The crypto market remains under broader risk aversion, driven by macro uncertainty, tightened liquidity conditions, and extended sell-offs across major assets. BTC and ETH are trading lower, reflecting persistent downside pressure and reduced risk appetite. Meanwhile, gold and other safe havens continue attracting capital as global macro stress rises — a classic risk-off environment.

Major recent developments include significant liquidation events, geopolitical tensions, and macro headlines that have temporarily dampened crypto sentiment, particularly around BTC and ETH.

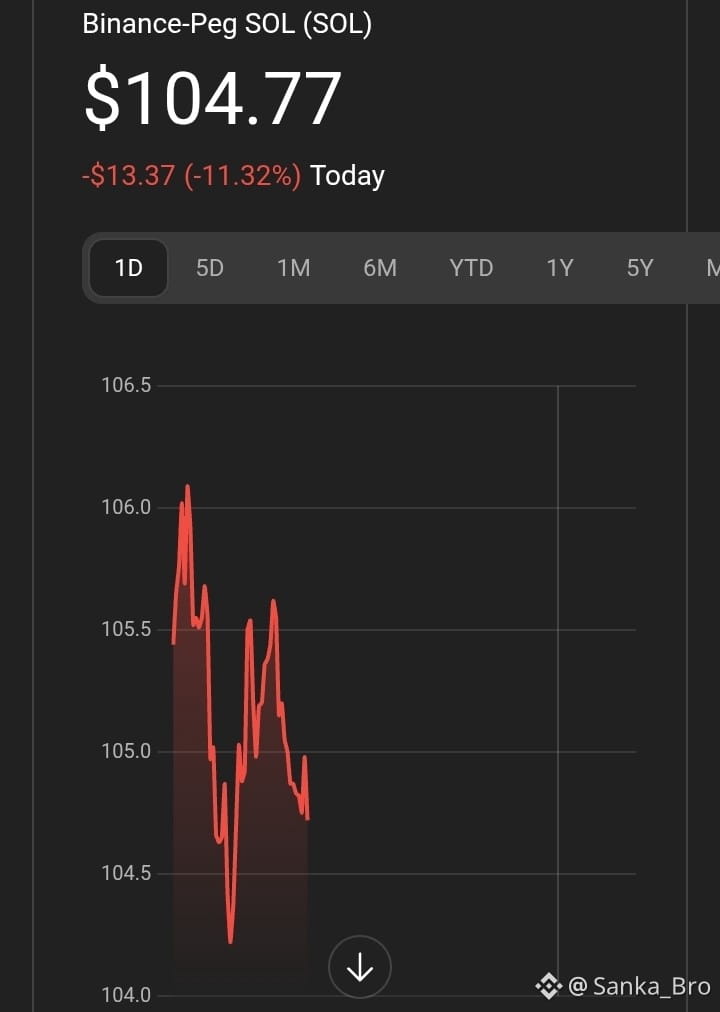

🔑 Solana ($SOL) — At a Critical Decision Zone

SOL’s price continues to struggle near key support ranging roughly $110–$120, with current price action showing both consolidation and downside risk. Technical indicators highlight:

📉 Technical Current View

Key support zone near $116–$120 — breaking this could open deeper downside toward $100 – $90.

Resistance and rejection remain near $130–$136 overhead — reclaiming this would signal waning seller control.

Indicators like RSI and momentum are closer to oversold or neutral, but trend direction remains ambiguous without a breakout confirmation.

This aligns with your “make-or-break zone” thesis: a break below the macro support structure confirms deeper correction bias, while holding above could lead to a relief rally.

📈 On-Chain & Fundamental Signals

Despite price weakness:

Institutional exposure via Solana ETFs has shown net inflows — suggesting longer-term holders are accumulating rather than liquidating.

Network activity metrics have shown bullish signs and higher transactional demand.

This divergence often appears in late-stage corrections rather than full structural breakdowns — but confirmation remains key.

📌 Key Scenarios to Watch — SOL

🟢 Bullish Scenario

If SOL:

Holds above $116–$120

Reclaims $130+ with strong volume

Then buyers could push toward $143–$160+ and potentially rekindle a broader uptrend.

🔴 Bearish Scenario

If SOL:

Breaks decisively below $110–$116

Then price could slide toward $90, and in aggressive sell phases even lower structural demand levels.

💡 Risk management is crucial: confirmation matters more than hope — wait for door-to-door closes, not just wick touches.

