In the evolving world of blockchain technology, Plasma emerges as a cutting-edge Layer 1 blockchain uniquely optimized for stablecoin settlement. By integrating full Ethereum Virtual Machine (EVM) compatibility through Reth, offering sub-second finality with its innovative PlasmaBFT consensus, and embedding specialized stablecoin-centric features such as gasless USDT transfers and a stablecoin-first gas payment model, Plasma is primed to revolutionize how stablecoins are transacted worldwide.

The added layer of Bitcoin-anchored security ensures unmatched neutrality and censorship resistance, making Plasma a compelling choice for both retail users in high-adoption markets and institutional players in payments and finance.

This article dives deep into Plasma’s architecture, features, market potential, and technological innovations supplemented with data-driven charts for clarity.

What Makes Plasma Stand Out?

Plasma Architecture Overview

Diagram: Plasma Blockchain Architecture

Execution Layer: Supports all Ethereum-compatible smart contracts via Reth.

Consensus Layer: PlasmaBFT consensus ensures fast and secure finality.

Security Layer: Periodic anchoring of Plasma’s state on Bitcoin’s blockchain.

Why Stablecoin-Centric Design Matters

Stablecoins like USDT and USDC have become essential for cross-border remittances, DeFi, and everyday payments. However, they often suffer from:

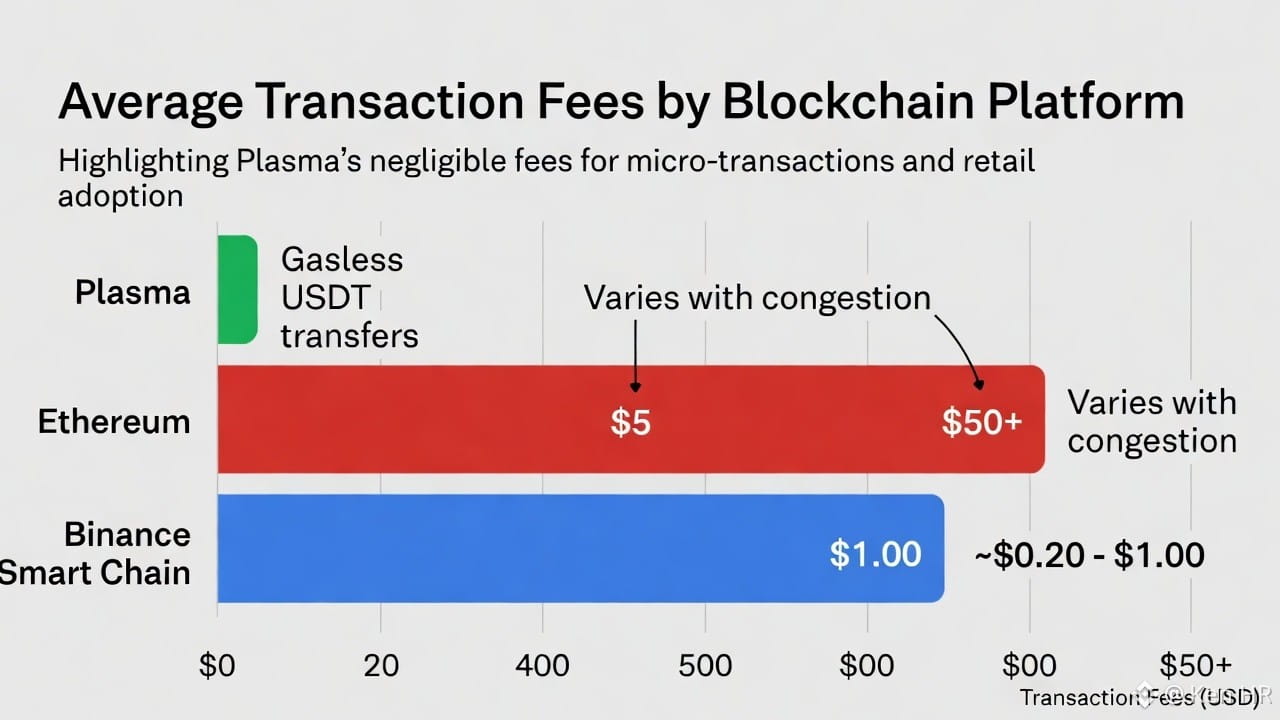

High gas fees, especially on Ethereum.

Slow transaction confirmation times.

Network congestion causing delays.

Dependence on Layer 2 or custodial solutions with potential security trade-offs.

Plasma tackles these by embedding stablecoin-first protocols:

Gasless USDT transfers: Users pay zero gas fees on USDT transfers, drastically reducing costs.

Stablecoin-first gas payment: Instead of native token gas fees, users pay in stablecoins, aligning incentives and simplifying user experience.

