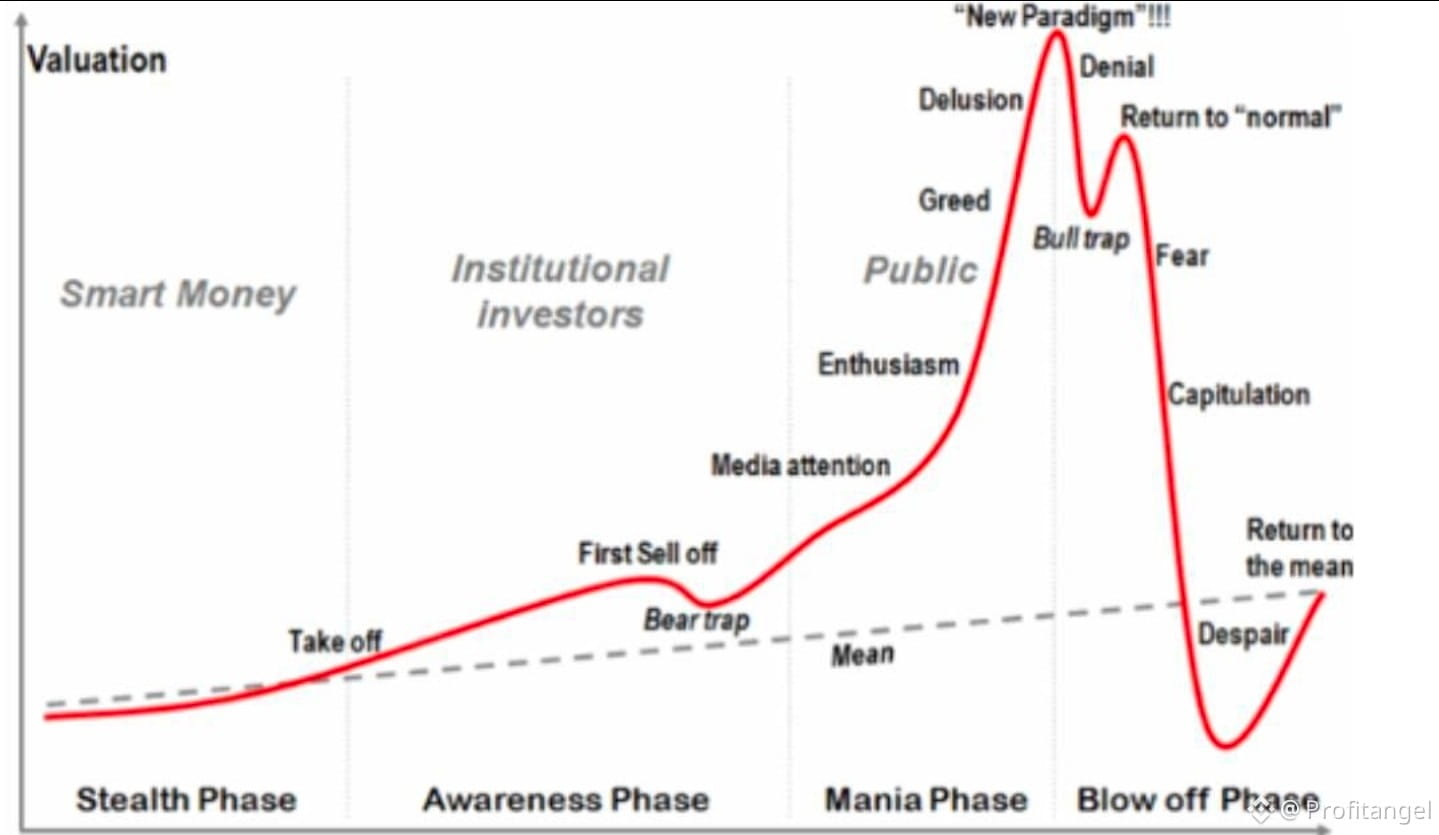

Financial markets don’t move randomly. They move in cycles, and the players with the deepest pockets — institutions and smart money — follow the same playbook every single time.

The strategy is simple, disciplined, and brutally effective: buy when fear is extreme, sell when excitement turns into euphoria.

Yet retail traders keep falling into the same trap.

