You probably wrote off plasma chains back in 2019 when every single implementation turned into an unusable nightmare of exit games and week long withdrawal times. Most of us did. The Vitalik blog post basically signed the death certificate while rollups were getting all the venture capital love and github stars. But here is the thing about crypto technology. It does not actually die just because twitter consensus decides it is unfashionable. It just sits in the garage getting rebuilt by stubborn engineers who cannot accept that the first attempt was the final word.

The original plasma spec had brutal requirements that made it completely impractical for anyone who wasn't running three monitors of chain data 24/7. You had to watch the operator constantly like some paranoid hawk or they could submit a fake exit and steal your funds while you were sleeping. The whole security model depended on users being online and vigilant which is ridiculous in the real world where people go on vacation, lose their phones, or simply have lives outside of blockchain surveillance. If you missed the withdrawal challenge window because you were in the hospital or just forgot, your money was gone forever. Plus the data availability situation was a mess. Operators could easily hide block information from users trying to exit, essentially trapping funds through obscurity rather than outright theft.

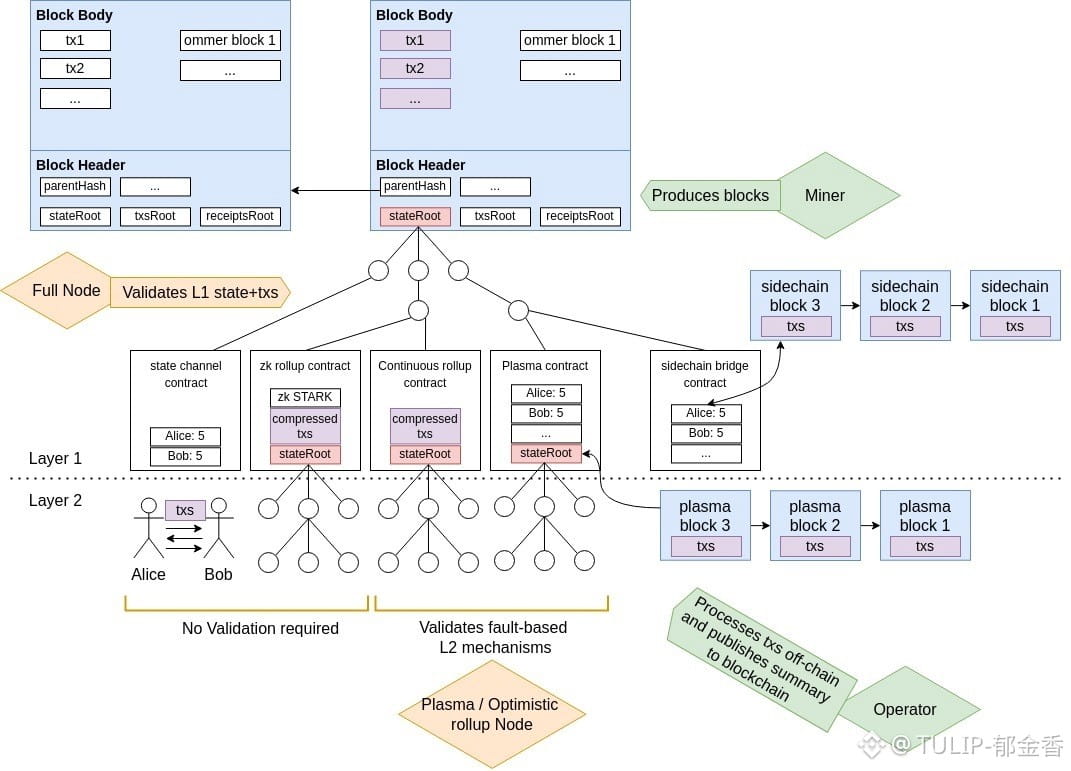

@Plasma looked at all these broken assumptions and basically threw out the playbook while keeping the core idea that matters. Move the heavy computation off the congested main chain but do it without requiring users to become full time security guards of their own assets. The new architecture uses what they call autonomous exit guarantees which is fancy terminology for saying you do not need to babysit your money constantly. Even if the operator is actively malicious and you have been offline for three weeks on a camping trip, your funds cannot be stolen through stale state submissions. The mathematics handle the protection passively rather than requiring you to press a panic button every few hours.

