Headline:

Bitcoin Falls to Lowest Level Since 2025 Tariff Shock — What It Means

Intro:

Bitcoin’s price dropped sharply to around $77,000, the lowest level since the major tariff-related market shock of the prior year. This continued decline is grabbing attention across the industry.

What happened:

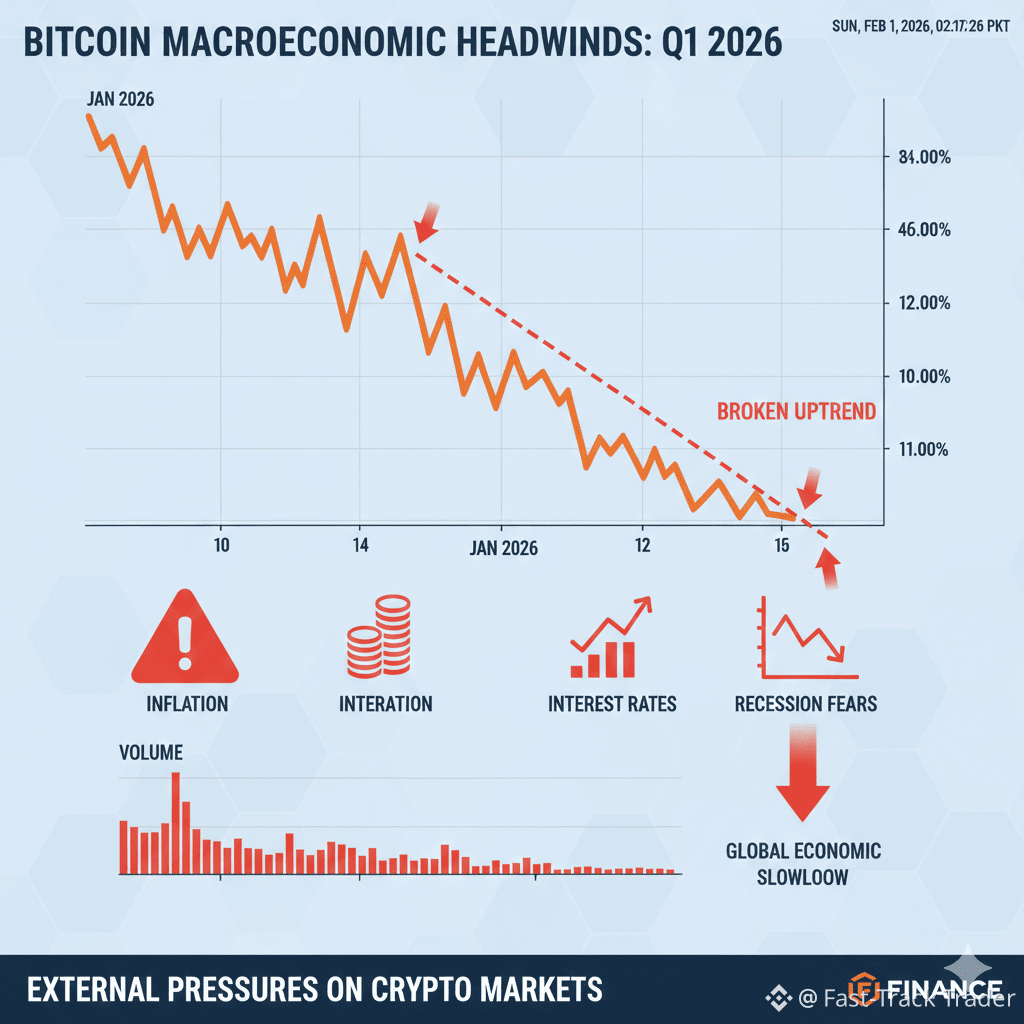

On January 31–February 1, 2026, Bitcoin fell roughly 8% in a single day and has declined nearly 13% so far this year. The slide comes amid broader macroeconomic pressures, geopolitical uncertainty, and waning confidence in Bitcoin’s role as “digital gold”. Major altcoins like Ethereum and Solana also showed sharp declines.

Why it matters:

Bitcoin often acts as the benchmark of crypto sentiment. A sustained downturn can affect wider market psychology. Understanding price action helps beginners differentiate short-term volatility from long-term structural trends — such as adoption, network development, and regulatory clarity. This is educational context, not financial advice.

Key takeaways:

• Bitcoin reached ~$77,000 — a multi-month low.

• Broader macro and geopolitical factors are influencing crypto prices.

• Altcoins like ETH and SOL tracked the weakening trend.

• Price movement reflects sentiment, not prediction.

#Bitcoin $BTC #CryptoMarket #Volatility