In the high-stakes world of regulated finance, two masters must be served: the uncompromising demand for transaction privacy and the non-negotiable requirement for regulatory oversight. For years, this has been an unsolvable paradox, forcing institutions to choose between opaque, legacy systems and transparent, yet exposed, public blockchains. This is the wall that DUSK Network is tearing down. Through real-world case studies and battle-tested technology, DUSK is not just proposing a solution—it’s actively laying the invisible rails for the next era of global finance, where assets move in confidentiality but always within the bounds of compliance.

The Privacy-Compliance Paradox: DUSK’s Foundational Breakthrough

At its core, DUSK is a Layer-1 blockchain engineered with a unique principle: “privacy by default, auditability when required.” This isn’t a mere feature; it’s the foundational philosophy that separates it from both fully public chains and black-box traditional systems.

The Technology of Trust: DUSK’s privacy engine is powered by zero-knowledge proofs (ZK-Proofs) through its Phoenix transaction model. This allows transaction details and participant identities to remain encrypted on the public ledger. However, unlike privacy coins that operate in the shadows, DUSK is built for the spotlight of institutional finance. Its Segregated Byzantine Agreement (SBA) consensus mechanism provides immediate transaction finality—a necessity for settling securities—while creating a pathway for authorized regulators to access information when legally mandated. This native compliance is designed to align with frameworks like the European Union’s Markets in Crypto-Assets Regulation (MiCA).

Case Study: The NPEX Partnership – Blueprint for Institutional Adoption

The theoretical becomes tangible with the €200-300 million tokenized securities trading platform built in partnership with NPEX, a Dutch Multilateral Trading Facility (MTF). This isn't a pilot or a testnet promise; it's a live, regulated exchange operating on DUSK’s infrastructure.

The Traditional Process: Issuing and trading a bond or security involves a labyrinth of intermediaries—custodians, transfer agents, and clearinghouses—each adding cost, time, and layers of opaque reconciliation.