Data availability got solved through bonded committees that actually hold skin in the game instead of just hoping the operator plays nice. These nodes put up serious collateral that gets slashed automatically if they withhold transaction data from users trying to verify their balances. It strikes a balance between pure rollup approaches that post everything to ethereum mainnet and the old plasma way of trusting a single operator completely. You get the cost benefits of not clogging layer one with every single transaction while keeping enough decentralization that one rogue actor cannot freeze the entire network.Speaking of what keeps the lights on, the $XPL token actually serves a purpose beyond speculation which is sadly rare these days. Validators need to stake substantial amounts to produce blocks and participate in consensus. If they act dishonest the protocol destroys their stake automatically without needing some multisig of humans to vote on whether to enforce the rules. Meanwhile transaction fees do not get recycled entirely to stakers creating infinite inflation pressure. Instead the network burns a portion of every fee which means the token supply shrinks organically as people actually use the chain for real economic activity rather than just ponzi farming. It is refreshing to see tokenomics designed around sustainability instead of pumping the chart for twelve weeks before dumping on retail.

The testnet performance surprised a lot of skeptics who assumed this was another vaporware whitepaper project. Sub second finality held up under deliberate spam attacks that simulated heavy retail usage. They are using a standard ethereum virtual machine too so developers do not need to rewrite their solidity contracts or learn some exotic new programming language just to deploy. That matters enormously because porting a defi protocol to a new chain normally takes months of audits and debugging. If you can just deploy the same code with minor configuration changes and dramatically lower gas costs, the decision becomes obvious during bear markets when teams are watching their burn rates.

Bridge architecture deserves a mention here because that is usually where layer twos quietly become centralized disasters. This setup connects back to ethereum mainnet and other major chains without handing custody over to anon multisig holders who might lose their hardware wallets. The fraud proof mechanisms that secure the base chain also protect the bridge deposits so you are not introducing weaker security perimeters at the edges of the system. Users can move assets between ecosystems without saying prayers that some random keeper bot will actually release their funds on the other side.

Now here is the reality check that usually gets ignored in marketing threads. Plasma chains still make different security tradeoffs than rollups. The data availability committees introduce slightly more complex trust assumptions even if those assumptions are cryptoeconomic rather than social. Smart contract risk remains the bogeyman lurking in every new deployment no matter how many audits you purchase. If there is a critical bug in the exit contract logic, people lose money period. Regulation is also a dark cloud hovering over every layer two solution right now as agencies try to figure out whether these tokens constitute securities in various jurisdictions.

Adoption timelines in crypto are notoriously slippery. We have all watched projects announce mainnet launches only to delay repeatedly while they find one more critical bug. The sequencer decentralization roadmap specifically needs close watching because single sequencers create irresistible honeypots for maximal extractable value attacks until they get distributed properly. If the team cannot deliver on their promises to decentralize block production within the next few quarters, the whole value proposition gets questioned regardless of how elegant the fraud proofs are.

Still, watching this technology mature from the abandoned ugly duckling of 2018 into something actually usable feels different than the usual hype cycle. Plasma was never conceptually broken. It was just implemented by people who did not fully understand the game theory of lazy operators and distracted users. @Plasma represents the version built by people who lived through those failures and fixed the user experience problems properly. It is not trying to replace rollups or start tribal warfare on crypto twitter. Different tools work for different jobs. High frequency micro transactions and retail payments make more sense on optimized plasma chains while complex defi composability probably stays on rollups or mainnet forever.

Keep an eye on the migration announcements from established protocols over the next few months. When serious builders with real user bases start moving liquidity to test the waters, that is your signal that the technology crossed from theoretical to practical. Ignore the token price action completely and watch the uptime statistics instead. A chain that stays online during traffic spikes without requiring users to pay ten dollar gas fees is what actually matters when the speculation dies down. Everything else is just marketing noise until then.