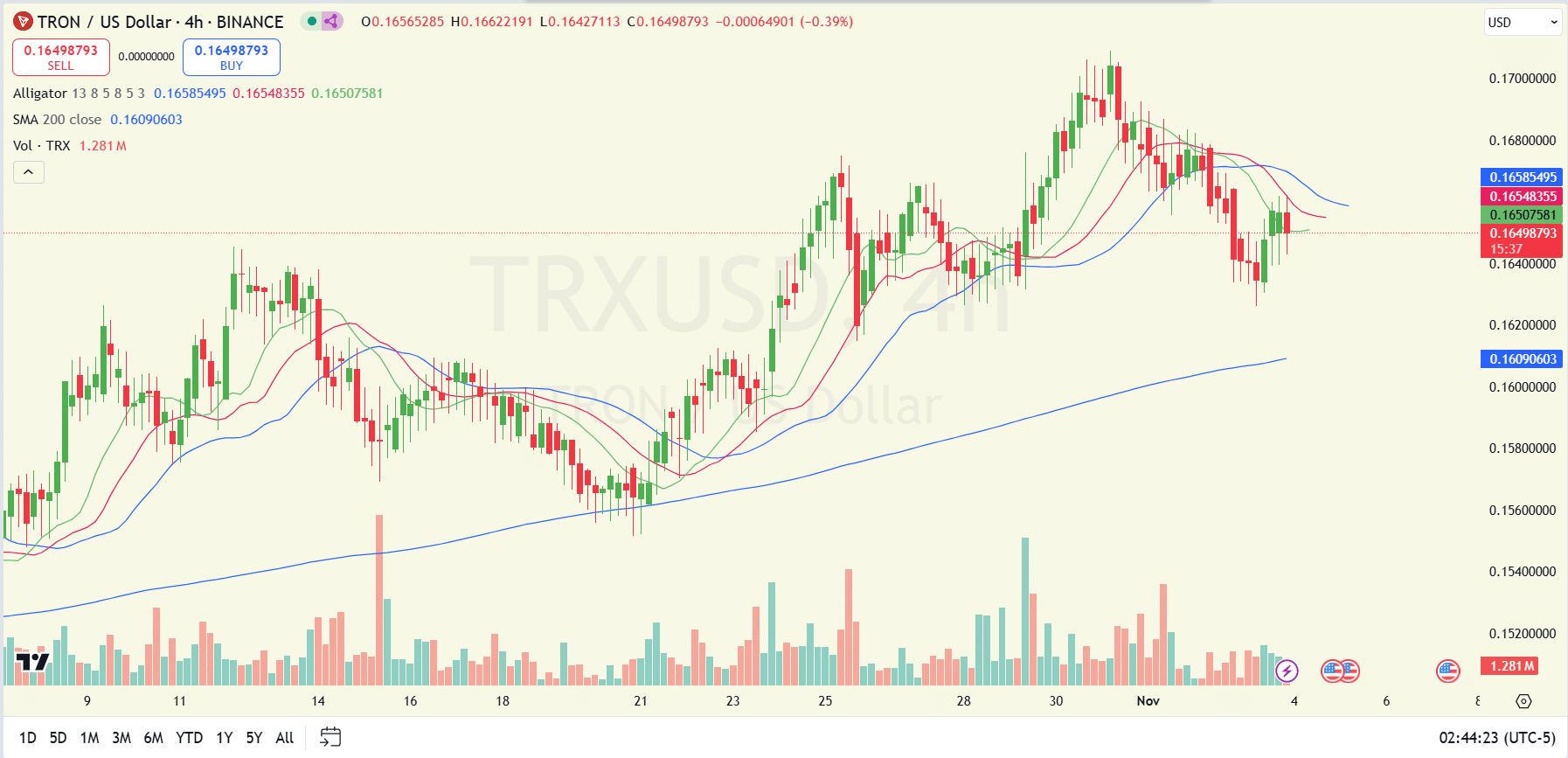

At the time of writing, TRX is trading above the 200-day simple moving average (200-SMA), indicating a long-term upward trend.

Token burning implies a deflationary mechanism for this altcoin.

Recently, TRON (TRX) reported a slight decrease in price on the charts, from $0.1678 at the beginning of the month to $0.1654 - a reduction of 1.8%.

However, the market capitalization of the altcoin has increased by 0.59%, with 24-hour trading volume rising sharply by 20.49% - a sign of growing interest from investors. These indicators, along with others, have highlighted sustained optimism around the altcoin's ecosystem.

