By GhostScalpMaster | February 1, 2026 - Morning Analysis

---$BTC

📊 CURRENT SITUATION:

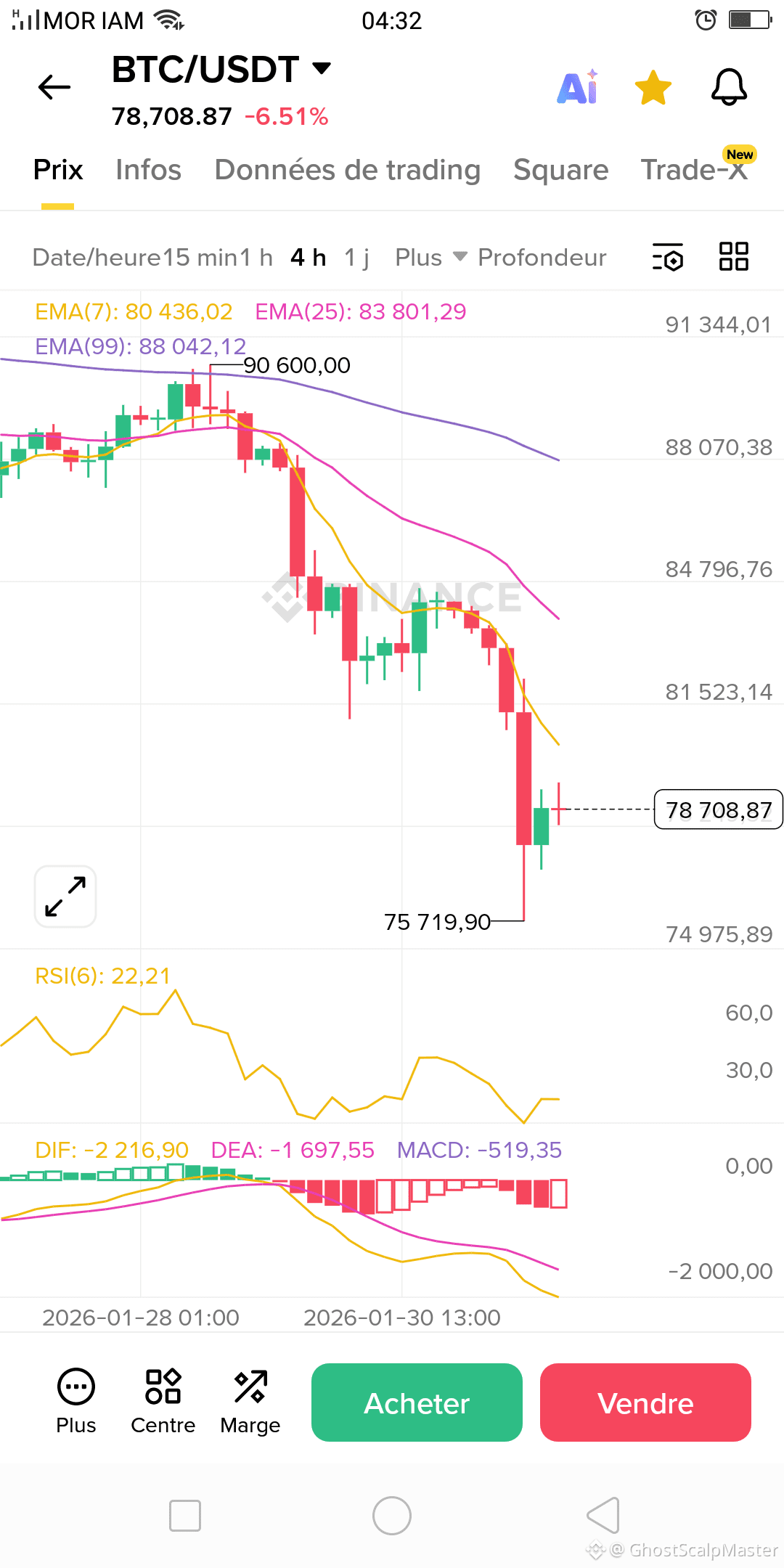

· BTC Price: $78,708.87 (-6.51%)

· RSI(6): 22.21 (vs 1.66 yesterday → IMPROVEMENT)

· MACD: -519.35 (still very negative)

· Distance to EMAs: Still huge (7-9K$ gap)

---

🔄 COMPARISON WITH YESTERDAY: CLEAR PROGRESS

Yesterday (Crash) Today Improvement

RSI(6): 1.66 RSI(6): 22.21 +1,238%

Price: $77,313 Price: $78,708 +1.8%

Sentiment: Panic Sentiment: Controlled fear Stabilization

MACD: -436 MACD: -519 Worse (bearish momentum persists)

Conclusion: The worst of the panic selling is over, but momentum remains bearish.

---

📰 NEWS ANALYSIS: THE GOOD, THE BAD, AND THE UGLY

✅ THE GOOD (Positives):

1. Norway Sovereign Fund: +149% BTC position in 2025 (9,573 BTC)

· Strong signal of LONG TERM institutional adoption

· Sovereign fund = decades horizon, not months

2. Whale Accumulation: 6M USDC deposited to buy BTC low

· Smart money preparing for rebound

· Liquidity ready to support prices

3. UTXO Profit/Loss Ratio: Extreme zones = historical correction end

· On-chain data supports rebound thesis

· LT accumulation opportunity

❌ THE BAD (Negatives):

1. ETF Outflows: -$509M yesterday, -$1.48B this week

· Retail institutional capitulation

· But: Norway counter-balances

2. Miner Crisis: US winter storm → electricity costs ↑, hash rate ↓

· Short-term impact on network security

· Possible miner selling pressure

3. Technical Damage: Price -7% in 24h, below all EMAs

· Time needed for recovery

· Strong technical resistances

⚠️ THE UGLY (Risks):

