The crypto market is known for its extreme volatility. Prices can rise hundreds of percent within days, but they can also plummet drastically in a short time. This often raises questions for investors: is the best time to buy when the market is down (market dip)?

In this article, we will discuss the pros and cons of the strategy of buying crypto when prices drop, as well as the factors that need to be considered before making a decision.

Why Many Investors Buy When the Market Dips?

There are several reasons why investors are interested in buying crypto assets when the market is down:

1. Getting a Cheaper Price

One of the biggest advantages of buying when the market dips is getting assets at a discount. If someone is confident in the long-term prospects of a particular crypto, a price drop can be a golden opportunity to buy more at a lower cost.

2. Buy the Dip (BTD) Strategy Popular Among Investors

'Buy the dip' is an investment strategy often used by experienced investors, both in the stock market and crypto. This strategy is based on the assumption that prices will rise again after a decline.

3. Market Psychology: Fear and Greed

The crypto market is heavily influenced by investor sentiment. When prices drop, many panic and sell their assets at low prices. On the other hand, savvy investors see this as an opportunity to buy from those selling out of fear.

Risks of Buying When the Market Dips

Although buying when the price drops sounds like a smart strategy, there are several risks to consider:

1. No Guarantee Prices Will Rise Again

Although history shows that Bitcoin and several other major crypto assets often recover after a drop, not all cryptos share the same fate. Some projects may experience permanent failure.

2. Bear Markets Can Last Long

Not all market dips are short-term corrections. There is a possibility that the market enters a prolonged bear market phase, where prices continue to decline for a long time before ultimately recovering.

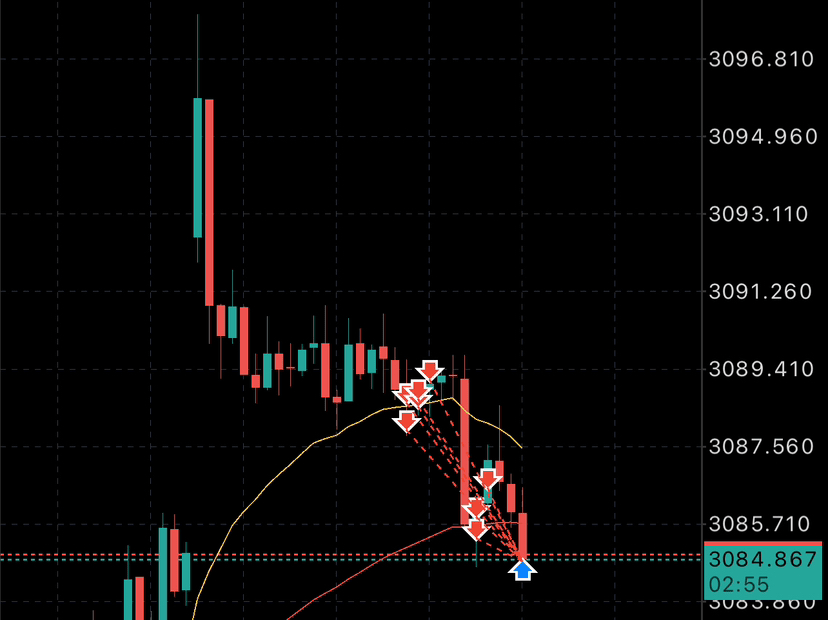

3. Mistakes in Timing Purchases

Many investors try to catch the 'bottom' or the lowest price point before it rises again. However, this is very difficult to predict. It is not uncommon for investors to buy too early, only to see prices drop further.

Factors to Consider Before Buying

Before deciding to buy crypto during a market dip, there are several things to consider:

1. Fundamentals of the Purchased Crypto

Ensure that the chosen project has strong fundamentals. Check the development team, market adoption, and use cases of the project. Do not just buy because the price has dropped without understanding the asset.

2. Macroeconomic Conditions

External factors such as central bank interest rate policies, government regulations, and global economic conditions can significantly impact the crypto market. Pay attention to these factors before making decisions.

3. Risk Management Strategies

Do not invest all funds in one purchase. Use strategies like dollar-cost averaging (DCA), where purchases are made gradually to reduce the risk of entering at the wrong price.

4. Liquidity and Financial Readiness

Ensure that the funds used to buy crypto are not emergency funds or money needed in the near future. Investments in crypto should use funds that are ready to be held for the long term.

Conclusion: Should You Buy When the Market Dips?

Buying crypto when the price drops can be a profitable strategy if done with good planning. However, there are risks to understand, including the possibility of prices dropping further or the market experiencing a prolonged bear market.

If you want to implement this strategy, make sure to

• Conducting thorough research before buying.

• Using risk management strategies like DCA.

• Not relying solely on emotions when making investment decisions.

At the end of the day, the decision to buy when the market dips should be adjusted according to the individual's risk profile and investment goals.