Fluctuations and change windows under multi-indicator resonance

I. Real-time analysis of core indicators

1. MACD: Glued above the zero axis, golden cross signal appears

- Current status: DIF and DEA are glued above the zero axis (DIF=3.2, DEA=3.0), MACD histogram only 0.2, indicating a stalemate in bullish and bearish momentum.

- Key signal: If DIF crosses DEA to form a golden cross, it may trigger a short-term rebound; if it breaks below the zero axis, it confirms a weakening trend.

2. RSI: Overbought risk intensifies

- Current value: RSI(6)=68.3 (close to the overbought zone of 70), but no top divergence has formed, still has upward momentum in the short term.

- Risk warning: If the price hits a new high while RSI does not synchronize with a new high, need to be alert to the risk of a pullback.

3. KDJ: High-level stagnation, beware of a dead cross

- Current value: K value 89.2, D value 85.6, J value 95.1, J line has been horizontally consolidated at a high position for 3 days, there is a risk of stagnation.

- Operation suggestion: If the J line crosses below the D line to form a dead cross, need to reduce positions to avoid risk.

4. Moving average system: Bullish arrangement but too high deviation

- MA5-13-33-55:

- MA5 (628.7) > MA13 (622.1) > MA33 (615.4) > MA55 (604.9), showing a standard bullish arrangement.

- Deviation risk: Price is far from MA55 (604.9), need to be alert for a technical pullback to the 615 USD support level.

---

II. Future 10-day trend forecast

1. Short term (1-3 days)

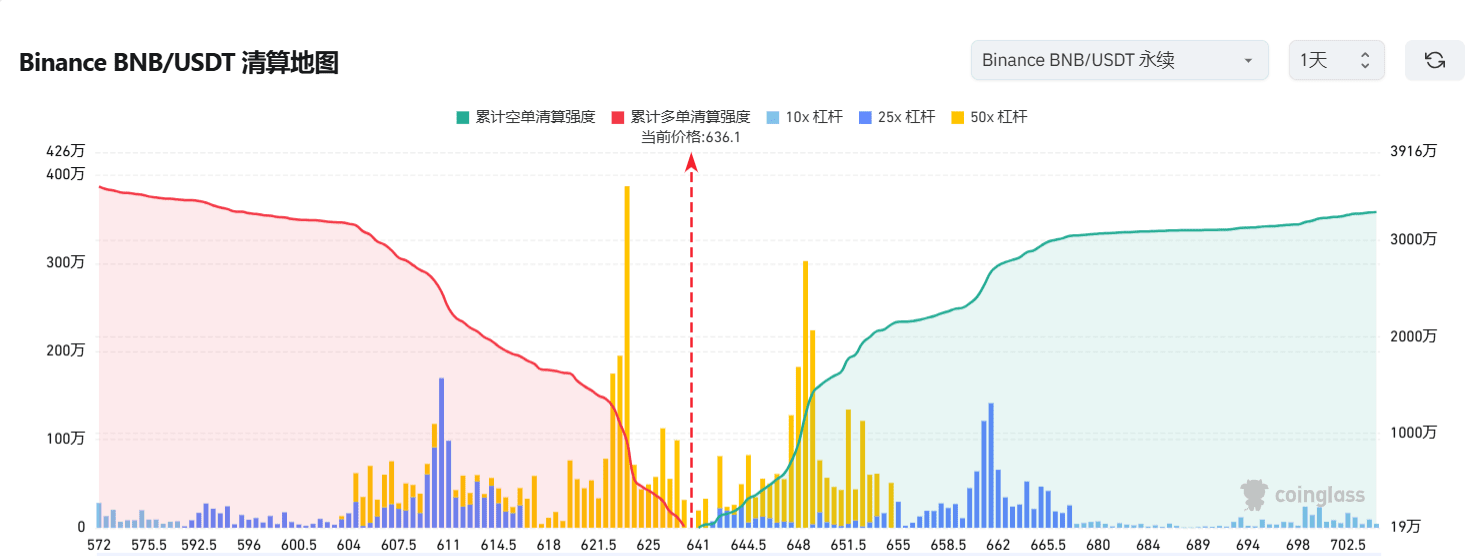

- Optimistic scenario: If it stabilizes above the 627 USD support and MACD forms a golden cross, it may hit the 633-639 USD range, target 645 USD (Fibonacci extension level).

- Risk scenario: Falling below 622 USD will confirm a downward continuation, target looking down at 615-600 USD (200-day moving average).

2. Medium term (4-10 days)

- Key variables:

- DEX trading volume: Trading volume on the BSC chain continues to grow, if it maintains a growth rate of 50%+, it may push BNB to break through 640 USD.

- Regulatory dynamics: If the US SEC approves the BNB spot ETF, it may attract tens of billions of USD in capital inflow.

- Trend prediction:

- Conservative expectation: Fluctuation range 600-650 USD, need to break through 650 USD to confirm trend reversal.

- Aggressive expectation: If technical upgrades + market sentiment resonance, may hit 700 USD (historical high).

---

III. Operation strategy suggestions

- Bullish: Build positions in batches near 622 USD, stop loss at 615 USD, target 645 USD.

- Short: Short above 635 USD, stop loss at 640 USD, target 620 USD.

- Arbitrage: Short volatility (sell straddle options), profit from short-term fluctuations.

---

Data source:

BNB technical indicators (2025.03.26) | MACD principles | RSI applications | KDJ strategy | Moving average system | Future predictions |

Risk warning: This article does not constitute investment advice, the market has risks, decisions should be made cautiously.