Notably, TRON, driven by strategic initiatives such as token burning, is designed to reduce supply and encourage long-term value growth.

Expert forecasts also maintain an upward direction, suggesting a logarithmic growth trend that could push TRON to a target level of $1.11. The support level at $0.1635 has historically triggered an upward trend. A successful retest of this level would lead to stronger upward action, paving the way for a potential rise to $0.18 this week.

The technical indicators suggest a strong and sustainable increase

In October 2024, TRON carried out a significant token burn, removing over 149.6 million TRX tokens from circulation. This token amount has an estimated market value of about $25 million.

This burn event is part of Tron’s commitment to reducing token supply, promoting scarcity, which could positively impact price stability in the long term.

On the daily chart, the price of the altcoin has surpassed the 200-SMA line since early August. This means that the position of the SMA line continues to reinforce the long-term upward trend for the altcoin.

Source: TradingView

The trading volume has been moderate, with no significant spikes at the time of writing. This indicates a stable, low-volatility environment for TRX traders.

The Alligator indicator with three lines (green, red, and blue) also seems to be converging, implying an accumulation phase. This configuration can be interpreted as a sign that TRX has been and is accumulating strength, potentially preparing for the next move.

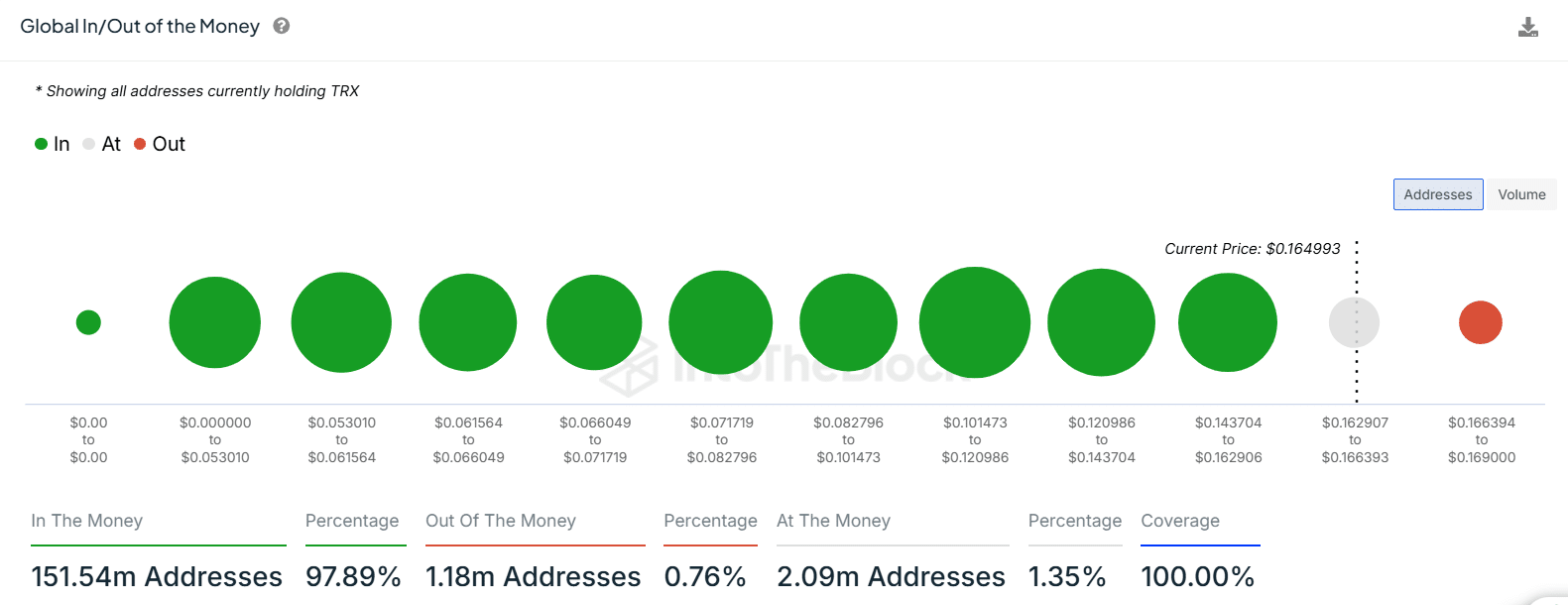

TRON holders are making profits, with less than 1% at a loss

At the time of writing, about 97.89% of all addresses holding TRX are 'in profit', indicating that these holders are making a profit compared to their initial purchase price.