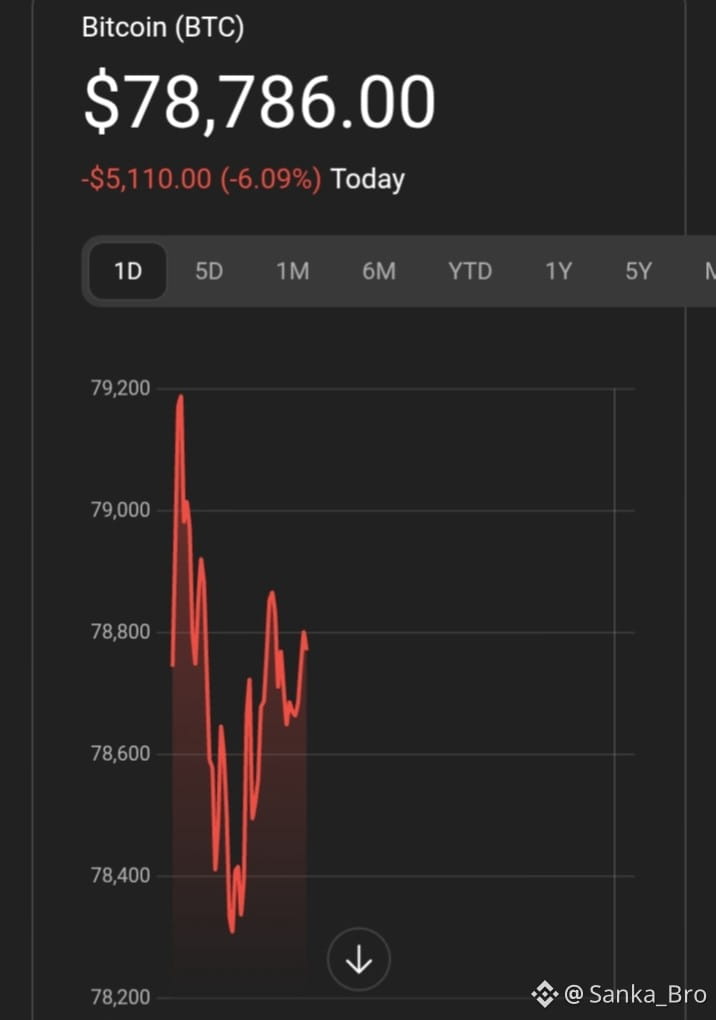

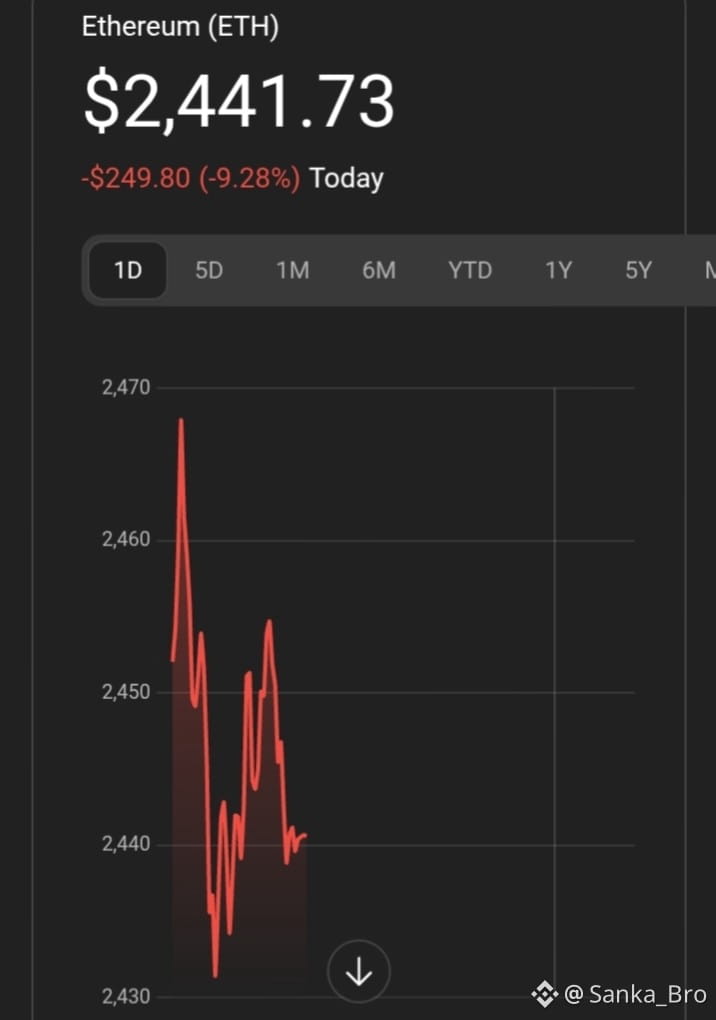

📈 Bitcoin (BTC) & Ethereum (ETH) Snapshot

BTC: Market volatility remains skewed to the downside, trading well below prior critical levels. Institutional flows are present but insufficient to offset bearish macro pressure.

ETH: Continues to lag Bitcoin’s performance, with similar macro tied weakness affecting sentiment and price structure.

In both cases, macro catalysts (Fed decisions, risk sentiment, liquidity swaps) remain dominant drivers — not just crypto-specific flows.

📊 Macro Market Influence

The crypto market is reacting to global macro risk conditions, including:

Tariff wars and geopolitical tensions

Monetary policy expectations

Liquidity shifts into traditional safe havens

This has pressured risk assets broadly and triggered temporary capital flows into safer assets like gold. These macro conditions tend to influence crypto market direction more than short-term technical setups during high-volatility regimes.

🧠 Trading Strategies (Today)

🚀 Bullish Scenarios

Long Entry (swing / value):

Above SOL support zone $116–$120

Confirmation: Daily candle close > $130

Targets: $143 → $155–$160

Stop: Below $110

ETH & BTC Relief Moves:

Long if BTC reclaims $85K with volume

ETH confirmation above $2.8K

📉 Bearish / Risk-Off Strategies

Short Continuation Trades:

SOL failure to hold below $116 → short targeting $100 → $90

BTC breakdown continuation below recent lows

ETH continuation if below $2.3K

Hedging / Safety Play:

Allocate a portion into gold or stable assets during macro stress

💡 Long-Term Investor Perspective

Longer-term investors may view

$116–$120 on SOL as a strategic accumulation zone

Macro pullbacks as opportunities — risk control first

Short-term traders must watch structural breaks and confirmation signals before committing.

#CryptoMarket