As April approaches, expectations are rising regarding Bitcoin's move towards a strong bullish wave. Technical and fundamental indicators support this scenario, as cash flow into the market is noticeably increasing, along with rising activity on the network and consistency of lows in recent price movement, signaling that the largest digital asset is preparing for a new upward wave.

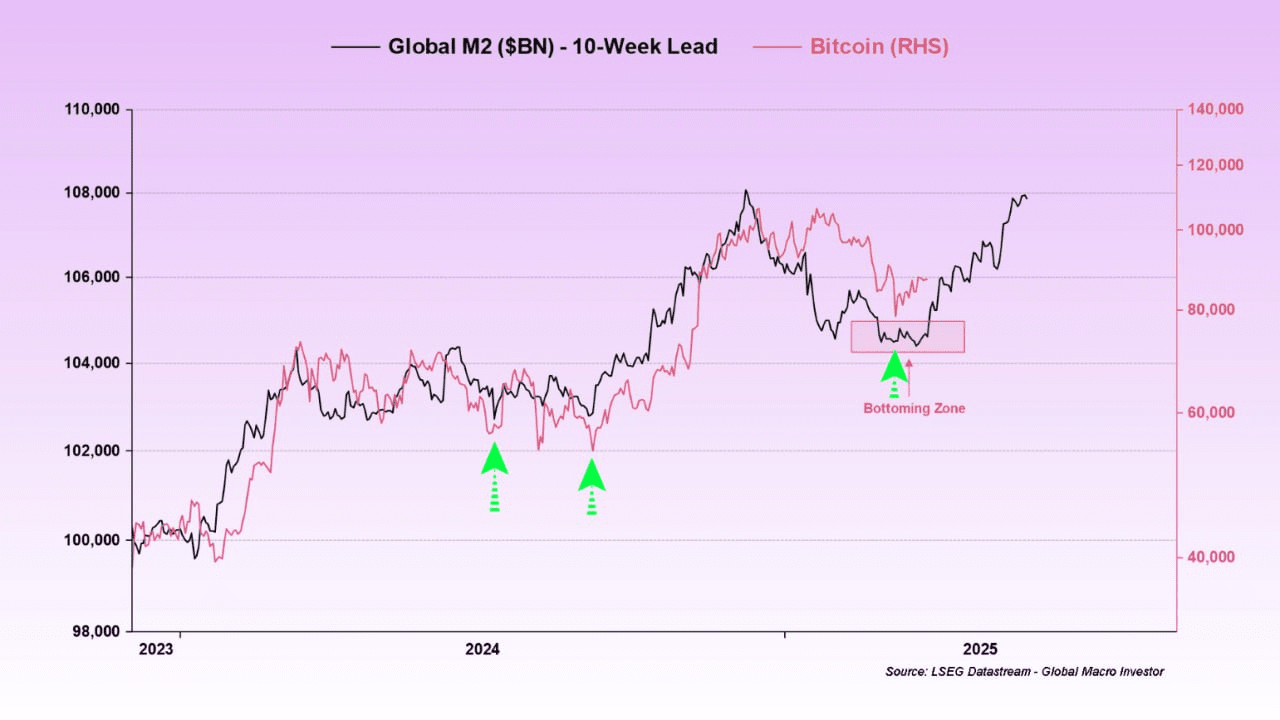

Cash Flow and Liquidity Enhancement

Data indicates a significant inflow of capital into the cryptocurrency market, which is viewed as a positive indicator of increasing demand. Trading platforms have seen intense buying activity in recent weeks, which could lead to breaking important resistance levels.

Consistency of Lows and Readiness for a Rise

Technical observers note that Bitcoin's recent lows show consistency in the upward trend, indicating strength in the bullish direction. This pattern is often a precursor to a strong upward move, especially with signs of increasing buying momentum.

Market cycles and history tend to repeat themselves.

Historically, April has been among the positive months for Bitcoin, with notable increases observed in past years during this month. Looking at previous patterns, we can see a significant similarity between the current phase and the bullish consolidation phases of 2017 and 2020, reinforcing the hypothesis that the market may be on the verge of a similar upward wave.

Other Factors Supporting the Rise

Institutional Adoption Increasing: Large institutions are increasingly purchasing Bitcoin as a hedge against inflation.

Global Monetary Policies: Fluctuating central bank policies may drive investors towards alternative assets like Bitcoin.

Reduced Supply: With the halving reward date approaching, expectations are growing that the decrease in supply will lead to price increases with rising demand.

However, as always, investors must exercise caution and manage risk well, as markets remain susceptible to sudden fluctuations that could impact price trajectories.