Plasma is one of the few Layer 1 projects I’m taking seriously for a very specific reason: it’s not trying to be “everything”, it’s trying to be the settlement rail for stablecoin payments at global scale, with near-instant transfers, low fees, and a system design that keeps stablecoins at the center of the whole experience.

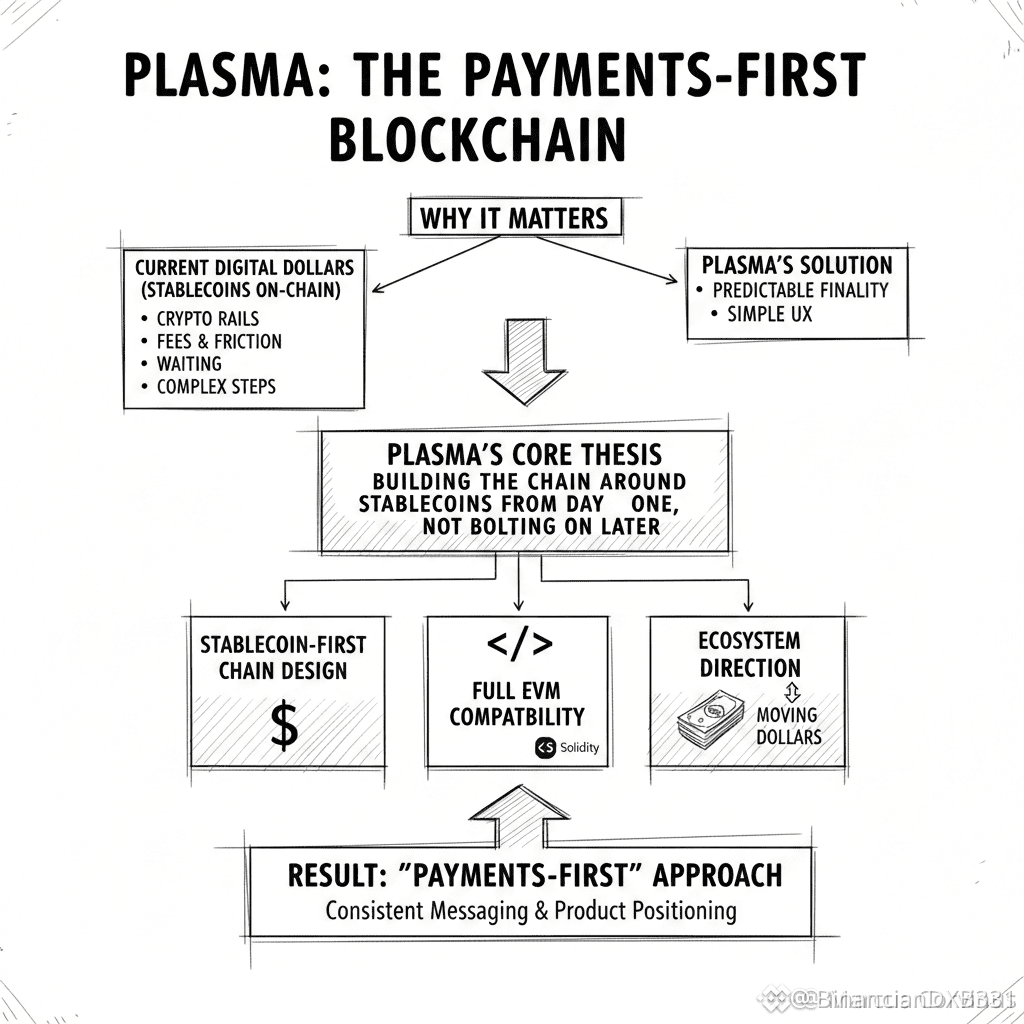

Plasma matters because stablecoins are already the most practical form of digital dollars onchain, but the rails still feel like crypto rails—fees, friction, waiting, and too many steps for normal people and real businesses. Plasma’s thesis is that payments need predictable finality and simple UX, and that means building the chain around stablecoins from day one, not bolting “payments” onto a general chain later.

Plasma is building the behind-the-scenes pieces that payments actually need: a stablecoin-first chain design, full EVM compatibility so builders can ship with familiar tooling, and an ecosystem direction that focuses on moving dollars rather than chasing random narratives. That “payments-first” approach shows up consistently across their core messaging and product positioning.

Plasma also pushed beyond “just a chain” by introducing Plasma One, which is positioned like a stablecoin neobank experience for saving, spending, and sending dollars in one place, with mainstream-style security and control features and clear disclosures around what it is and isn’t. I like this because it shows they’re thinking about distribution and product UX, not only blockspace.

Plasma’s token story is straightforward on paper: XPL is described as the native token of the Plasma blockchain, used for transactions and to reward network support through validation, and it’s framed as a key piece of how the network runs and aligns participation around the stablecoin settlement mission.

