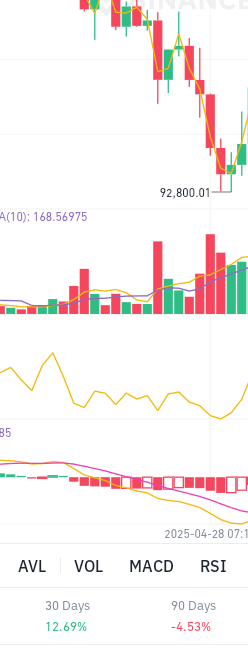

Below are the functions of the indicators AVL, VOL, MACD, RSI in simple language:

1. AVL (Average Volume)

Work: Shows the average trading volume (transaction amount) over a specific time.

Usage: Indicates how much participation or interest there is in the market.

See: If the volume suddenly increases, a large movement may occur.

2. VOL (Volume)

Work: The number of coins/shares traded within a specific time.

Usage: Indicates how much buying and selling is occurring in the market.

See: Large green/red bars mean there is significant buying and selling.

3. MACD (Moving Average Convergence Divergence)

Work: Indicates how strong the trend (upward/downward) is.

Usage: Helps to provide buy or sell signals.

See: When the MACD line and the signal line cross—buy/sell signals are obtained.

Bars: Green means bullish (up), red means bearish (down).

4. RSI (Relative Strength Index)

Work: Shows whether the market is overbought or oversold.

Usage: To catch when the trend might reverse.

Above 70: Overbought, the price may drop.

Below 30: Oversold, the price may rise.

In short:

AVL/VOL: Indicates how much trading is happening.

MACD: Trend and strength

RSI: Indicates whether it is being overbought/sold.