The narrative of meme coins began to surpass other narratives in March 2024, with returns soaring from 96.6% to 1,713.1% within a month. Subsequently, despite high volatility, meme coins continued to maintain the highest return rates, becoming the most profitable narrative for most of 2024.

Under such circumstances, in the cryptocurrency market of 2025, the traditional rise paths of meme and VC coins—relying on white papers, technical narratives, or institutional endorsements—have significantly declined.

In place of this is a 'fast-paced' strategy mimicking meme coins: issuing tokens at low costs on-chain, leveraging social media like platform X to create hype, sprinting towards Binance ALPHA (incentive mechanisms like Binance Launchpool), and ultimately seeking to list on Binance perpetual contracts and spot trading.

This 'meme-ification' path provides new traffic entry points for meme coins, but their long-term value and stability remain in question. This article will delve into the pros and cons of on-chain token issuance for meme coins, assess the risks for retail investor participation, explore breakthrough strategies, and discuss how meme coins can find a balance between traffic-driven growth and ecosystem development.

I. The meme-ification path of on-chain token issuance for meme coins: mechanisms and background

Path mechanism: The 'meme-ification' path of meme coins typically includes the following steps:

On-chain token issuance: Utilizing public chains like Ethereum, Solana, or BNB Chain to deploy smart contracts for token issuance, with costs as low as several hundred dollars.

Social media hype: Rapidly accumulating attention through KOLs on platform X, meme content, and community activities (like airdrops), creating FOMO.

Binance ALPHA: Utilizing mechanisms like Binance Launchpool and exclusive TGE to attract user participation in mining by staking BNB or BUSD, further amplifying hype.

Perpetual and spot: Listing on Binance perpetual contracts (offering high leverage trading) to attract speculative funds, ultimately locking in liquidity through spot listings.

Background drivers:

Retail-driven traffic economy: From 2024 to 2025, the retail proportion in the crypto market continues to rise, with platform X data showing that meme coin-related topics have an average daily view of over 1 billion times. Following legendary cases like Dogecoin and Shiba Inu, there are now Pepe, Wif, Bome, Neiro, and even Trump, encouraging meme coins to imitate their low barriers and high dissemination models.

VC coin dilemma: Traditional VC coins have lost market trust due to hollow ecosystems, lock-up collapses, and aesthetic fatigue from technical narratives. Many VC coin projects in 2024 saw price declines of over 80%.

Exchange catalysis: The Binance ALPHA mechanism provides a traffic entry point for projects, with over 60% of ALPHA projects in 2024 being lightweight tokens issued on-chain, highlighting the attractiveness of the 'fast track'.

II. In-depth analysis of the advantages and disadvantages of on-chain token issuance

Meme coins mimicking the on-chain token issuance model of meme coins exhibit unique advantages in traffic acquisition and fund attraction but also come with significant limitations.

Advantages

Low-cost and high-efficiency traffic entry

Low barrier: The development cost of on-chain token issuance is extremely low. For example, deploying an ERC-20 token on Ethereum costs only a few hundred dollars, which is highly cost-effective compared to the millions typically needed for traditional VC coin development and marketing budgets.

Rapid dissemination: Through meme content, KOL promotion, and airdrop activities on platform X, projects can reach hundreds of thousands of users within days. In 2024, $Bonk attracted 600,000 wallet addresses within 3 days through airdrops and marketing on platform X, with daily trading volumes reaching 150 million USD.

Community spontaneity: The decentralized nature of on-chain token issuance encourages community-driven promotion, reducing marketing costs for project teams. The humor of meme culture (like 'dog' or 'frog' themes) further amplifies the dissemination effect.

Flexible fund attraction mechanisms

Early incentives: On-chain token issuance can attract early users through airdrops and liquidity mining, laying the groundwork for subsequent Binance ALPHA listings. The staking mechanism of Binance ALPHA further incentivizes user participation, with the average number of participating users for ALPHA projects exceeding 1 million in 2024.

Opportunities for leveraged trading: The high leverage of perpetual contracts (up to 125x) attracts speculative funds, which can push up token prices in a short time. For example, $Ai16z increased by 150% within 24 hours after its perpetual contract went live in October 2024, drawing in 200 million USD in speculative funds.

Liquidity locking: Listing on spot provides a stable trading environment for tokens, attracting long-term holders and reducing early selling pressure.

Adapting to market sentiment

The meme-ification path aligns with the current retail-driven market sentiment, where simple narratives (like 'dog culture' or 'anti-Wall Street') resonate more easily than complex technologies.

Projects can iterate quickly, adjusting narratives to combine with hot topics like AI, metaverse, or Web3, maintaining market attention.

Disadvantages

Vulnerability driven by speculation

Lack of value anchoring: Most on-chain token projects rely solely on meme hype, lacking practical application scenarios or technical support. 70% of on-chain meme coins drop over 50% within a month of listing.