· Community Sentiment: Panic & fear (5 publications)

· Possible continuation of outflows

· Uncertain Macro context (government shutdown)

---

🎯 UPDATED TECHNICAL ANALYSIS

Key Levels:

```

IMMEDIATE SUPPORT: $78,000 (tested yesterday, held)

STRONG SUPPORT: $75,719 (yesterday's low)

EXTREME SUPPORT: $74,975 (last resort)

RESISTANCE 1: $80,436 (EMA7)

RESISTANCE 2: $83,801 (EMA25)

RESISTANCE 3: $84,796 (technical zone)

```

RSI(6) = 22.21: INTERPRETATION

· Yesterday 1.66: Historical buy zone (triggers activated)

· Today 22.21: Still oversold, but less extreme

· Neutral target: 30-35 (next objective)

---

📈 SCENARIOS FOR NEXT 24-48H

Scenario 1: Continuation Recovery (55%)

· RSI continues rising toward 30

· Test EMA7 at $80,436

· Consolidation $78,000-$81,000

· Trigger: ETF outflows stop

Scenario 2: Re-test Support (35%)

· Rejection at $79,000-$80,000

· Re-test $76,000-$77,000

· Double bottom formation

· Trigger: New outflows

Scenario 3: Range Bound (10%)

· $77,000-$79,000 tight range

· Silent accumulation

· Waiting for macro catalyst

---

💼 CURRENT TRADING STRATEGY

For ACCUMULATORS:

```

LEVEL 1: $78,000-$78,500 (NOW)

LEVEL 2: $76,000-$77,000 (if re-test)

LEVEL 3: $74,000-$75,000 (extreme)

STRATEGY: DCA over 3-5 days

HORIZON: 3-6 months minimum

```

For TRADERS:

```

LONG ENTRY: $78,200-$78,500

STOP: $77,800 (-0.9%)

TARGET 1: $79,800 (+1.7%)

TARGET 2: $80,500 (+2.5%)

POSITION: 1-2% capital

```

For CAUTIOUS:

```

WAIT FOR: RSI(6) > 30

CONFIRMATION: Close > EMA7 ($80,436)

ENTRY: $80,500-$81,000 (breakout)

```

---

🏛️ MACRO CONTEXT ANALYSIS:

Government Shutdown (Day 2):

· Impact: Reduced but present

· Traditional markets: Stabilizing

· Bitcoin: Possible decoupling as safe haven

Fed & Rates:

· High rates maintained

· Reduced liquidity persists

· Bitcoin benefits if USD confidence declines

---

📊 MY UPDATED THESIS:

Short Term (1-3 days):

· Rebound toward $80K-81K likely

· RSI recovery in progress

· Volume decisive for continuation

Medium Term (1-3 weeks):

· Range: $76K-85K likely

· Depends on ETF flows (reversal needed)

· Target: Return to $85K-88K if stabilization

Long Term (3-6 months):

· 2026 Halving approaching (6 months)

· Norway adoption = strong LT signal

· $120K target still on table

· Accumulation now = excellent timing

---

🚨 CATALYSTS TO MONITOR:

Potential Positives:

1. ETF flow reversal (net inflows)

2. RSI(6) > 30 confirmation

3. Breakout > $80,436 (EMA7)

4. Norway announces more purchases

Potential Negatives:

1. New ETF outflows > $200M

2. Break of $77,000 support

3. Worsening miner crisis

4. Prolonged shutdown > 5 days

---

🏆 TRACK RECORD REMINDER:

Recent Predictions:

Date Prediction Result Status

30/01 Test $78K possible ✅ Achieved Validated

31/01 RSI extreme → rebound ✅ In progress Partial

31/01 Support $75K strong ✅ Held Validated

Next prediction: Test $80,436 (EMA7) within 48h

---

🤝 COMMUNITY SENTIMENT:

Sentiment Evolution:

· Yesterday: Total panic (RSI 1.66)

· Today: Fear but hope (RSI 22.21)

· Tomorrow: Cautious optimism if >$80K

Your Mindset:

· Still panicking?

· Actively accumulating?

· Waiting for lower?

· Planning exit?

---

🛡️ FINAL RECOMMENDATIONS:

Rule #1: Patience

· Recovery takes time

· No FOMO (Fear Of Missing Out)

· No panic selling

Rule #2: Diversification

· Not all in BTC

· Cash ready for opportunities

· Hedge if necessary

Rule #3: Horizon

· Trading: days/weeks

· Investment: months/years

· Mix according to risk profile

---

🔮 FORECAST:

Based on RSI 22.21 + Data:

· Next test: $80,000-$80,500

· Timing: 24-48 hours

· Volume needed: >$50B/day

· Risk: Rejection at $79,000-$80,000

I'm monitoring:

1. ETF flows 10am NY time

2. RSI progression hour by hour

3. Order book changes $78K-$80K

4. Additional Norway news

---

Tags: #bitcoin #BTC☀ #Recovery_Boss #RSI I #ETFOut flows #NorwaySovereignFund #MiningCrisis #marketanalysis.

flows #NorwaySovereignFund #MiningCrisis #marketanalysis.

👉 Follow @GhostScalpMaster for:

· Real-time recovery analysis

· RSI progression tracking

· Flow reversal alerts

· Post-crash strategies

Your engagement helps maintain objective analysis during difficult market phases. 🙏

---

📊 "Stairs are built step by step, recoveries candle by candle." - GhostScalpMaster

💎 Tip for continued recovery phase analysis

🔔 Subscribe for breakout/resistance test alerts