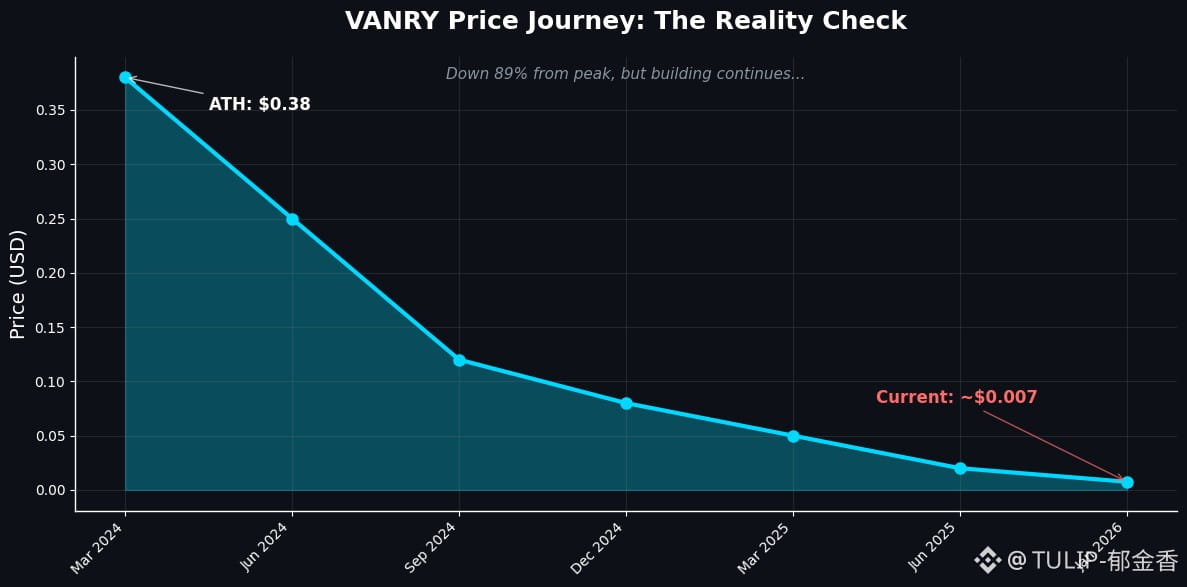

If you're holding $VANRY right now, I feel you. We've all been there—watching that chart bleed from 0.38 back in March '24 to basically a penny today. It's brutal. You probably bought the top, or you bought the "dip" that kept dipping, and now you're sitting there like... do I cut losses or ride this to zero?

But here's the thing nobody's talking about on CT: while the price has been absolutely demolished, the devs haven't ghosted. They're actually shipping stuff. Weird, right?

From Metaverse Meme to AI Infrastructure (Yes, Really)

Remember Virtua? Yeah, that metaverse play from 2021-2022 when everyone and their grandma was selling virtual land? That was Vanar before the rebrand. And honestly, everyone—including me—assumed they were dead when the metaverse narrative died.

But they pivoted. Hard.

