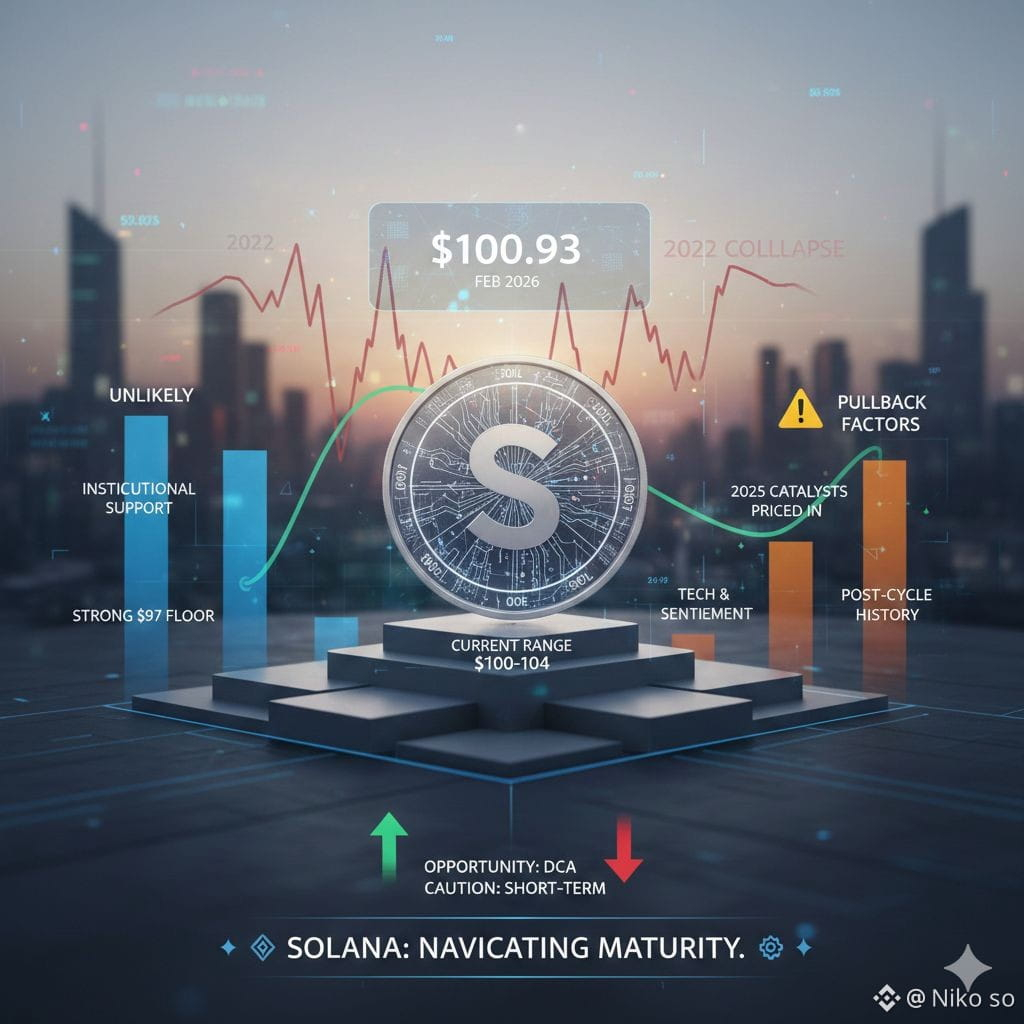

Solana ($SOL) is once again at the center of market debate. As of February 2026, SOL has retraced over 5% from its 2025 peak near $106, currently trading in the $100–$104 range (latest around $100.93).

Predictably, fear is spreading fast:

“SOL is doomed.”

“This is another 2022-style collapse.”

But after closely tracking SOL daily, the reality looks far more nuanced. ⚖️

My concise view: Solana is unlikely to repeat the full 2022 crash, but a structural pullback in early 2026 remains highly probable — potentially unfolding in phases.

❌ Why a Full 2022-Style Collapse Is Unlikely

🏦 1. Market Participants Have Changed

The Solana ecosystem today is not the same as it was in 2022. Institutional participation is higher, leverage is more controlled, and forced liquidations are far less aggressive. This significantly reduces systemic crash risk.

🌍 2. Macro Conditions Are More Supportive

Unlike past cycles, the broader environment is relatively stable. Crypto-friendly regulations, maturing infrastructure, and global acceptance act as shock absorbers against deep downside moves.

📊 3. Stronger Technical Floors

In prior bear markets, SOL collapsed through weak support levels. This time, major demand sits around $97–$98, making a vertical crash less likely without a major external shock.

⚠️ Why a Pullback Still Makes Sense

⏳ 1. 2025 Catalysts Are Largely Priced In

Many of the bullish drivers that fueled the 2025 rally have already played out. Markets rarely move in straight lines — digestion phases are normal.

📉 2. Technical & Sentiment Signals

Momentum indicators suggest short-term exhaustion, while sentiment has swung quickly from euphoria to fear — a classic setup for volatility.

🔁 3. Post-Cycle History

Historically, assets often enter retracement and consolidation phases after major cycle highs. This is not weakness — it’s structure.

🔮 Scenario Outlook (Not Financial Advice)

Most Likely 📌:

SOL gradually drifts toward $97–$101, then consolidates before the next directional move.

Optimistic 🚀:

$100 holds firmly as support, triggering a rebound toward $106–$108.

Pessimistic ⚠️:

Negative macro or network-specific news could briefly push SOL to $95–$96 — still far from a true collapse.

A total meltdown like 2022? Highly unlikely.

🧠 Final Mindset

This phase is less about panic and more about positioning.

📉 Dips can be opportunities for dollar-cost averaging, but short-term caution remains essential.

Strong assets don’t just pump — they breathe, correct, and rebuild.

Solana isn’t reliving 2022.

It’s navigating maturity. 💎⚙️

#solana #TrumpEndsShutdown #KevinWarshNominationBullOrBear #GoldSilverRebound #StrategyBTCPurchase