The cryptocurrency market is extending its correction, with total market capitalization slipping to around $2.54 trillion after a daily decline of more than four percent.

Key takeaways:

Bitcoin has fallen to its lowest level since early 2024, signaling a breakdown in medium-term market structure

Market sentiment has deteriorated sharply, with fear dominating investor behavior

Losses are broad-based, affecting both major assets and altcoins

Capital rotation into stable coins suggests defensive positioning rather than full market exit

Broad selling pressure has pushed the market into deep risk-off territory, reflected by a Fear and Greed Index reading of fifteen, firmly in the “extreme fear” zone.

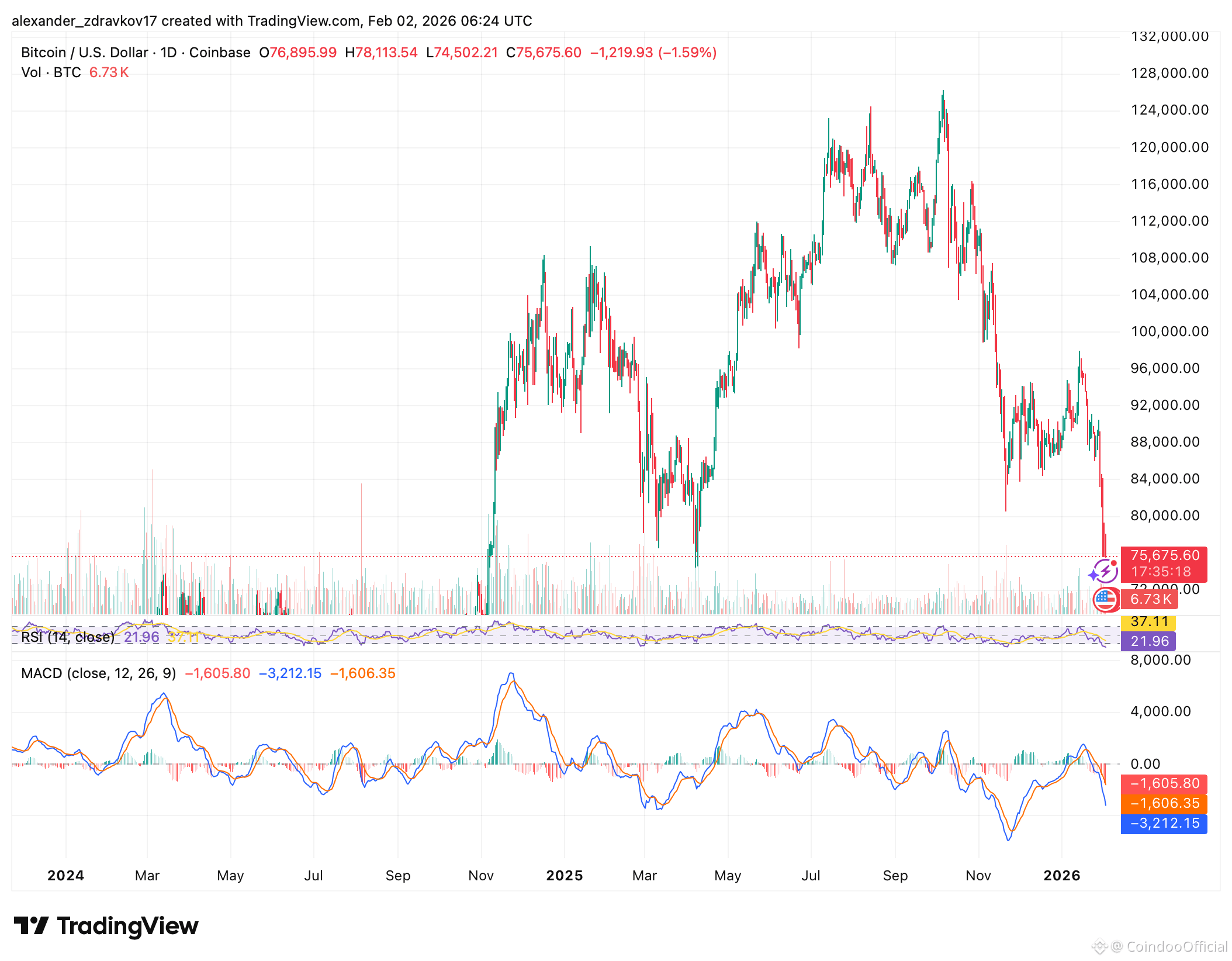

Bitcoin has dropped to its lowest level since early 2024, briefly trading near $75,600. Despite minor intraday rebounds, the leading digital asset remains down close to fourteen percent on a weekly basis.

Technical indicators point to growing downside momentum, with the daily Relative Strength Index hovering near oversold levels and the Moving Average Convergence Divergence remaining deeply negative, signaling that bearish control has not yet been broken.

Technical indicators point to growing downside momentum, with the daily Relative Strength Index hovering near oversold levels and the Moving Average Convergence Divergence remaining deeply negative, signaling that bearish control has not yet been broken.

Selling pressure is not limited to Bitcoin. Ethereum has underperformed the broader market, falling more than twenty-three percent over the past seven days and slipping toward the $2,200 level. Other large-capitalization assets have followed a similar trajectory, reinforcing the sense of a market-wide deleveraging phase rather than isolated weakness.

Altcoins Struggle as Capital Remains Defensive

Altcoins have offered little relief. Solana and BNB have both posted double-digit weekly losses, while XRP has declined more than seventeen percent over the same period. The Altcoin Season Index currently stands at thirty-one out of one hundred, indicating that capital continues to favor Bitcoin relative to alternative assets, even as prices fall across the board.

From a technical perspective, Bitcoin is approaching a historically significant support zone between $72,000 and $75,000. A sustained break below this range could open the door to a deeper retracement, while a successful defense may provide the basis for a short-term relief bounce. However, momentum indicators suggest that any recovery attempt may face strong resistance unless broader market sentiment improves.

For now, the crypto market remains firmly in a corrective phase, characterized by declining prices, elevated volatility, and persistent risk aversion. Traders and investors appear to be waiting for clearer macro or regulatory signals before committing fresh capital, leaving the market vulnerable to further downside in the near term.