Of course. Here is an article for a business/finance app, written in a sharp, analytical style suitable for professional investors, mirroring the structure and tone of your provided example.

Tech Rally Reverses Sharply, Exposing Market's Dependency on Momentum and Options Leverage

Major technology stocks plunged in afternoon trading today, erasing early gains and dragging key indices into negative territory. The abrupt about-face, which saw the Nasdaq drop over 3% from its intraday peak, occurred in the absence of significant earnings news or economic data, highlighting the market's underlying structural vulnerabilities.

The reversal points directly to the erosion of robust, fundamental buying in the underlying equities. When conviction among long-term holders is thin, prices become unmoored from traditional valuation metrics and increasingly dictated by algorithmic flows and speculative crowd behavior.

In this environment, the influence of the options market is magnified. With record levels of open interest in short-dated calls and puts concentrated in a handful of mega-cap names, the market has effectively become a playground for leveraged gamma positioning. The massive hedging activity by options dealers creates reflexive feedback loops that accelerate both rallies and declines.

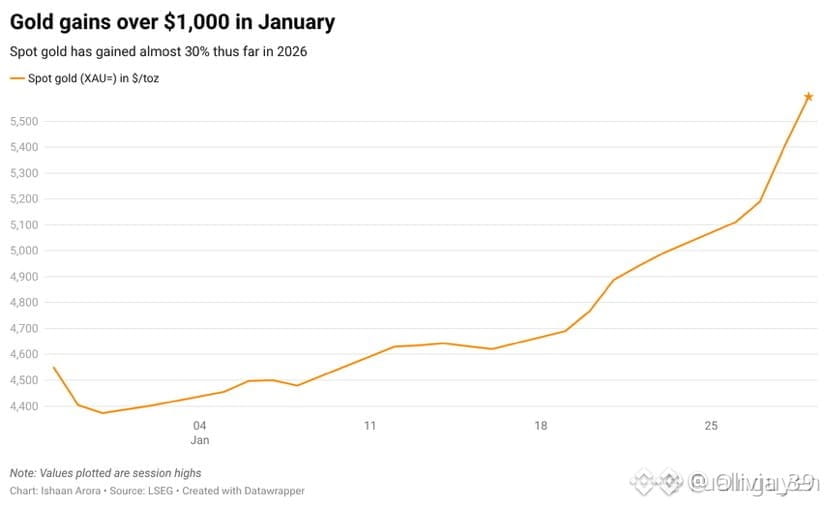

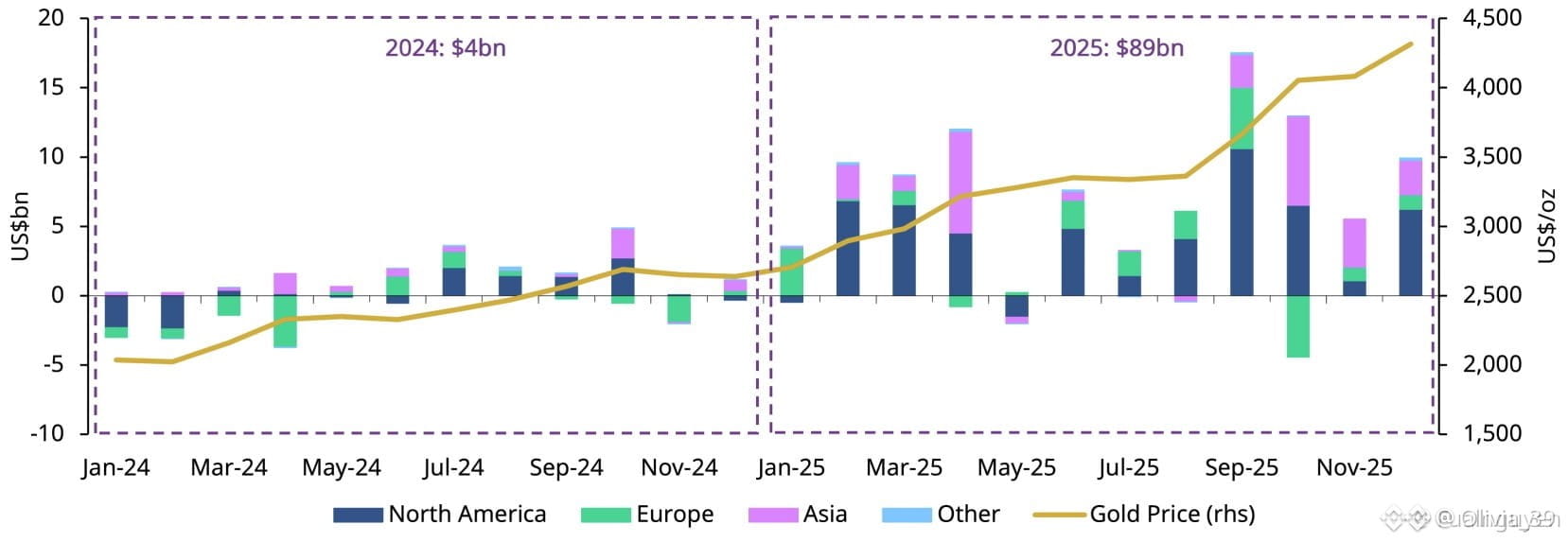

#GoldOnTheRise #BTC #VIRBNB #XAUUSDT

the momentum tide turns, the lack of deep, fundamental bids becomes glaringly apparent. Automated selling triggers are hit, forcing systematic funds to reduce exposure, while options dealers unwind hedges in a way that exacerbates the move. Today's action—a violent rejection at a key technical resistance level—is a classic case study in how derivatives mechanics can override fundamentals in the short term.

Significantly, this volatility spike occurred without a clear catalytic event—no Fed speaker revelations or sector-specific bad news. Instead, it underscores a market where positioning and market structure are primary drivers of near-term price action.

Even the most dominant " secular growth" stories are not protected when markets are fueled by leverage and momentum chasers. Under these conditions, price swings become detached from corporate fundamentals, allowing for severe dislocations without a change in the business outlook.

Today's sell-off is a potent reminder that in a market saturated with derivatives and dependent on momentum, corrections can be swift and self-reinforcing. For portfolio managers and traders, navigating this landscape requires a keen understanding of positioning flows and options market dynamics, not just earnings models and economic forecasts.

#MarketStructure #Volatility #Derivatives #Liquidity #Trading