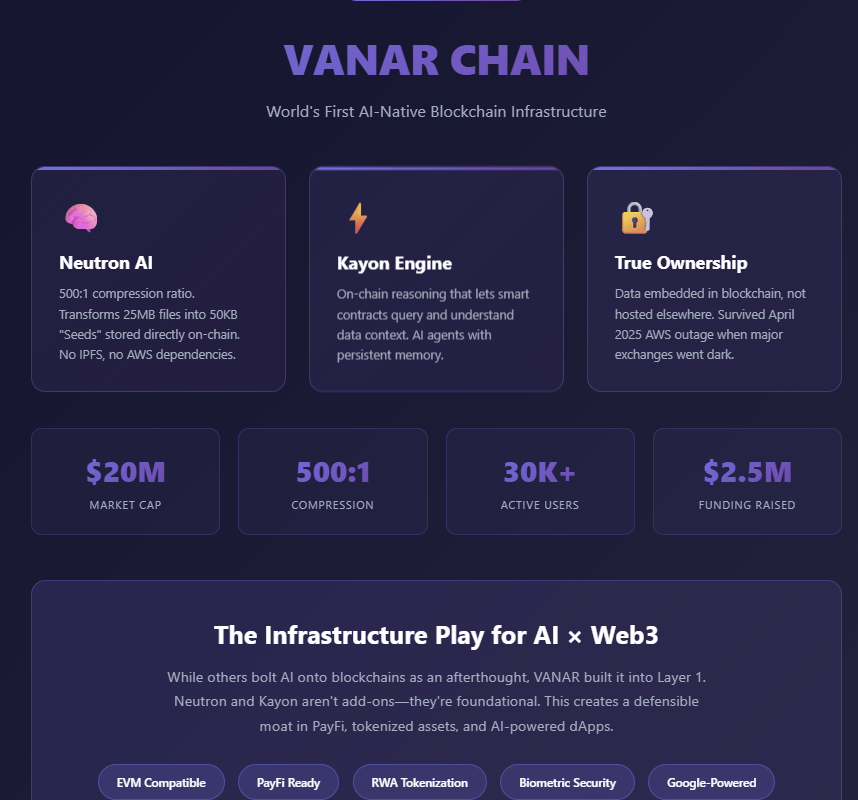

#VANAR is the first blockchain with AI tools like Neutron and Kayon embedded directly into Layer 1 . Not middleware. Not a plugin. Core infrastructure.

What Makes It Different:

Neutron compresses files up to 500:1 into "Seeds" stored on-chain. A 25MB file becomes 50KB. No IPFS. No AWS. When AWS went down in April 2025 and took Binance, KuCoin, and MEXC with it, VANAR kept running Cointelegraph. That's the value prop.

Kayon is a decentralized reasoning engine that lets smart contracts query and act on compressed data CoinMarketCap. AI agents get persistent memory. DeFi apps can verify compliance on-chain. Tokenized real-world assets carry their own documentation.

The Market Position:

Current market cap sits at $20M with $7M in daily volume Coinbase. Token price has declined 92% from its all-time high, which screams either "abandoned project" or "undervalued infrastructure play" depending on execution.

Recent development includes biometric security integration, a subscription model for AI tools, and pilot agent features for natural-language blockchain interactions CoinMarketCap. Real products shipping, not just whitepapers.

Use Cases That Matter:

PayFi with compliance-ready queries. Gaming with on-chain assets that survive server shutdowns. RWA tokenization where the deed lives on-chain, not in a Google Drive folder. World of Dypians has 30,000+ players already using the chain .

The Reality Check:

EVM compatibility means developers don't need new tools. Fixed transaction costs at 1/20th of a cent. Google's underwater cable network for speed. Founded in 2018, headquartered in Dubai, raised $2.5M from investors including Hashed and NGC Ventures PitchBook.

But low funding relative to competitors. Social sentiment is lukewarm—40% bullish vs 22% bearish on Twitter, with 59% neutral Coinbase. That's tepid, not enthusiastic.

Bottom Line:

$VANRY solved a real problem—centralized storage dependency—with genuinely novel tech. If Web3 moves toward AI agents and tokenized assets, this infrastructure matters. If not, it's vaporware in a bear market.

The 92% drawdown prices in failure. Recovery requires developer adoption and network effects that haven't materialized yet. High risk, potentially high reward if the AI × blockchain thesis plays out over 2025-2026.

ADPWatch