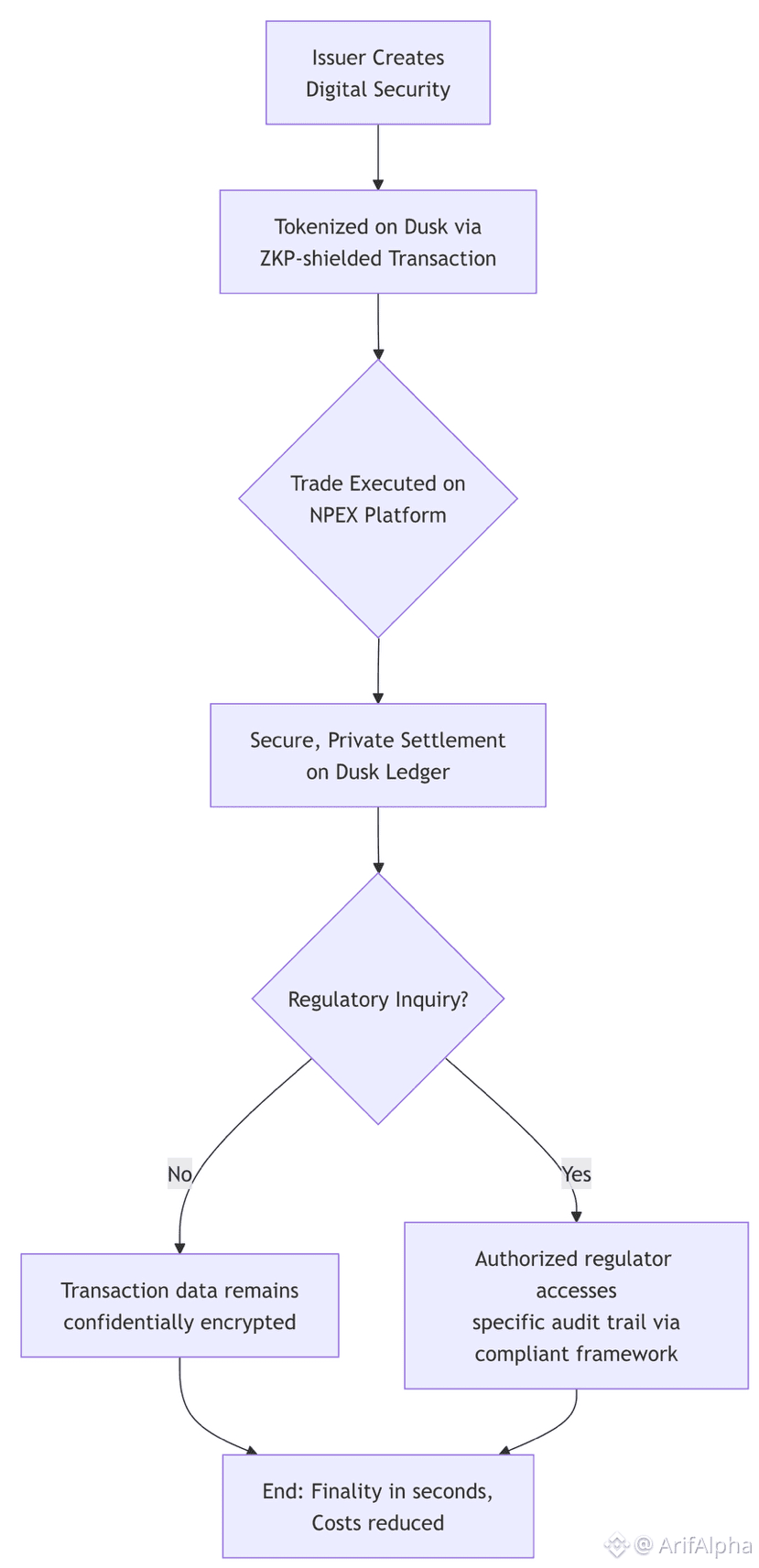

The DUSK-Enabled Process: NPEX leverages DUSK to create a streamlined, on-chain ecosystem. Here’s how it transforms:

This architecture demonstrates DUSK’s product-market fit. Institutions gain the efficiency and programmability of blockchain without sacrificing the confidentiality required for sensitive financial operations or the compliance needed to operate within strict jurisdictions like the EU.

The Engine Room: Audited Security and Growing Utility

Trust in this infrastructure is non-negotiable. DUSK has undergone one of the most rigorous audit processes in the industry, with 10 independent audits covering over 200 pages of reporting. Firms like Oak Security and cryptographers like JP Aumasson have scrutinized everything from its core consensus mechanism to its zero-knowledge proving systems. Critical findings were resolved, with auditors repeatedly praising the code quality and documentation. This commitment proves security is treated as the bedrock, not a checkbox.

For the DUSK token ($DUSK), this translates into robust utility within a secured network:

Network Security & Staking: Holders can stake DUSK to participate in consensus, currently earning approximately 12% APY through its Hyperstaking model, which allows for programmable staking logic.

The Fuel for Transactions: Every asset tokenization, trade settlement, and smart contract interaction on DUSK requires DUSK for gas fees, with costs kept at a fraction of a cent.

Cross-Chain Expansion: The recent integration of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is a pivotal development, enabling DUSK-based tokenized assets to interact seamlessly with Ethereum, Avalanche, and other major chains. This directly addresses liquidity fragmentation and massively expands the potential market for assets born on DUSK.

Joining the Frontier: Your Role in the Ecosystem

For developers, DUSK offers DuskEVM, an Ethereum-compatible environment for building confidential smart contracts in familiar languages like Solidity. For investors and users, participating starts with acquiring DUSK tokens from supported exchanges and can extend to staking for rewards or providing liquidity for early-stage DeFi applications on the network.

The narrative for DUSK has shifted from "what if" to "what's next." With its mainnet live for over a year, proven institutional adoption, and a technology stack built for the regulatory realities of global finance, DUSK is positioning itself as the go-to infrastructure for the multi-trillion dollar Real-World Asset (RWA) tokenization sector.

The future of finance will be built on rails that are both invisible and inspectable, private and compliant. DUSK is not just building that future but is already demonstrating it in production. The question is no longer about the viability of such a system, but about the scale of its reach.

What real-world asset class do you believe will be most transformed by compliant, privacy-preserving blockchain technology like DUSK, and why? Share your perspective below.