Low community loyalty: The communities of meme coins are often driven by speculators, and once the hype fades, users quickly dissipate. $Fartcoin reached a market value of 1.46 billion USD in January 2025, but due to the lack of subsequent updates, community activity dropped by 80% within a month.

Long-term bottlenecks in ecosystem development

Insufficient development resources: The low costs of on-chain token issuance often mean small team sizes and limited technical capabilities, making it difficult to support complex DApp development or ecosystem building.

Homogenization of competition: The narratives of meme projects tend to become similar (like 'the next Shiba Inu'), making it difficult to form differentiated advantages. In 2024, over 80% of on-chain token projects failed to launch substantial applications within 6 months.

Market trust crisis

The low barriers of on-chain token issuance have led to a proliferation of 'air coins', causing investors to lose trust in meme projects. 65% of retail investors believe that '99% of on-chain token projects are scams.'

Early airdrop selling by the 'wool party' exacerbates price volatility, harming the interests of long-term holders.

III. Risk analysis of retail investors participating in on-chain token issuance

Retail investors participating in meme-based on-chain token issuance face higher price fluctuation risks than traditional crypto assets:

High volatility risk

Speculation-driven price fluctuations: On-chain token projects often rely on short-term FOMO, and token prices can surge (like 100-1000%) in the early stages of hype, but often crash once the heat fades. $TRUMP listed on Binance at the beginning of the year, increasing by 300% within 24 hours, but dropped 60% a week later (the on-chain frenzy subsided).

Leverage trading amplifies risks: The high leverage of perpetual contracts attracts retail investors to chase prices, but losses can be magnified when the market reverses. For example, after a project launched its perpetual contract in 2024, retail investors lost over 200 million USD due to liquidation from high leverage.

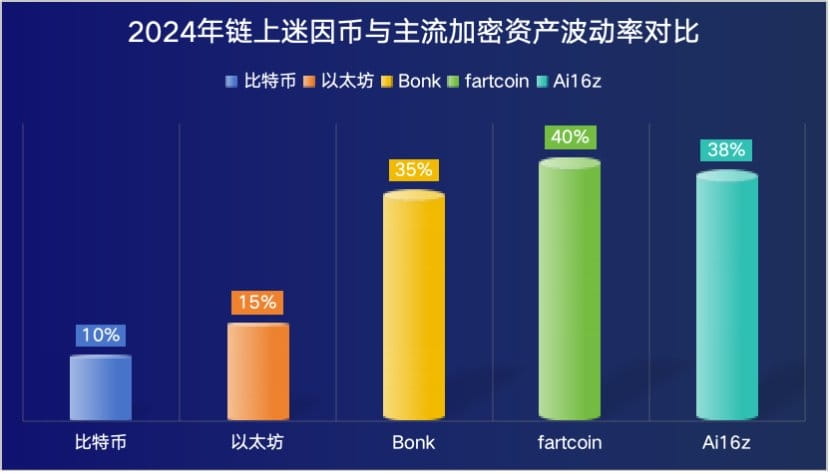

Data support: The average daily volatility of on-chain token projects reaches 30%, far exceeding that of Bitcoin (10%) and Ethereum (15%).

Information asymmetry and the risk of 'cutting韭菜'

Lack of transparency in teams: Most on-chain token projects are run by anonymous teams, making it difficult for retail investors to verify their true intentions, resulting in a high risk of being 'cut' during the token launch and after. In 2024, 50% of on-chain projects were reported to 'run away after pumping', leading to significant losses for retail investors.

Selling pressure from 'wool party': The 'wool party' attracted by airdrops tends to sell off en masse after the token unlock, leading to a rapid decline in token prices. 50% of on-chain token projects experienced drops of over 30% on the first day after airdrop unlock.

Long-term risks of an empty ecosystem

Retail investors often invest in meme projects based on short-term price increase expectations, but projects lacking ecosystem support struggle to maintain value. In 2024, 90% of on-chain token projects had trading volumes less than 10% of their initial issuance 6 months after listing.

Retail investors, lacking professional analytical skills, are easily misled by KOLs on platform X, resulting in buying high and getting stuck at elevated levels.

Risk summary: Retail investors do face higher price fluctuation risks when participating in on-chain token projects; the potential for short-term surges is appealing, but the likelihood of crashes is greater. Holding thousands of worthless tokens is not just a saying. It is recommended that retail investors diversify their investments across multiple projects to reduce the impact of a single project's collapse.

Focus on ecosystem: Prioritize projects with early DApp prototypes or clear roadmaps.

Control leverage: Avoid using high leverage in perpetual contracts and set stop-loss lines.