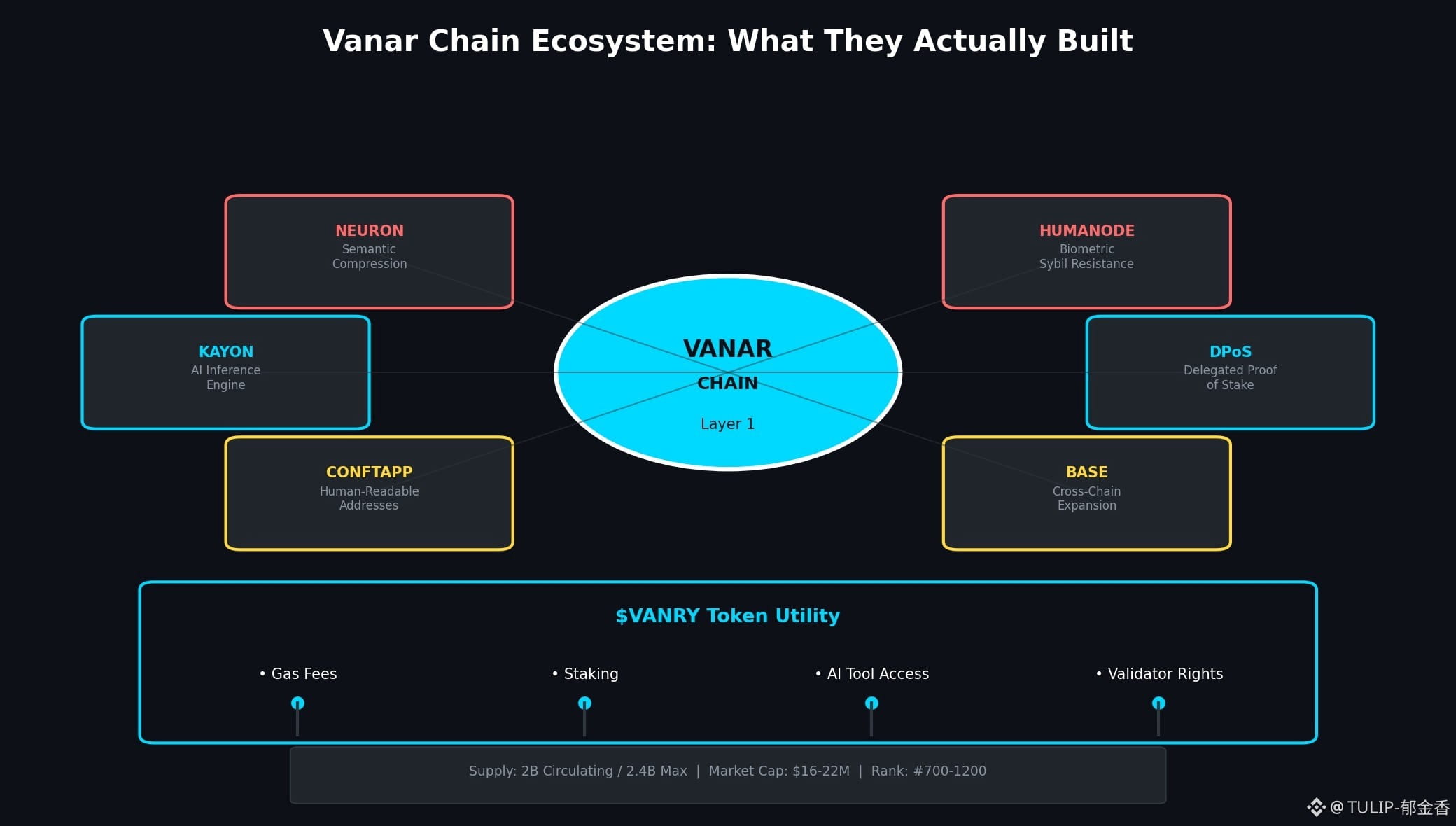

Now they're calling themselves an "AI-native Layer 1" which sounds like buzzword bingo, but hear me out. Their big thing is this protocol called Neuron.

So check this out: they launched this semantic compression thing in May. Instead of storing files the normal way (or worse, dumping them on AWS and pretending it's decentralized), they use AI to crush files into these tiny "Seeds."

We're talking 25MB videos becoming 47-character strings that live actually on chain. Not IPFS. Not some server. On chain. And smart contracts can still query them.

Is it overkill? Maybe. Is it kinda genius if it works? Absolutely. Because the biggest pain in the ass for AI projects is always storage—these models need massive datasets, and blockchain storage costs are insane. If this actually scales, it's a real solution to a real problem. Not just "we're faster than Ethereum" #387.

The "Actually Useful" Updates

July was a busy month for them. They dropped Humanode integration—which sounds scary until you realize it's basically "are you a human?" verification without doxing yourself.