Plasma’s benefits, to me, come down to one thing: making stablecoin payments feel normal. If a chain can keep settlement fast, keep costs low and consistent, and keep user flows simple enough that people don’t have to “learn crypto”, that’s when stablecoins stop being a niche tool and start acting like real internet money. Plasma’s own positioning is clearly aiming for exactly that outcome.

Plasma “exists” in a very real way right now because the explorer is live and you can see ongoing activity, transaction throughput, and latest blocks updating—so it’s not just a whitepaper idea. When I evaluate payment rails, I always check if the network looks alive, and Plasma’s public explorer view gives that transparency.

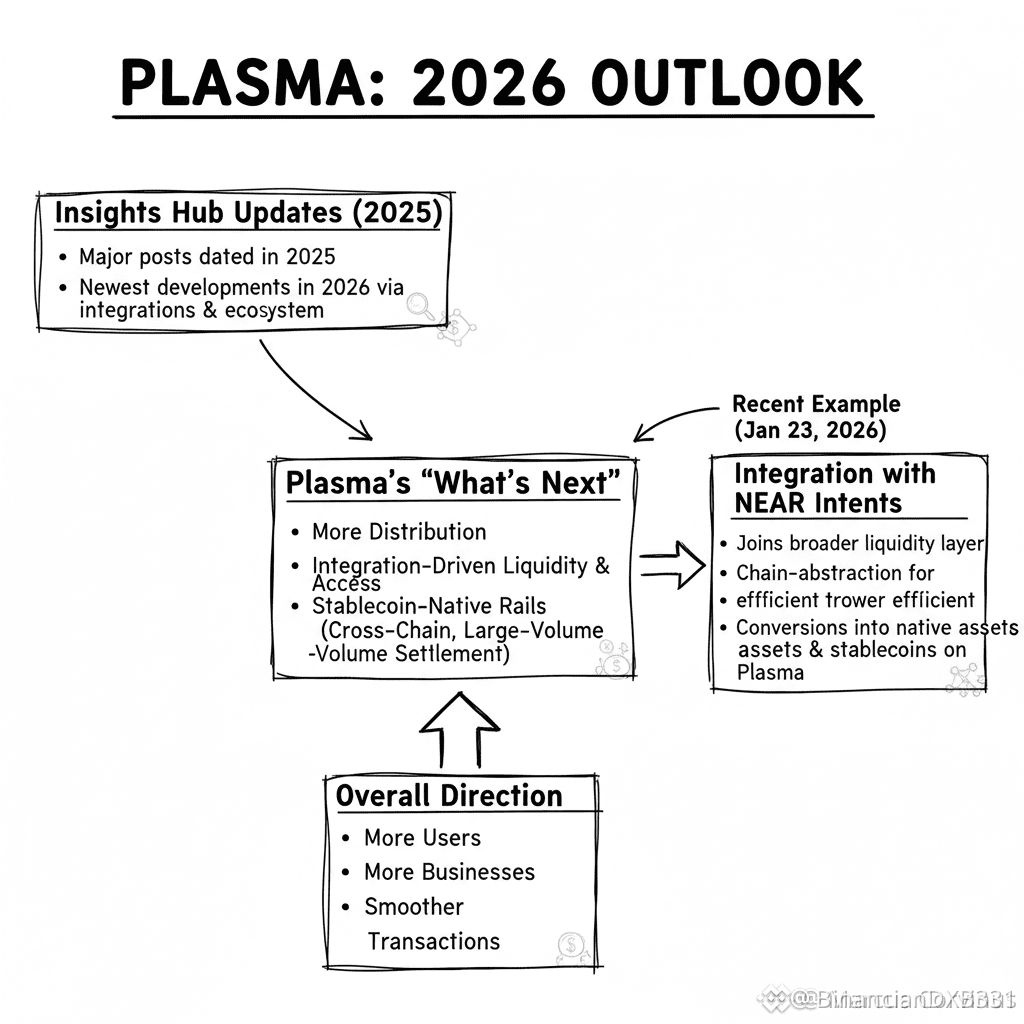

Plasma’s latest project-level updates from its official Insights hub (the place you’d expect formal announcements) show major posts dated in 2025, which tells me the newest developments in 2026 may be showing up more through integrations and ecosystem activity than through that specific blog feed.

Plasma’s “what’s next” is pretty clear from what’s already being discussed publicly: more distribution, more integration-driven liquidity and access, and more stablecoin-native rails that make cross-chain movement and large-volume settlement smoother for real users and real businesses. A recent example is the reporting around Plasma integrating with NEAR Intents (announced Jan 23, 2026), which frames Plasma as joining a broader liquidity and chain-abstraction layer for efficient conversions into native assets and stablecoins on Plasma.

Plasma’s last 24 hours “what’s new” is best described as momentum on the live network side rather than a brand-new official announcement: the explorer is showing continuing block production and large-scale transaction activity visible on the main page, and that’s the most concrete “fresh” signal available without guessing or stretching. If I’m judging it as a payments rail, that ongoing activity is exactly what I want to see—steady operation, steady usage, and a chain that looks like it’s being used for what it was built for.