The cryptocurrency market fell by 1.40% over the last 24 hours to a level of $2.68 trillion, as market sentiment quickly shifted following macroeconomic announcements and stablecoin volatility. Despite the drop in value, overall trading activity increased, with the total 24-hour market volume rising by 65.41% to $129.81 billion.

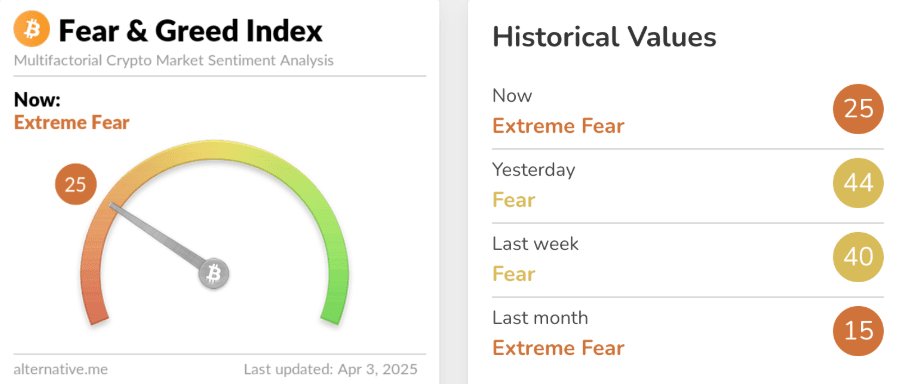

Stablecoins dominated the market, accounting for 96.86% of the total volume ($125.74 billion), while DeFi protocols contributed to a turnover of $7.74 billion. Bitcoin's dominance increased slightly to 61.87%, and the Crypto Fear and Greed Index dropped to the 'Extreme Fear' level of 25, compared to yesterday's score of 44.

Circle, the issuer of USDC, filed its long-awaited IPO application on April 1 under the ticker 'CRCL.' The company reported revenue of $1.67 billion in 2024, a 16% year-over-year increase, although its net profit fell by nearly 42% to $155.6 million. Over 99% of its revenue came from profitable treasury bonds supporting its stablecoin.

The market's immediate reaction to the new tariffs announced on April 2 by President Donald Trump was negative, with futures contracts on US stock indices falling by 2% to 3.3%. Bitcoin's price was volatile, initially rising during the announcement but later dropping to around $86,000 and then to $83,000 on Thursday morning. Analysts have differing opinions on the long-term impact of these tariffs on the cryptocurrency market. Some suggest that while short-term pressures may lead to market instability, a weakened US dollar due to trade tensions could make cryptocurrencies like Bitcoin attractive alternative assets. On the other hand, increased economic uncertainty may prompt investors towards traditional safe assets.

Materials sourced from third-party sites are for informational purposes only.

🧠 Leave a follow and subscribe if you want more.