Using zero-knowledge proofs (zk stuff is hot right now for a reason), it proves you're a real person without storing your face or fingerprints anywhere sketchy. For DeFi projects on Vanar, this means they can stop the bot armies from nuking their token launches without forcing everyone through some invasive KYC nightmare.

Oh, and they partnered with ConftApp for human-readable addresses. Finally. No more sending money to 0x8de5... and praying you didn't mess up a character. Now you can just use "yourname.vanar" like a normal person.

Small thing? Yeah. But it's the kind of UX improvement that makes you think they're actually using their own product.

The Token Isn't Just For Gambling Anymore

Here's where it gets spicy for bagholders.

Earlier this year, VANRY stopped being purely a "hope number goes up" coin. Now you need it to access their serious AI tools—specifically Kayon, which is their decentralized engine for running AI queries.

So if devs want to build on Vanar and use the AI infrastructure? They gotta buy and burn VANRY. That's actual demand. Not speculation—utility.

Tokenomics aren't terrible either. About 2 billion circulating, 2.4 billion max supply. No infinite mint, no "surprise inflation" like some projects pull. Just steady, predictable emissions.

They also flipped their consensus model in January to this hybrid thing—DPoS (Delegated Proof of Stake) mixed with Proof of Authority and something they call "Proof of Reputation."

Basically: you can't just buy a validator spot. They check if you've been good to the network, your community rep, even your environmental impact. It's their attempt to stop the "rich get richer" validator centralization that screws most PoS chains. Does it work? TBD. But at least they're trying something different.

Wall Street Cosplay

The most interesting Recently (December), they popped up at Abu Dhabi Finance Week—not some crypto convention, but actual institutional finance. Their CEO Jawad Ashraf was on stage with Worldpay (yeah, the payment giant) talking about "the future of money flows."

They weren't shilling NFTs to degens. They were discussing real stuff: regulated payments, treasury management, compliance, dispute resolution—all the boring infrastructure stuff that makes banks actually want to use blockchain.

Ashraf kept saying "agentic payments" which is fancy VC speak for "software that handles money without human babysitting." But legitimately, if they crack that, it's huge. Most crypto projects can't even handle a simple transaction without needing manual intervention when something breaks.

The Binance Reality Check Alright, let's address the bleeding obvious. If you're looking at VANRY on Binance right now, it's not pretty.

- Down 89% from ATH

- Volume around 3-4M daily (used to be way higher)

- Binance delisted the VANRY/BTC pair (consolidation signal—means they're not dead but they're not hot either) Still on $VANRY /USDT though, so liquidity exists Works with MetaMask if you want to explore beyond just holding bags.

What's Actually Next?

They expanded to Base (Coinbase's L2) late last year for cross-chain AI stuff. Still pushing gaming with NUMINE and Kumami World partnerships. That Brinc Gaming accelerator is still running too.

Will any of this pump VANRY back to 38 cents?

Honestly? Probably not soon. Market cap is sitting at 16-22M which is basically nothing in crypto terms. You're not getting rich overnight on this unless there's a serious catalyst or the entire AI narrative rotates into基础设施 plays (infrastructure, for the non-Mandarin speakers).

But here's the distinction: dead projects stop building. Vanar hasn't stopped. They've got working tech, institutional connections, and a pivot that actually makes sense for where the market is going (AI everything).

If you're holding right now, you're betting that:

1. AI agents actually need blockchain infrastructure (debatable but trending yes)

2. Vanar's compression tech gets adoption (possible)

3. The market eventually cares about fundamentals again (lol, but maybe?)

It's a speculative play for sure. But at least it's speculation on tech that's shipping, not just another meme coin or abandoned metaverse graveyard.

Sometimes the best time to pay attention is when everyone else has written something off. Not saying ape in—but maybe don't delete it from your watchlist just yet.

---

Images still apply exactly where I said! The price chart hits harder now with this conversational tone, and the Neuron compression image breaks up that technical explanation perfectly.