been built with one main job in mind: moving stablecoins around quickly and cheaply. That’s the core idea. Instead of trying to be everything for everyone, it focuses on payments, settlement, and money flows the boring but important stuff.

The chain is designed to finalize transactions almost instantly, handle large volumes, and avoid the usual friction people run into when sending stablecoins. Things like paying gas in a volatile token or waiting around for confirmations are problems Plasma is trying to smooth out. On top of that, it leans on Bitcoin for extra security, which is a bit different from most newer chains.

The way it’s positioned, Plasma wants to sit underneath retail payments, remittances, point-of-sale systems, and even institutional settlement — basically anywhere stablecoins move a lot.

How the tech side works (in simple terms)

Consensus and speed

Plasma uses its own consensus setup, called PlasmaBFT. It’s based on Fast HotStuff, which is known for being quick and predictable. The main point here is speed transactions are supposed to settle in under a second, and the network is built to handle thousands of transfers without choking.

That matters when you’re dealing with stablecoins, because payments don’t work well if they feel slow or unreliable.

Ethereum compatibility

Under the hood, Plasma runs a Reth execution client, which means it’s fully EVM-compatible. In practical terms, developers can deploy Ethereum smart contracts without rewriting them. Existing tools like MetaMask, Hardhat, or Foundry still work, which lowers the barrier for people building on it.

So while Plasma is specialized, it doesn’t cut itself off from the Ethereum ecosystem.

Bitcoin anchoring and bridging

One of the more interesting parts is how Plasma connects to Bitcoin. From time to time, it anchors its state to Bitcoin, basically using Bitcoin as a long-term security reference point. That adds an extra layer of trust without fully living on Bitcoin itself.

There’s also a bridge that allows BTC to be brought onto Plasma as pBTC. The idea is to avoid custodial risk as much as possible, so users aren’t just trusting a single entity with their Bitcoin.

Stablecoin-first features

This is really where Plasma leans in:

Simple USDT transfers can be sent with zero fees, thanks to protocol-level sponsorship.

Gas doesn’t have to be paid in a native token. Users can pay fees using USDT or even BTC, and the system handles the conversion in the background.

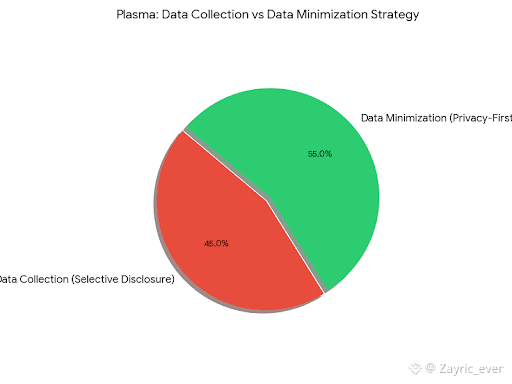

Privacy features are planned, letting users hide amounts or addresses while still allowing disclosures if needed.

All of this is clearly aimed at making stablecoin payments feel less “crypto-ish” and more like normal digital money.

Usage, liquidity, and where it stands so far

According to a mix of official statements and third-party reporting, Plasma has already attracted a surprisingly large amount of stablecoin liquidity early on — reportedly over $7 billion. That puts it high on the list in terms of USDT balances, especially for a newer chain.

It’s also set up to support dozens of stablecoins through partnerships, which reinforces its role as a settlement layer rather than a speculative playground.

The target audience seems split between everyday users in regions where stablecoins are already popular, and institutions that care more about reliability and cost than flashy DeFi experiments.

Funding and the XPL token

Plasma hasn’t been short on backing. It’s raised over $24 million, with major funding coming from groups like Framework Ventures and Bitfinex-related entities. Earlier support reportedly involved big names tied to Founders Fund, Peter Thiel, and leadership connected to Tether.

The native token, XPL, exists mainly for governance and validator economics. It’s not strictly required for everyday transactions since gas can be paid in stablecoins or BTC. XPL has already shown up on major exchanges and has been included in launch programs and liquidity incentives.

Ecosystem and partnerships

On the ecosystem side, Plasma has been lining up integrations that make sense for a payments-focused chain. There are ties with stablecoin issuers and platforms like Tether, Ethena, and USDT0, as well as payment-oriented services such as Yellow Card.

Wallet support is also expanding. For example, Tangem announced support, which means users can hold XPL and USDT on Plasma using hardware wallets an important step for trust and usability.

What’s coming next

Looking ahead, Plasma’s roadmap sticks closely to its original theme. Planned upgrades include:

Privacy features for transactions, with options for selective compliance.

A more decentralized and robust Bitcoin bridge.

Better SDKs and APIs aimed at merchants, payment apps, and financial services.

Nothing too flashy — just more tooling to make the network easier to plug into real-world systems.

How Plasma fits in compared to other chains

Plasma isn’t really trying to compete head-to-head with general-purpose blockchains like Ethereum or Solana. Instead, it’s carving out a narrower role as a stablecoin settlement layer.

What sets it apart is the combination of zero-fee stablecoin transfers, gas paid in regulated assets, and Bitcoin-anchored security. On chains like Ethereum or Tron, stablecoins work fine, but users still deal with native gas tokens and variable fees.

Plasma’s bet is that removing those small frictions actually matters at scale.

Things to keep in mind

There are trade-offs, of course. By focusing so tightly on stablecoins, Plasma may never develop the broad app ecosystem that bigger L1s have. Its success depends heavily on integrations — wallets, exchanges, merchants, and institutions all need to show up.

There’s also the usual uncertainty around token economics, governance changes, and evolving regulations around stablecoins.

Final thoughts

Plasma is a pretty clear attempt to rethink how stablecoin payments should work at scale. It’s fast, EVM-compatible, built around fee-free transfers, and anchored to Bitcoin for extra security. Instead of chasing trends, it sticks to one problem and tries to solve it well.