Market caution signals suggest that Bitcoin (Bitcoin-BTC) is entering a phase of reevaluation, and changes in both investor behavior and demand for Bitcoin may be the beginning of the path toward long-term structural changes.

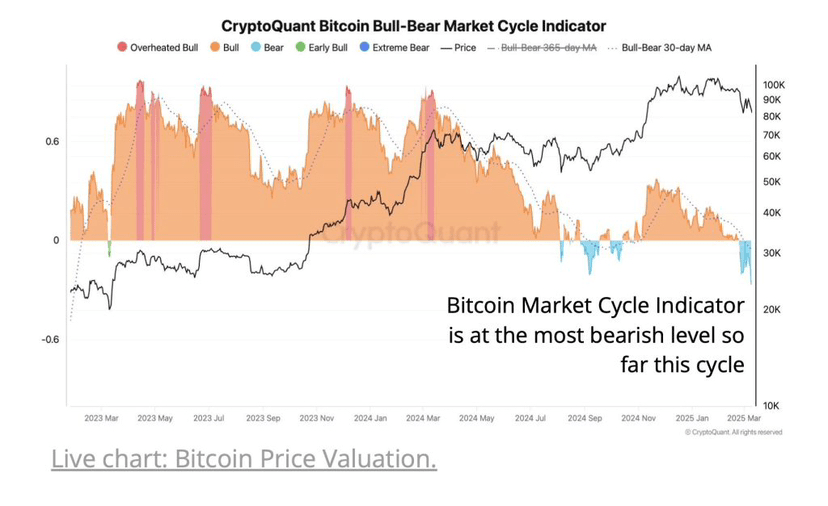

While Bitcoin (Bitcoin-BTC) value indicators reflect a bleak picture, one CryptoQuant analyst suggests that the market may experience swings between Bitcoin's actual value and the beginning of a bear market, as this analysis - published on March 11 - revealed that all leading indicators point to a dominant caution in the market, with the Bitcoin bull/bear market indicator currently positioned at its lowest level for this cycle, a level that is usually followed by a sharp correction or downward trend according to what has happened in previous market cycles.

In parallel, the MVRV Ratio Z-score has fallen below its 365-day moving average, which is an indicator that reflects the ratio between market capitalization and realized value and the standard deviation of all historical market cap data, determining whether Bitcoin is overvalued or not, suggesting the fading of Bitcoin's previous upward momentum. This shift in overall sentiment is crystallized through the noticeable decline in demand for it, which decreased by 103,000 BTC in one week, marking the fastest pace of decline since July 2024.

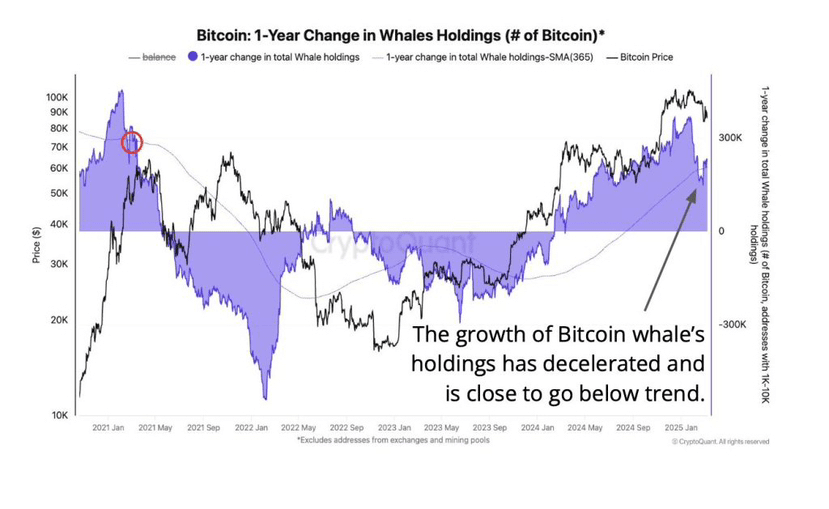

The slowdown in whale purchases of Bitcoin signals declining demand.

This sharp decline indicates that hesitation is dominating buyers and weak confidence in the market, as the pace of large whale purchases of Bitcoin has slowed down, and they are typically the ones who move the market through large purchases.

Likewise, outflows from Bitcoin Spot ETFs in the United States have outpaced inflows this year, increasing downward pressure on prices.

While the current price drop of BTC by 22% seems consistent with the corrections it has experienced during previous bull market cycles, value indicators raise concerns and indicate that it is an unusual decline, rather it is a deeper correction.

Bitcoin is currently trading around $81,000, a range that sits slightly below the minimum price achieved on the blockchain, representing a key support level. The situation worsened yesterday with the cryptocurrency market's market capitalization dropping by 6% amid investor concerns stemming from President Donald Trump's recent trade policies; the rising tensions around tariffs targeting the United States' key trading partners - Canada, Mexico, and China - have disrupted the markets, triggering an intense sell-off of high-risk assets.

If the price of BTC fails to stay above the current support level, it may head towards the $63,000 level, which corresponds to the minimum price achieved on the blockchain, which previously formed the most important price safety net during its sharp corrections.

On the other hand, the analyses of the crypto analyst at CryptoQuant shed light on the convergence of factors supporting the state of uncertainty, and the Bitcoin market has gone through a critical position amid negative signals, declining demand, and a decrease in whale purchases alongside outflows from Bitcoin ETFs, leaving investors questioning whether the negativity of these indicators is merely a short-term disturbance or if it reveals a deeper structural weakness in the Bitcoin market. Consequently, the interpretation of these signals by investors in the coming weeks will determine whether the price of Bitcoin will witness strong rebounds or continue its downward trend.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the author's personal views and do not reflect my opinion. We encourage readers to conduct thorough research before making any investment decisions. I am not responsible for any financial losses.