News background

1️⃣From important macroeconomic perspective - the FOMC forecast has started to take into account Trump's tariffs as a long-term phenomenon. And this is not very good for the American economy and, consequently, one of the important factors putting pressure on the market, which will be with us for now.

2️⃣Tariff story. No changes here. Talks between China/USA and EU/USA remain relevant, and it is still completely unclear how they will end.

3️⃣Conflicts. The Iran/Israel situation seems to be fading. Because of this, the crypto market has stopped being shaken, but the background is still felt. An end to it would give us optimism.

4️⃣The rate is in place. 4.5%. The number of Fed members who believe that the rate should NOT be lowered in 2025 has changed from 4 to 7 (there are a total of 19 of them).

Technique.

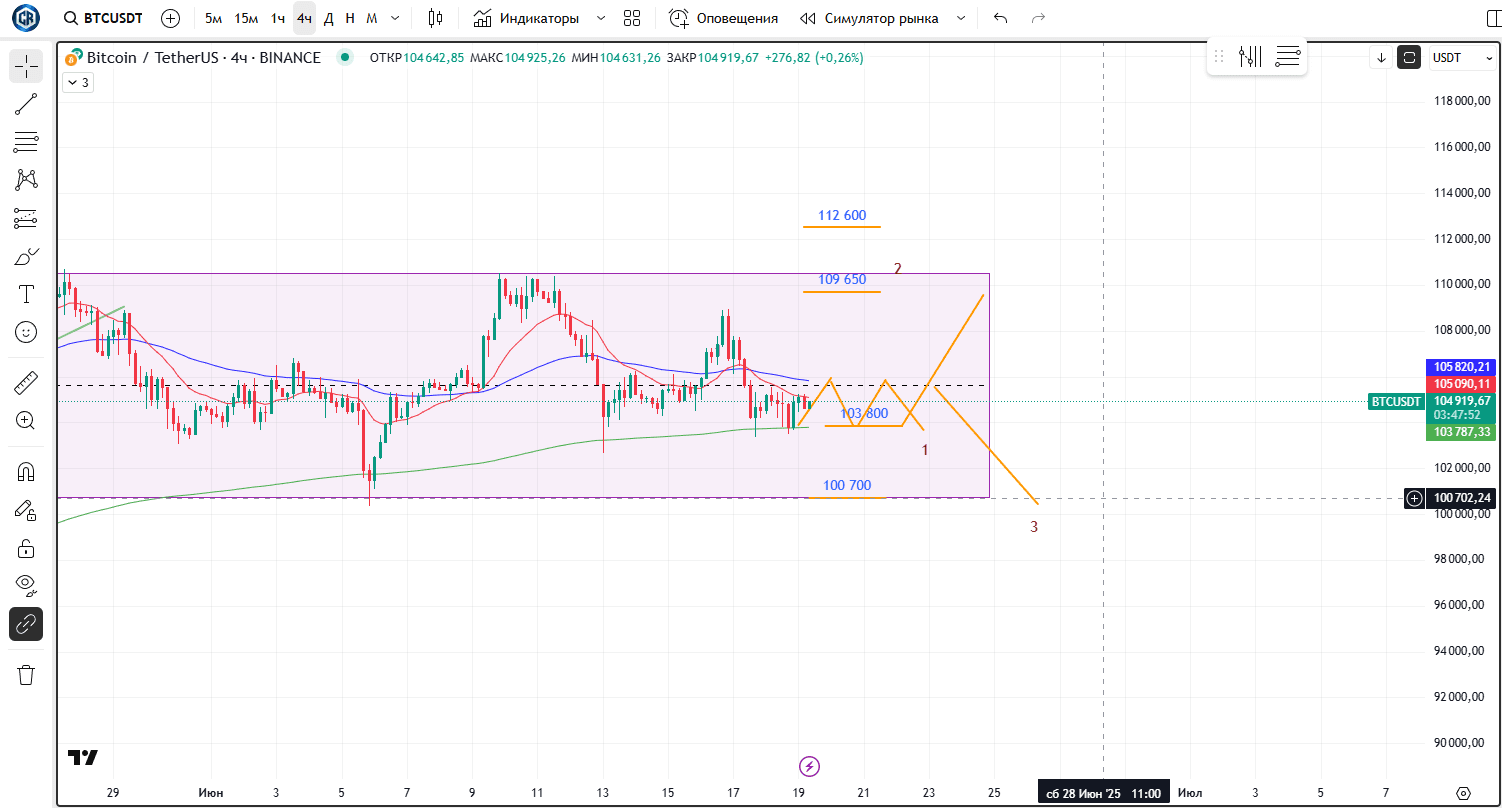

Stuck in a micro flat. And this is actually not the best scenario for daily futures trading if you are not a scalper. Let's consider the options:

1️⃣We continue to hang out in the flat. Approximately 106 - 103 500. Quite a story for the next few days. The rate is in place, a lot of unclear things are happening, contradictory news - we can stay in the flat. To get out of it, some trigger is needed: so far the most obvious one is the resolution of the suspended Iran/Israel conflict.

2️⃣Growth. As a target - 109 650. Frankly speaking, an unlikely scenario without any positive news.

3️⃣Decrease. This one is quite possible. The nearest and major supports are at 103 800 and 100 700. Just a little nonsense could roll into negativity, and we will definitely head down.

Considering what is happening: a day off in the USA, sluggish talks about tariffs, decreasing intensity of real actions regarding Iran/Israel, there is a very high probability that we will hang out in the flat until Monday in the more or less defined area I indicated.