Only a small portion, 0.76% of addresses are 'losing money', meaning these holders are at a loss at the trading price of the altcoin at the time of writing.

Meanwhile, 1.35% of addresses are 'breaking even' - a level where the purchase price is close to the current trading price of the cryptocurrency.

A high percentage of profitable addresses is a sign of strong market confidence in TRON, with the majority of investors benefiting from the recent price trend.

Source: IntoTheBlock

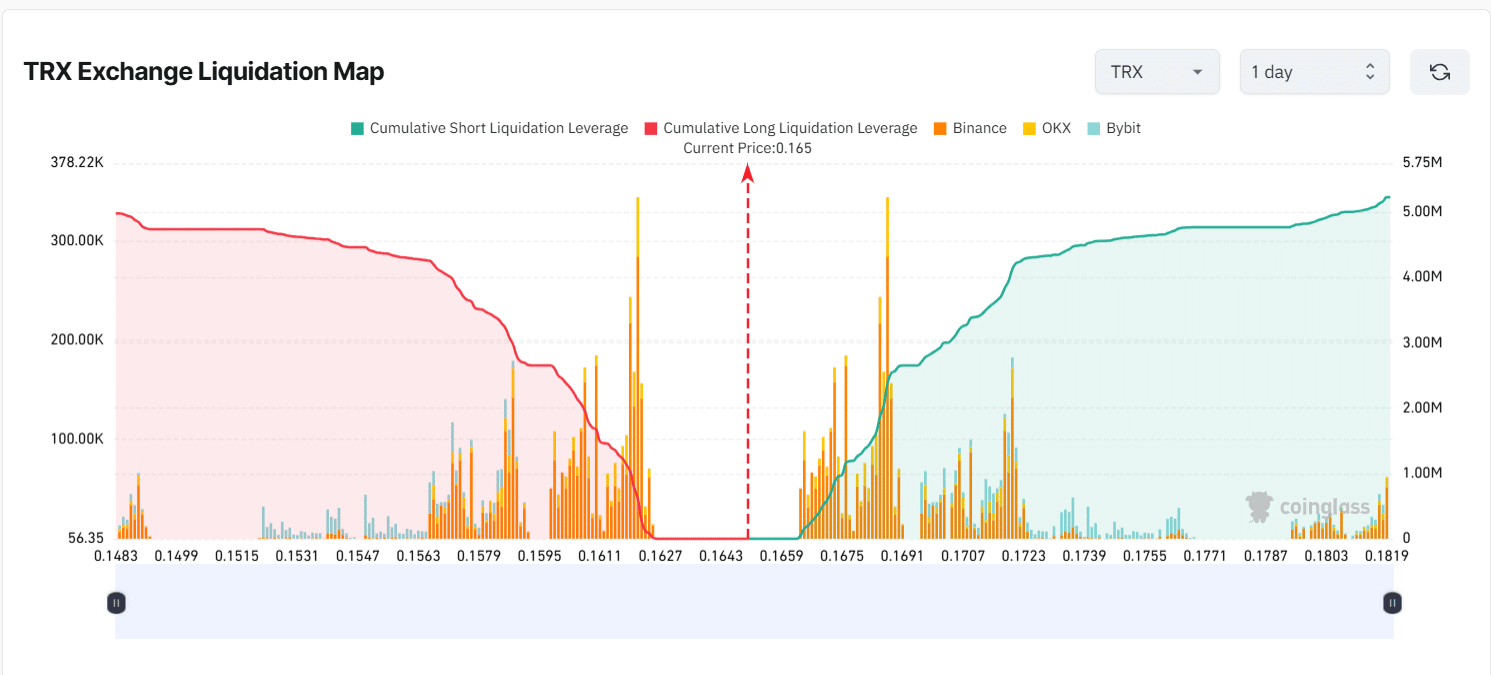

High liquidation levels around $0.165

At the time of writing, there seems to be a balanced distribution of long and short liquidation levels around the current TRX price of $0.165.

On the left, the short liquidation leverage (red area) has begun to accumulate significantly below $0.164. This is likely to increase if the price declines. This means that short positions are using strong leverage at these levels.

See more: Tron replaces oracle provider with Chainlink

Source: Coinglass

Conversely, on the right side, the long liquidation leverage has increased above $0.166, with leverage significantly rising above $0.170.

This concentration indicates where long positions may face liquidation if the TRX price rises sharply.

Follow @TinTucBitcoin for the latest updates.

#tintucbitcoin #Write2Win #btc #binance #bitcoin $BTC $ETH $TRX