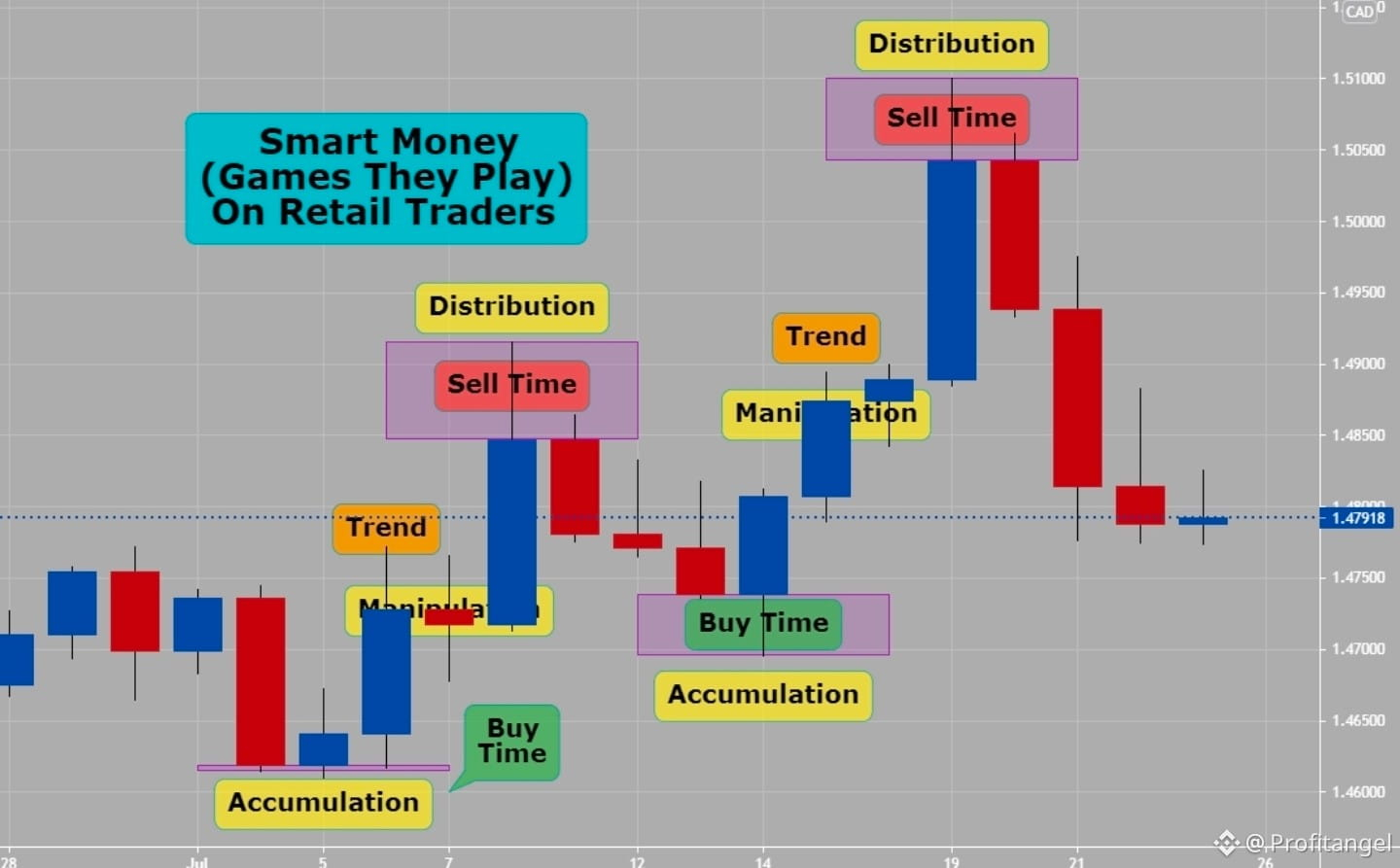

How Institutions Really Operate

Institutions don’t chase green candles. They wait for pain.

When markets are bleeding, headlines are screaming “crash,” and social media is flooded with panic, that’s when smart money quietly steps in. Liquidity is high, emotions are low, and prices are discounted.

They accumulate patiently while:

Retail is selling out of fear

Analysts downgrade targets

Influencers go silent

This phase is never loud. It’s uncomfortable. That’s the point.

The Public Illusion: Buy Loud, Sell Quiet

One of the most important things to understand is how information is used as a tool.

Institutions often publicly disclose what they buy — filings, interviews, press releases. This creates confidence and draws attention after they’ve already built positions.

But when it’s time to sell?

There are no announcements

No press conferences

No warnings

Instead, you’ll see denial:

“This is just a healthy pullback.”

“We’re still bullish long-term.”

While those words are circulating, smart money is distributing into strength — selling to an excited, overconfident crowd.

Fear Is for Buying, Excitement Is for Selling

Retail traders are emotional by nature:

They sell when price collapses

They buy when price feels “safe” again

Institutions do the opposite.

They understand a core truth:

Fear creates opportunity

Euphoria creates exit liquidity

When everyone is scared, prices are cheap. When everyone is excited, prices are expensive.

The crowd wants certainty. Smart money wants value.

Why This Cycle Never Changes

Technology evolves. Assets change. Narratives rotate.

But human psychology never does.

Fear, greed, hope, and regret drive markets just as they always have. Institutions understand this and design their strategies around it — not around emotions, not around headlines.

That’s why the same pattern repeats:

1. Panic → Accumulation

2. Recovery → Silence

3. Euphoria → Distribution

4. Denial → Collapse

And then it resets.

The Lesson Retail Must Learn

You don’t need insider information to survive these markets. You need discipline and emotional control.

Buy when fear feels uncomfortable

Reduce exposure when excitement feels irresistible

Stop following narratives at market extremes

If you find yourself feeling safe buying, you’re probably late. If you feel scared buying, you’re probably early.

Final Thought

Markets reward patience, not panic. They reward courage in fear, not confidence in euphoria.

Smart money isn’t smarter because it knows more. It’s smarter because it acts when others can’t.

Same playbook.

Every cycle. #Write2Earn