IV. In-depth strategies for meme coins to break into the mainstream: Dual track of traffic and value

To break into the mainstream amid the meme wave, meme coins need to deeply integrate the traffic advantages of on-chain token launches with ecosystem development. Here are three strategies:

Precise anchoring of segmented scenarios: From traffic to stickiness

Core logic: Meme projects excel at attracting traffic but need to convert users into ecosystem participants through practical applications. Focus on segmented tracks (such as on-chain gaming, decentralized social networking, or green finance), developing DApps that meet users' essential needs, and assigning usage scenarios to tokens.

Implementation path:

On-chain token launch phase: Attract users through airdrops and meme marketing on platform X, while releasing MVPs (such as a test version of on-chain games).

Binance ALPHA phase: Show early DApp data (such as daily active users, trading volume) to attract speculative funds while bringing in developers.

Perpetual and spot phases: Launch complete DApps, consolidating the ecosystem with token incentives (such as in-game payments, social rewards).

Cross-industry ecological collaboration: From within the circle to cross-industry

Core logic: The limitations of meme-based community dissemination are strong; meme coins need to break through the closed ecosystem of blockchain through cross-industry cooperation, attracting Web2 users and traditional industry funds.

Implementation path:

On-chain token launch phase: Collaborate with Web2 platforms (such as short videos or e-commerce) to launch token-based digital collectibles or points systems, attracting non-crypto users.

Binance ALPHA phase: Announce strategic partnerships (such as developing traceability systems with supply chain companies) to enhance institutional trust.

Perpetual and spot phases: Implement cross-industry applications (such as on-chain advertising platforms) to expand the user base.

Community empowerment and narrative iteration: From speculation to co-construction

Core logic: The enthusiasm of the meme coin community is a traffic engine; meme coins need to convert speculators into long-term contributors through DAO governance and deep narratives.

Implementation path:

On-chain token launch phase: Attract followers through KOLs on platform X and meme content, distributing governance tokens to incentivize community promotion.

Binance ALPHA phase: Launch DAO, granting the community proposal rights (such as allocating marketing budgets) to enhance the sense of participation.

Perpetual and spot phases: Iterate narratives (like 'empowering creators' or 'Web3 inclusivity'), enhancing brand value through public welfare or support programs.

V. Refined paths for fund attraction

In the path of 'on-chain → ALPHA → perpetual → spot', meme coins need to optimize fund inflows through the following strategies:

Dynamic balance of token economics

Logic: Token economics need to balance early incentives with long-term stability, avoiding selling pressure from 'wool party'.

Path:

On-chain phase: Airdrop 5-10% of tokens, set lock-up periods (such as 6 months unlock) to reduce selling risks.

ALPHA phase: Attract users through staking rewards (annualized 5-10%) and destroy 1% of transaction fees to stabilize token prices.

Perpetual and spot phases: Use tokens for DApp payments (such as game items, social rewards) to increase demand.

Dual track of hot marketing and value anchoring

Logic: Hot topics drive retail investors, while value attracts institutions.

Path:

On-chain phase: Combine AI or metaverse hot topics to launch conceptual products (such as AI on-chain prediction markets) and spread via meme marketing on platform X.

ALPHA phase: Release DApp testing data (like 100,000 daily active users) to attract institutional attention.

Perpetual and spot phases: Disclose ecosystem progress (such as cross-industry partnership agreements) to consolidate market confidence.

Refined liquidity management

Logic: Liquidity is key post-spot listing and needs to balance supply and demand.

Path:

On-chain phase: Provide initial liquidity on DEX like Uniswap (10% of tokens).

ALPHA phase: Collaborate with Binance to ensure depth in staking pools.

Perpetual and spot phases: Set up buyback plans (like using DApp revenues to buy back tokens) to stabilize the market.

VI. Future trends and open-ended thinking

The meme-based path of meme coins is a product of market evolution, with the low barriers and traffic advantages of on-chain token issuance providing projects with opportunities for rapid take-off. However, traffic is easy to obtain, while value is hard to maintain. Successful meme coins need to find opportunities within the following trends:

Cross-chain collaboration: Compatibility with multiple chain ecosystems (like Ethereum, Solana) to lower user migration costs.

Integration with real-world scenarios: Collaborating with industries such as supply chain, entertainment, and finance to expand the user base.

Community economy: Using DAOs and token incentives to convert users from speculators to co-builders.

However, the ultimate path to breaking into the mainstream remains full of uncertainties. Can the low barrier of on-chain token issuance nurture real ecological value? Will the traffic dividends from meme culture fade due to homogenization? Can meme culture genuinely integrate with ecosystem development? Can meme coins find a dynamic balance in the game between traffic and value? These questions do not have standard answers.

Perhaps the future path to breaking into the mainstream lies in continuous trial and error: embracing the viral spread of meme culture while anchoring on the deep values of real-world needs; catering to the enthusiasm of retail investors while winning the trust of institutions. The next station for meme coins could be a cooling and sedimentation after the hype, or a new chapter after breaking out of the ecosystem, finding their own path to mainstream breakthrough.

#Crypto #memecoin #Altcoins