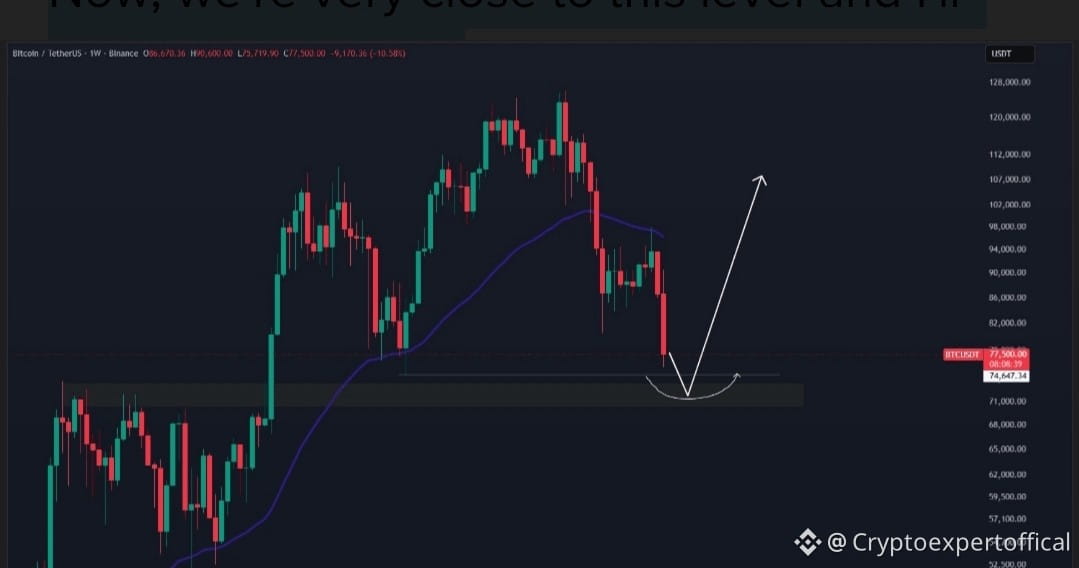

For months, this exact scenario has been on the radar. Now, price is approaching a critical level — and the reaction here could define the next major move for $BTC.

📊 The Setup: A Classic Liquidity Grab

The current structure suggests a potential liquidity sweep below previous lows, followed by a strong reversal.

We’ve seen this playbook before — not just in crypto, but in the biggest stocks in the world:

$NVDA 📈

$GOOG 📈

$MSFT 📈

Each showed the same pattern:

🔻 Break below support (trap sellers)

🚀 Aggressive rally afterward

It’s one of the most efficient moves big money uses to shake out weak hands.

🌎 The Macro Perspective

From a broader macro view, 2026 still favors strength in equities and crypto.

This recent move could be a necessary reset before continuation. Liquidity grabs often act as fuel for the next expansion phase.

However — and this is important — acceptance below key levels would invalidate this thesis and force a full re-evaluation toward bearish scenarios.

This is not certainty. It’s probability. ⚖️

📍 Key Levels & Timeline

🔹 75K — Strong short-term support

If this level holds, a push upward into early–mid February is likely 📈

🔹 After that — another pullback

A potential major low forming between Feb 26 – March 2 ⏳

🔻 If 75K breaks decisively:

The deeper bottom range sits between 58K–68K

That zone would likely mark the true cyclical low.

🚀 What Comes Next?

If this structure plays out:

📈 Recovery begins after early March

📈 Major upside momentum into mid-April

📈 Another potential peak around mid-July

That defines the strategy:

Low to bid. High to distribute. 🎯

⚠️ Risk Reminder

This outlook carries risk.

The bearish case is valid.

Disagreement is healthy.

In the end — liquidity will decide the direction. 💧

Stay flexible.

Stay objective.

And let price confirm the story. 🟠🔥$BTC