Plasma feels like it was built by people who are tired of hearing “stablecoins are the future” while watching stablecoin payments still behave like a crypto chore.

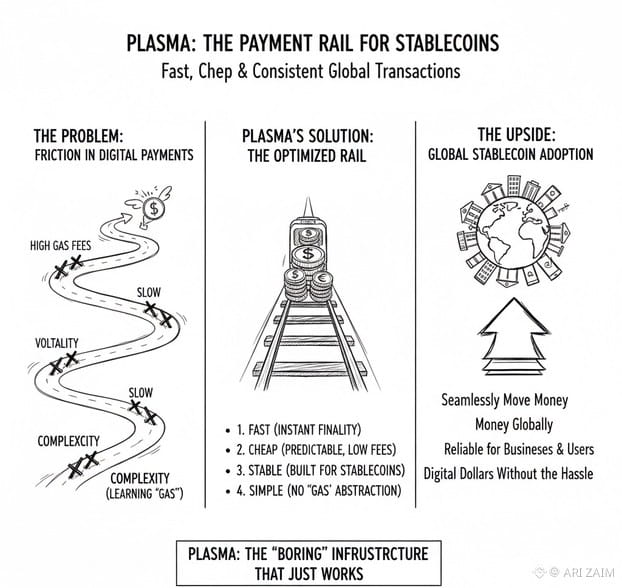

The project’s whole idea is pretty grounded: if stablecoins are already being used like digital dollars across the world, then the chain they settle on should behave like a real payment rail—fast, cheap, consistent, and easy enough that you don’t have to learn “gas” just to move money. Plasma isn’t trying to be everything for everyone. It’s trying to be the place where stablecoins move at scale without the usual friction.

What Plasma is actually building is a Layer-1 that speaks EVM fluently (so apps can use familiar Ethereum tooling) but is tuned for settlement speed. They talk about sub-second finality using their own BFT approach (PlasmaBFT) and an EVM stack based on Reth. Under the hood, the way they describe it is closer to payments infrastructure than a typical community-first chain: validators focus on finality and security, while non-validator nodes can scale out RPC capacity so apps don’t fall apart under load. It’s also not shy about progressive decentralization—early stages are more controlled, with the idea that validator participation opens up over time. That tradeoff is worth knowing because it’s part of the project’s “we want this to work at scale on day one” mindset.

The biggest one is gasless stablecoin transfers—especially around USDT. The project’s docs describe a protocol-managed paymaster system that can sponsor fees for certain stablecoin actions like transfers, with things like eligibility checks and rate limits. In plain terms, the dream is: you hold stablecoins, you send stablecoins, and you’re not blocked by “you don’t have the gas token.” That sounds small until you’ve onboarded real users. That one moment—needing a separate coin to move your dollars—is where a lot of people quit.

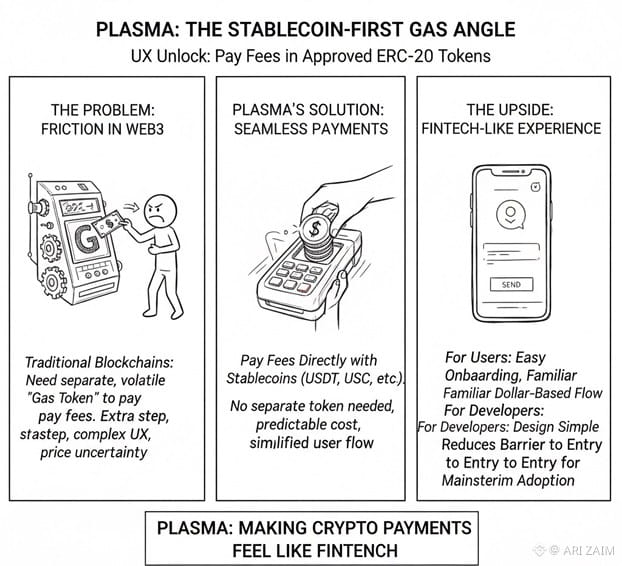

Then there’s the “stablecoin-first gas” angle. Plasma supports paying transaction fees using approved ERC-20 tokens (including stablecoins). If that works smoothly in real wallets and apps, it’s a huge UX unlock. It means builders can onboard users into a dollar-based flow without forcing them into a separate token step first, and it lets products design experiences that feel like fintech instead of like a blockchain tutorial.

Plasma also frames itself around neutrality and censorship resistance by bringing Bitcoin into the security narrative—what they call Bitcoin-anchored security. A major piece of that is the Bitcoin bridge / pBTC idea that’s described in their docs as still under active development rather than fully live at the mainnet beta stage. Conceptually, they want a bridge design that can mature toward being more trust-minimized over time (they mention things like verifier networks, threshold signing, and future cryptographic upgrades). Practically, it’s best to treat that as the direction they want to go, and measure it by shipped features and audits rather than by the storyline. It’s still an important part of “what Plasma is trying to become,” but it’s not the thing you rely on today unless it’s live and proven.

On the “what exists now” side, Plasma publicly lists its mainnet beta network configuration (RPC endpoint, chain ID, explorer, etc.), and it has its own explorer at plasmascan. That’s where you can get the least biased signal: whether people are actually using it. On-chain charts show real movement—new addresses, transactions, contracts deployed, and fee totals—numbers that can’t be polished into a press release. Even if you ignore everything else, this is the part that tells you if the chain is getting traction as a payments rail.

Now the token piece—XPL—fits into Plasma’s design in a way that’s easy to misunderstand. Plasma wants stablecoins to feel like the default user currency, but the chain still needs a native token for network mechanics: validator incentives, default gas behavior, and the economic plumbing that supports security. Their tokenomics outline supply, allocations, validator reward emissions with a declining inflation schedule, and an EIP-1559 style fee burn. What’s notable is the intent: Plasma is trying to build a world where many users don’t have to think about XPL at all, because stablecoin-denominated fees and sponsored transfers can carry the everyday experience. That’s different from chains where the native token is the unavoidable toll booth for every interaction.

The “what’s next” path for Plasma is pretty clear if you look at what it’s optimizing for. First, the stablecoin UX has to hold up under real scale—gasless transfers and paymasters only matter if they don’t collapse into spam defenses, confusing limits, or unpredictable behavior. Second, stablecoin-first gas has to land in real products—wallets and payment apps using it as a default, not a demo. Third, decentralization has to become visible over time—more external validators, delegation, and transparent security assumptions as the network matures. And finally, the Bitcoin bridge narrative has to move from roadmap to reality, because that’s where their long-term “neutral settlement layer” story becomes more than marketing.