In the impression of most people, trading is an action, a 'buy and sell' completed within a certain price range; but in the true depths of the market, trading is actually a language — it records everyone's choices, judgments, hesitations, and executions, forming a dynamic game between countless individuals and the market.

However, these actions are often fleeting. Most people click 'market buy' or 'take profit' and then forget about it all. They drop like water droplets into the ocean, merging into a larger market trend, but leave no 'works' that belong to you.

What AIW3 aims to do is to recover this overlooked value.

Trading behavior used to be consumables, now it is assets.

In traditional trading systems, the vast majority of traders' operations are viewed as one-time behavioral consumption. You may have accurately judged a price reversal at some point or grasped the rhythm of an emotional rebound, but this judgment will not leave a verifiable record, will not transform into any systematic ability accumulation, and will not constitute an inheritable foundation for your next trade. On most platforms, there is no 'logical bridge' between your trades today and tomorrow.

But in AIW3's system, we attempt to overturn this logic. We believe that behind every trade, there is actually a behavior structure that can be abstracted, modeled, and traced: it implicitly contains your understanding of trends, management of risks, and control of rhythms. Once this implicit knowledge can be recognized and packaged by the system, it possesses the potential for strategic application. Your operations will no longer be isolated events, but the primary form of strategy assets — a chain logic unit that can be executed, replicated, verified, and combined repeatedly.

In short: In the past you were trading; now, you are creating.

Strategies are never just experience talks, but callable logical modules.

In the minds of many people, strategy is still a highly specialized 'intellectual product' — it belongs to a small number of traders with quantitative, modeling, and statistical backgrounds, to those who can skillfully use Python, R, Rust technical teams. But the reality is not so. Truly effective strategies are never monopolized by complexity, but are clear in structure, precise in rules, verifiable, and reusable judgment logic. And such logic has long been hidden in the operations of countless ordinary traders, just lacking a platform to abstract, organize, package, and assetize it.

What AIW3 does is to facilitate the leap of these trading behaviors from 'scattered' to 'executable strategies'.

Here, every take profit decision you make, every long-short reversal, every position adjustment based on volatility or trading volume, will be recognized as a potential strategy factor. The system will automatically match input-output conditions, execution frequency, parameter ranges, and other metadata, and simultaneously generate risk labels such as Sharpe ratio, maximum drawdown, and win rate. It is not a 'strategy warehouse', but a complete set of 'strategy packaging and distribution automation pipeline'. You were just a user of strategies, now you have the capability to become a strategy issuer, even a subscriber.

The biggest problem for retail investors is not a lack of capital, but a lack of a conversion path.

There has always been a huge misconception in the market: retail investors find it hard to make money because they have small capital, poor understanding, and slow reactions. But this explanation is increasingly untenable. The reality is that retail investors are exposed to the market every day, tracking hotspots, analyzing trends, studying announcements; many even cross-validate information, test parameters, and review logic in different communities. However, this vast observation and action system has not been truly recorded and utilized — once the trade ends, this content disappears into K-line charts and screenshot dialogues.

What AIW3 aims to solve is this fundamental issue of 'information evaporation'. We hope to provide a complete path for every trader with basic cognitive abilities: transforming their judgments into logic, converting logic into structure, and turning structure into on-chain assets. This path means that you do not have to become a tech geek to have a callable strategy contract; you do not have to build a team to allow others to use your logic through a subscription system and gain automatically settled profits.

This is not just a tool innovation, but a role transformation: from an operator consumed by the platform to a trading creator with an independent income curve.

AIW3 Strategies: Let every judgment have the 'right to be used'.

AIW3 is not a mover of strategy markets, nor an intermediary platform for bundled models. We are building a 'infrastructure layer' for strategy assets — it includes strategy behavior capture, template contract packaging, authorized subscription systems, Sharpe & drawdown indicator systems, and an upcoming execution engine. This is a complete path from operation to assets, from experience to works, from traders to issuers.

