Despite the weak performance of Ethereum's price (Ethereum-ETH), significant movements are taking place behind the scenes by cryptocurrency whales, as they bought 1.10 million Ethereum coins in the last 48 hours, raising questions about the potential change in market direction, especially since this purchase amounts to 0.92% of the circulating ETH supply of 120 million coins.

While whales continue to accumulate coins, the price of Ethereum remains under pressure, currently standing at $2,195.

This divergence between whale movements and price performance has sparked widespread debate; are the whales betting on a rocket-like rise in the distant future, or is this merely a clever tactic amidst market turmoil?

And as always, the accumulation of whales in cryptocurrencies in large quantities has been an indicator of violent price movements; in January 2025, whales acquired 330,000 ETH coins in one week, leading to a temporary price bounce. However, the market remains affected by a state of caution, and the price struggles to break through significant resistance levels.

Ethereum price movement: bulls struggle to gain positive momentum.

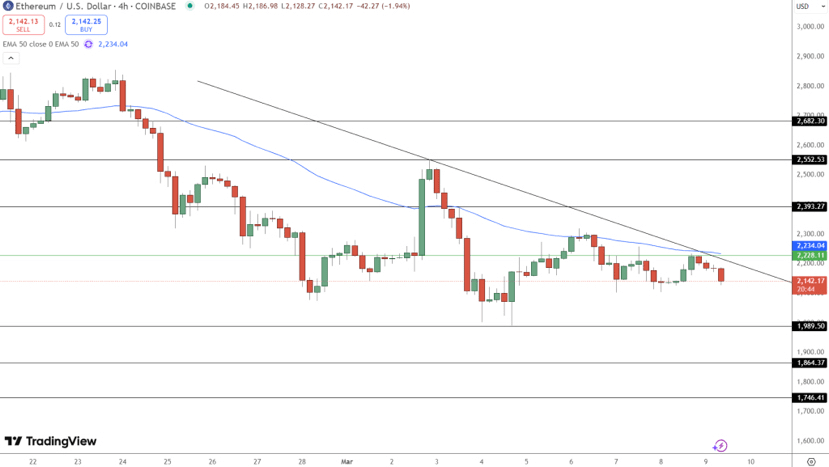

The price of Ethereum continues to trend downward even with whale buying pressure; it is below the 50-day moving average at $2,234 and faces strong resistance at $2,228. A breakthrough at this level could change the momentum's course; but until then, the risks of decline remain very high.

Technical indicators support the bearish outlook:

Relative Strength Index (RSI): stands at 37 and is approaching the overbought area.

MACD Indicator: a negative crossover indicating weak buying pressure.

Downward trend line: Ethereum's price must break the $2,228 level to regain upward momentum.

If the price fails to hold above the $2,000 level, it may test the levels of $1,989 or even $1,864. Meanwhile, it will need to break the $2,393 level to negate the bearish trend scenario.

What affects the price of Ethereum? Trump's reserve for digital currencies and ETF forecasts.

Ethereum's price movement is accompanied by key developments in the crypto sector. On March 2, 2025, U.S. President Donald Trump announced the establishment of a strategic reserve for digital currencies in the United States that includes Ethereum.

This sparked initial optimism, but the market's positive mood soon faded after it was revealed that the reserve would only include seized digital assets and not new purchases. Additionally, the White House summit on digital currencies on March 7, 2025, sparked discussions and speculation about the potential approval of Ethereum (ETH ETFs).

Ethereum's blockchain currently dominates the stablecoin market with a 56% share, enhancing its long-term investment value despite the prevailing uncertainty in the short term.

In conclusion, the price of Ethereum is still under the influence of a bearish trend, with the $2,228 level posing a significant obstacle; failure to break it is likely to lead to a price drop towards $1,989 and $1,864.

If the bulls manage to reclaim the $2,228 and $2,234 area, the price may target the $2,393 level in the near term.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the author's personal views and do not reflect mine. We encourage readers to conduct thorough research before making any investment decisions. I am not responsible for any financial losses.