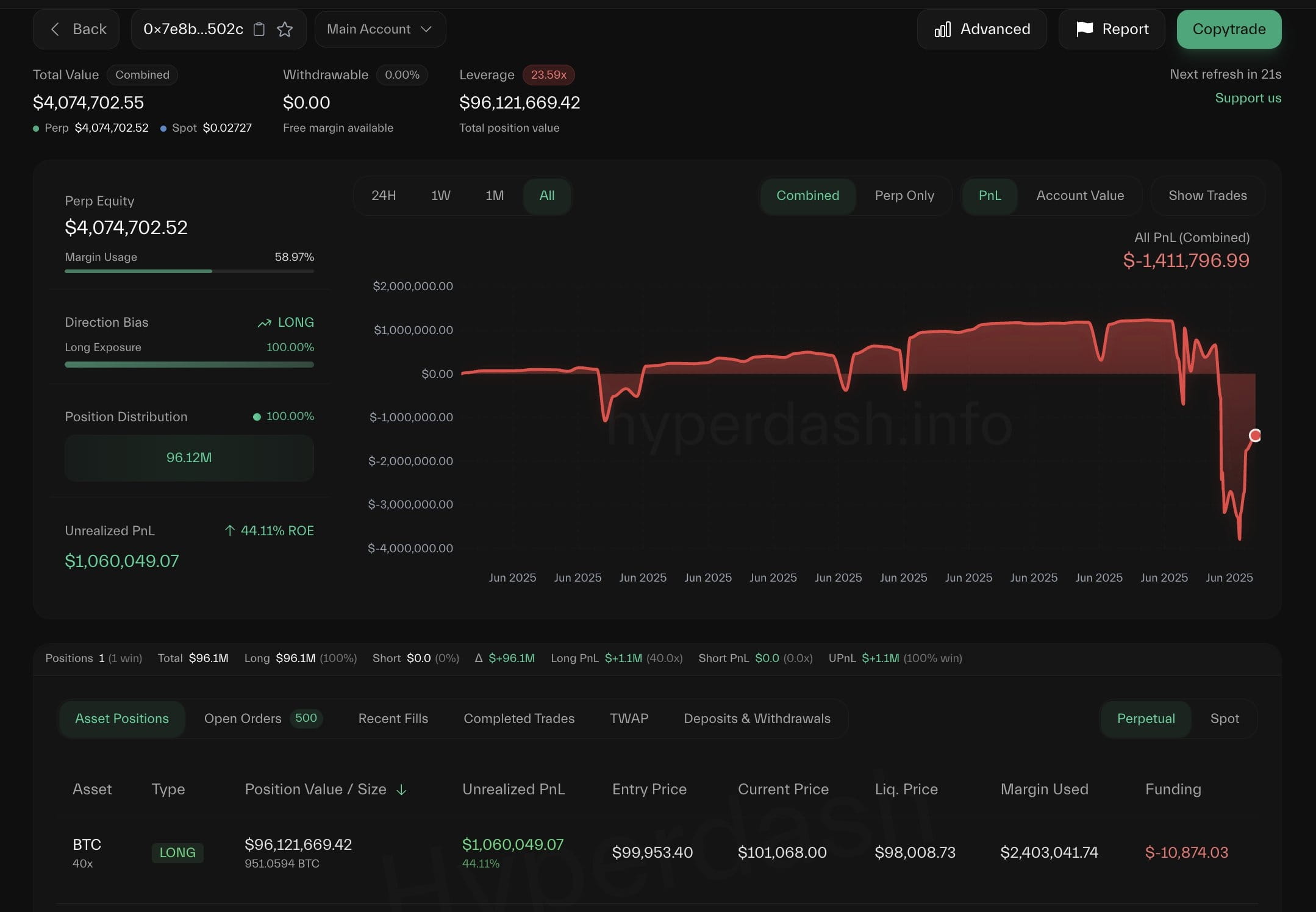

$BTC $ETH #BTCbelow100k #MarketPullback #IsraelIranConflict #ScalpingStrategy #SaylorBTCPurchase BlockBeats – According to Lookonchain, a whale trading on Hyperliquid (address 0x7e8b) has:

Liquidated all long positions due to the market crash on June 23:

965 BTC (worth 97.5 million USD)

12,024 ETH (worth 26.22 million USD)

Total loss: Over 3.5 million USD

Immediately open a new long position with:

Leverage 40x on BTC

Current profit: 1.06 million USD (not closed)

🔍 Analyzing this whale's 'reckless' strategy:

The mentality of 'getting back' after losses:

Instead of backing down, the whale doubles down on a long BTC position with higher leverage (40x).

This is a dangerous strategy, suitable only when the market has bottomed out.

Reasons to choose BTC over ETH:

BTC often recovers faster after a crash compared to altcoins.

BTC liquidity is better, reducing the risk of slippage when opening/closing large orders.