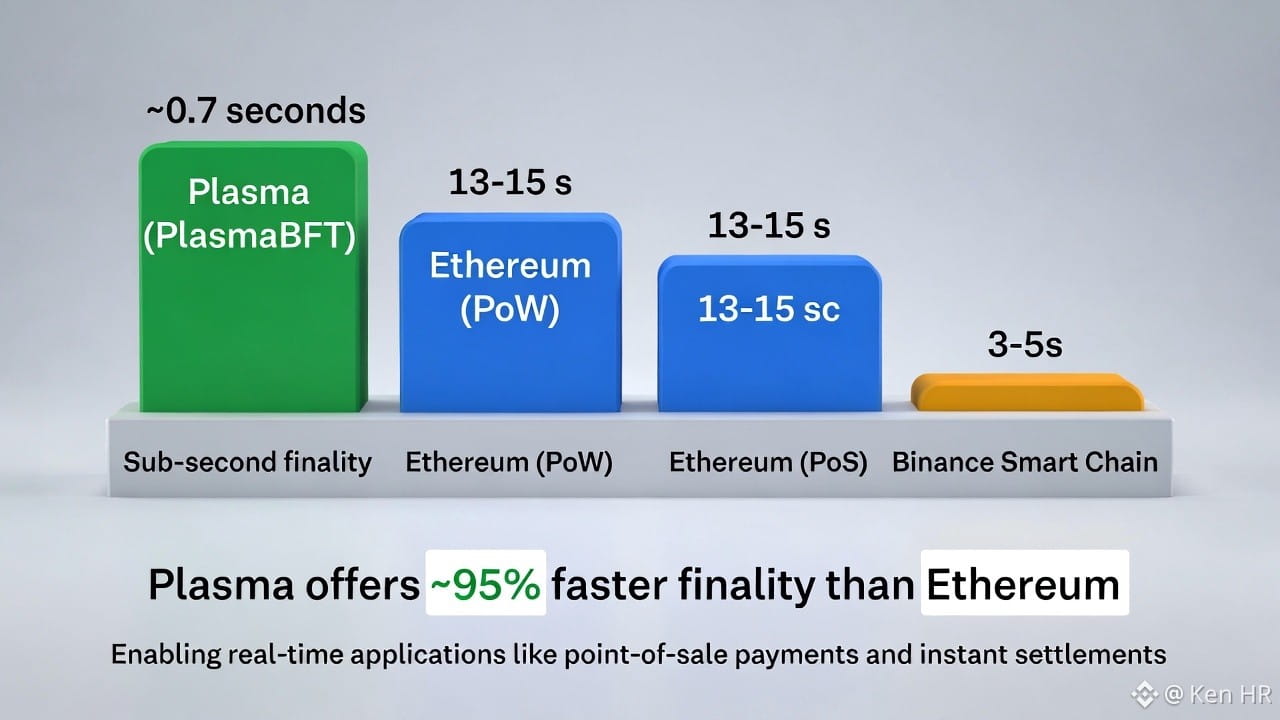

Transaction Finality Comparison

Transaction Fee Comparison (USD Equivalent)

Bitcoin-Anchored Security: The Backbone of Trust

Plasma enhances trust through anchoring its blockchain state on the Bitcoin network at regular intervals. This mechanism:

Leverages Bitcoin’s unmatched hash power for security.

Reduces risks of censorship and centralization.

Provides a secure final checkpoint for Plasma’s transaction history.

This innovative approach ensures that Plasma benefits from Bitcoin’s robustness without sacrificing scalability.

Target Markets and Use Cases

Retail Users in High-Adoption Markets

Plasma’s cost efficiency and speed make it ideal for markets with high stablecoin usage, such as emerging economies. It enables:

Micro-payments for everyday purchases.

Fast remittances with minimal fees.

Seamless integration with digital wallets and merchant platforms.

Financial Institutions and Payment Providers

Plasma serves institutions needing:

Instant cross-border settlements.

Efficient treasury management.

Compliant, auditable transactions with blockchain transparency.

Technical Innovations

Reth enables full Ethereum compatibility, easing migration of existing dApps.

PlasmaBFT consensus combines Byzantine Fault Tolerance with rapid finality.

Stablecoin-first gas payment transforms user experience by eliminating the need for multiple tokens.

Conclusion

Plasma blockchain is a visionary platform designed from the ground up for stablecoin settlement. By fusing advanced technical design with stablecoin-first usability, it delivers a fast, secure, and scalable infrastructure capable of supporting the next generation of decentralized finance and payment applications.

Its Bitcoin-anchored security model uniquely positions it to withstand censorship and attacks, while gasless transfers and sub-second finality ensure frictionless adoption for retail and institutional users alike.

As the stablecoin economy grows exponentially, Plasma stands ready to power the future of digital payments with unmatched efficiency and security.