Sendo a segunda maior criptomoeda do mundo, o Ethereum (ETH) sempre esteve em destaque. Embora tenha apresentado desempenho inferior ao Bitcoin (BTC) e a alguns blockchains da Camada 1 (como Solana e SUI) em 2024, os analistas de mercado geralmente acreditam que o início de 2025 pode trazer uma virada de alta para a ETH. Uma série de tendências de mercado, análises técnicas e mudanças no ambiente político parecem estar lançando as bases para o próximo salto da Ethereum.

Primeiro trimestre de 2025 – Avanço do Ethereum

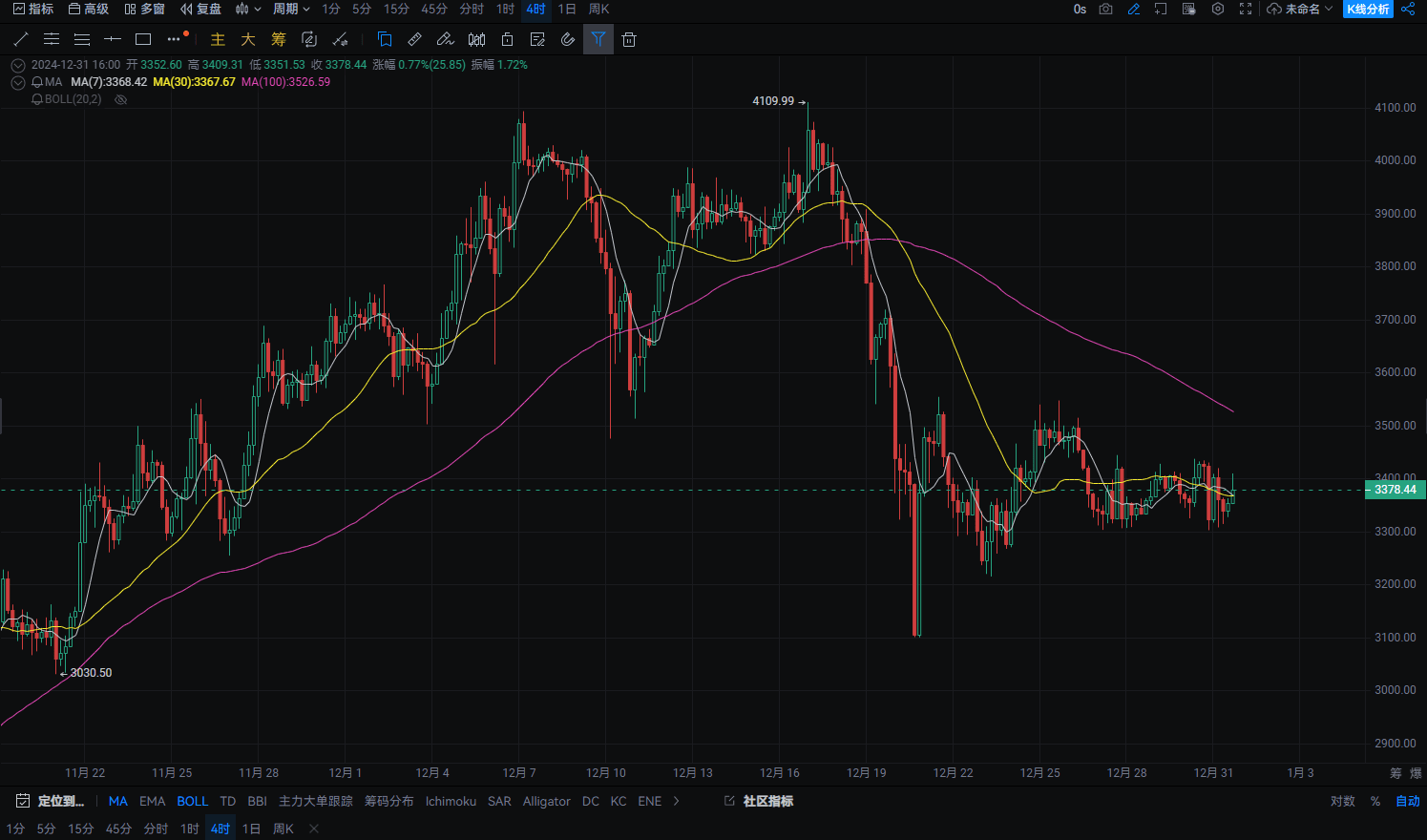

No final de 2024, o crescimento acumulado do Ethereum no ano atingiu 43%, mas é ligeiramente inferior ao crescimento de 115% do Bitcoin. No entanto, muitos analistas têm expectativas otimistas quanto à tendência da ETH no primeiro trimestre de 2025:

According to analyst Crypto Bullet's observations, a classic 'bullish pennant' pattern has appeared on Ethereum's daily chart. This pattern is often seen as a precursor to further price increases. If this pattern continues, he predicts that ETH could reach $6,000 by March 2025.

Meanwhile, another analyst, Anup Dhungana, has identified an inverted head and shoulders pattern on Ethereum's weekly chart. This is a strong bullish signal indicating that the price could see a significant rise. He further points out that Ethereum may drop to $2,800 in the short term, but is expected to soar to $8,000 by May 2025.

Senior analyst Quinten Francois emphasizes that the first quarter following the U.S. presidential election is usually a time window of excellent performance for Ethereum. If history repeats itself, the first quarter of 2025 could be a critical period for ETH to set new records.

Staking and supply tightening - Price drivers of ETH

Galaxy Research's report also adds a layer of certainty to ETH's prospects in 2025. The report indicates that the staking rate of the Ethereum network could exceed 50% in the coming year, causing supply tightening. This supply dynamic could become a core factor driving a significant rise in ETH's price.

Staking is a mechanism where holders lock up tokens to support network operations and earn rewards. As more investors stake ETH, the circulating supply will further decrease, and increased market demand may drive prices up.

If the Trump administration provides a clearer regulatory framework for the cryptocurrency industry, such as allowing for the staking of held ETH in spot ETH ETPs (exchange-traded products), it will further attract institutional investors. Galaxy Research predicts that this favorable policy could easily push ETH's price beyond $5,500 by 2025.

The possibility of the ETH/BTC trading pair and altcoin season

It is worth noting that the ETH/BTC trading pair also shows potential bullish trends. Currently, the price of this trading pair hovers around 0.03, but Galaxy Research predicts that as ETH continues to outperform BTC in the coming years, this trading pair may reach 0.06 by 2025. This increase will open the long-awaited 'altcoin season' for the market.

The technical analysis in the market and policy trends indicate limitless potential. As the applications of smart contract platforms continue to expand in decentralized finance (DeFi) and non-fungible tokens (NFTs), Ethereum remains at the forefront of industry innovation.

Want to catch the wave of digital assets in the new year? Be sure to follow the experts, who will help you understand the market, avoid pitfalls, and embark on the broad road of crypto investment together!

#ETH #DAR #PHA #MicroStrategy增持BTC #2025比特币价格预测 $ETH $DAR $PHA