Crypto usually rewards whoever shouts the loudest.

$BNB is doing the opposite.

While most ecosystems compete on promises, BNB has been quietly optimizing something far more important: how value actually moves.

In 2026, the strongest blockchains are not the ones with the most apps. They’re the ones where capital flows efficiently, predictably, and at scale. This is where BNB has built an edge most people underestimate.

From Speculation Token to Infrastructure Asset

BNB’s transformation didn’t happen overnight. It happened through boring but decisive upgrades.

Fee discounts evolved into:

Settlement utility across Binance products

Gas asset for BNB Smart Chain

Governance and validator incentives

Payment rails via #BinancePay

Continuous supply reduction through burns tied to real usage

That matters because it shifts BNB from “exchange exposure” to infrastructure exposure.

Speculation fades. Infrastructure compounds.

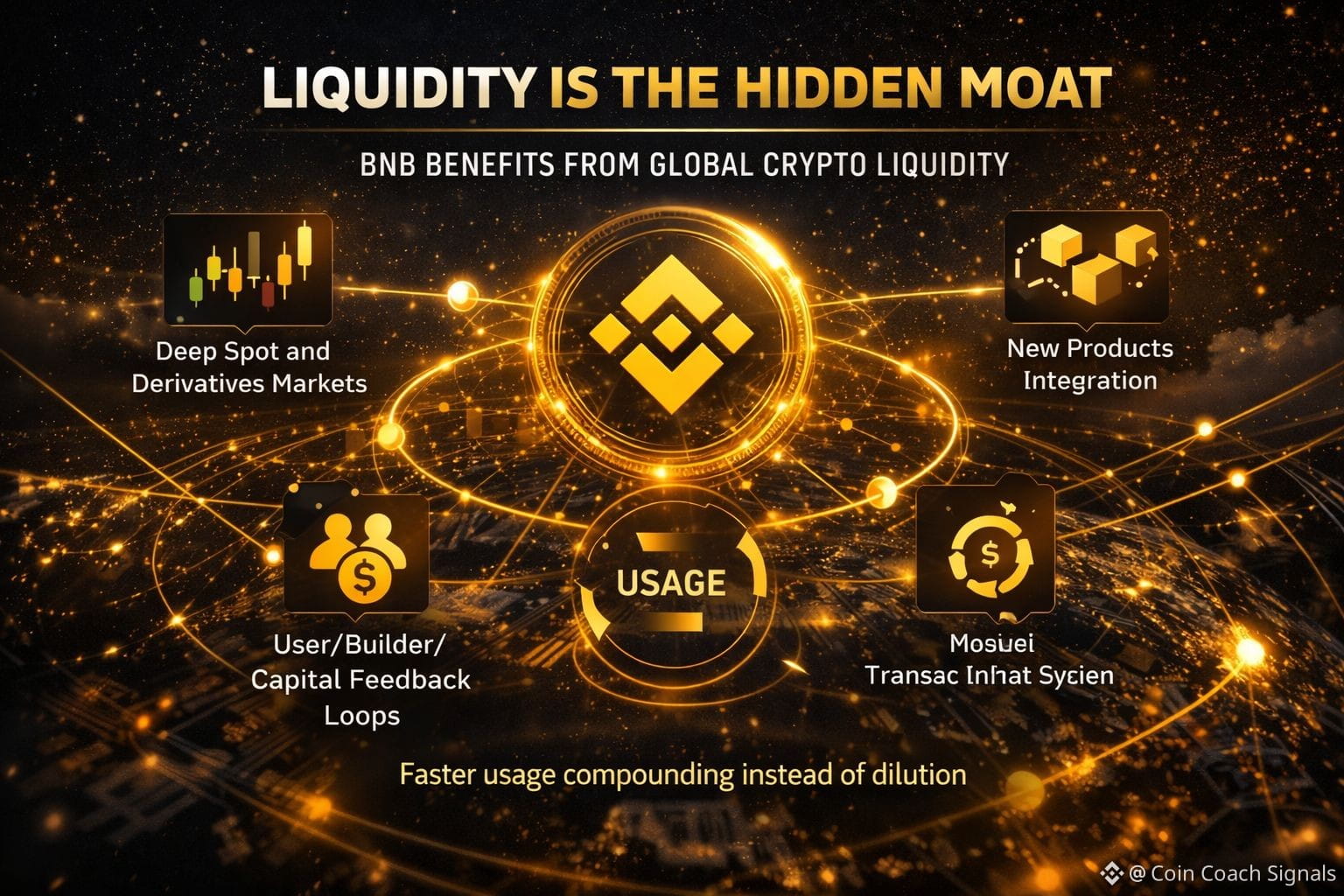

Liquidity Is the Hidden Moat

Here’s an uncomfortable truth:

Most Layer 1s struggle not with technology, but with liquidity fragmentation.

BNB doesn’t.

Because Binance sits at the center of global crypto liquidity, BNB benefits from:

Deep spot and derivatives markets

Immediate integration of new products

Faster feedback loops between users, builders, and capital

This creates a flywheel where usage reinforces value instead of diluting it.

Burns That Actually Mean Something

Token burns are common.

Effective burns are not.

BNB quarterly burn mechanism is tied to:

On-chain activity

Ecosystem growth

Real transaction volume

This aligns supply reduction with demand generation. Not promises. Not projections. Usage.

That’s why BNB’s tokenomics have aged better than most high-inflation Layer 1 models.

Builder Reality: Why Developers Still Choose BNB Chain

Developers don’t care about narratives. They care about:

Users

Liquidity

Stable infrastructure

Fast deployment

BNB Chain continues to attract builders because it offers predictable costs and immediate access to real users, not just testnet metrics.

In a market where many ecosystems optimize for grants, BNB optimizes for survival and scale.

The Market Is Slowly Repricing Utility

BNB doesn’t move like a meme.

It doesn’t need to.

Its value grows as:

Trading volumes scale

Payments expand

Infrastructure hardens

Supply continues shrinking

This makes $BNB less of a “moon asset” and more of a core crypto holding, similar to how ETH evolved, but with tighter integration into a revenue-generating platform.

Final Thought

BNB isn’t winning because it’s exciting.

It’s winning because it works.

In a market maturing beyond hype, that may be the strongest position any crypto asset can hold.

#VIRBNB #FedWatch #bnb #BNBChain $BNB