

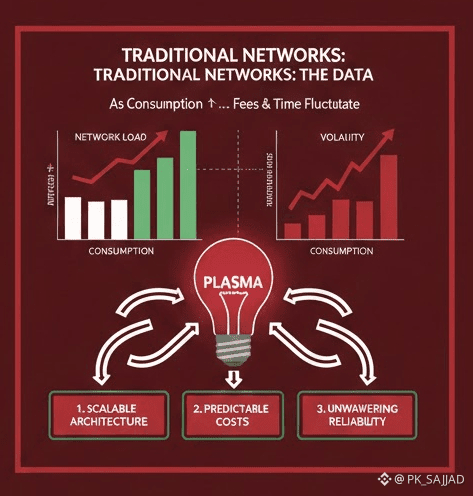

Most networks have a hard time when the consumption goes up.

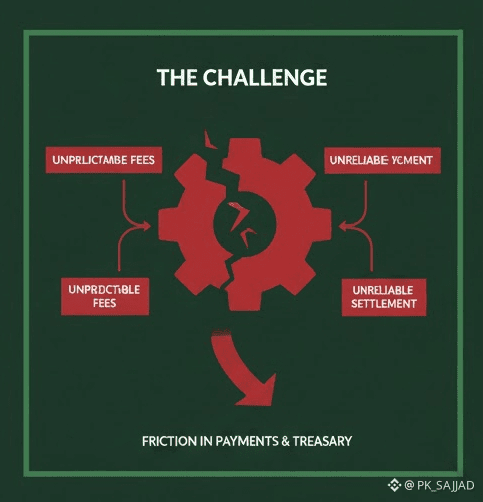

Fees change in an instant, and confirmation times are no longer predictable.

This is what creates friction in payment flows and treasury operations.

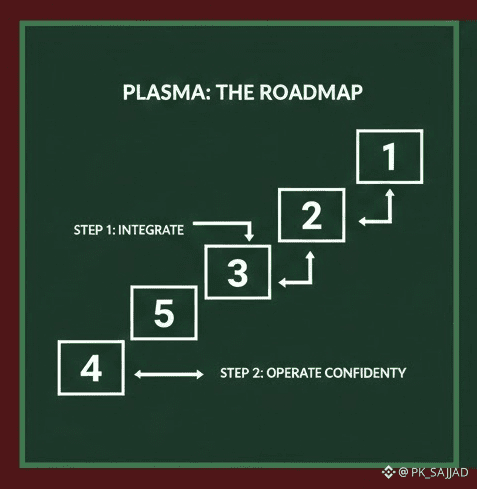

@Plasma approaches the main issues of stablecoin settlement with a primary focus on real financial needs.

The architecture is built to scale with continuous volume without degrading performance.

Fee behavior remains predictable to allow costs to be planned in advance.

It is equally important that this be done reliably. The financial infrastructure has to function predictably and steadily regardless of the market activity in question.

Any institutional workflow cannot afford downtime or instability. #PLASMA treats settlement as core infrastructure, not an add on. By focusing on stability and clarity it supports practical use across payments clearing and internal transfers. In finance, trust is built through systems that work quietly and consistently. $XPL