Currently, you can perform the following operations on AIW3:

Use the behavior capture tool to automatically recognize your past trading logic;

Transform the operation process into standardized strategy templates through the strategy packaging module;

Choose whether to open subscription and authorization, allowing others to call your strategy logic;

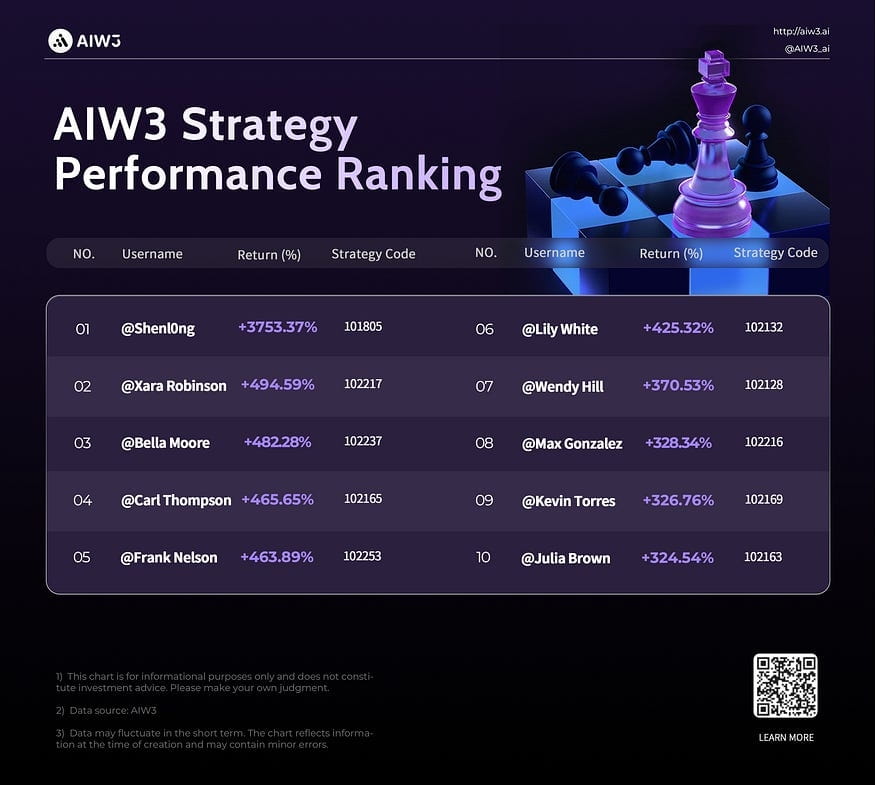

Obtain performance ratings on the platform and enter the leaderboard display and search system;

If the strategy performance remains stable, you will gain a revenue-sharing channel of your own.

We believe that in the future, the competition of strategies will not be about who has the most traffic, but about who can build the most solid on-chain history. A strategy with a Sharpe ratio greater than 2.1 is more persuasive and sustainable than any statement like 'buy this coin and it will rise immediately'. It can be called, optimized, interacted with other logical contracts, and even form an ecological network. And you will be the source of this network.

Finally: Trading is the entry point, but strategy is the structure.

Trading is essentially a behavior of judgment about the future, while a strategy is a systematic expression of this judgment.

Most people stop at behavior and fail to step into expression; even fewer move from expression to system building. What AIW3 does is precisely to open this door.

If the market in 2021 was still a 'heaven for signal callers', then the market in 2025 has long become the 'home ground for strategy creators'. In an era of narrative decay, signal proliferation, and fragmented trends, a truly capable trader no longer relies on hitting a particular sector but continuously produces 'logic that can be used by others'.

In the future, this market will not return to the era of 'widespread increases', nor will it accommodate too many gamblers who rely on luck for dividends. Those who remain will be those who truly build asset models, create path advantages, and establish a portfolio of strategies. They are not lucky but systematic; they do not rely on a single explosion but on structural compound interest.

AIW3 does not sell signals or create anxiety. We simply provide a possibility — a possibility for you to accumulate assets using your own judgment, transforming from a trader into a strategy owner. The significance of this possibility lies in breaking the hierarchy between the platform and users, turning something that originally belonged to 'institutions' into a tool you can control.

So the question you should always ask is not 'should I go long or short today?', but:

Can my judgment today be recorded? Can it be reused? Can it become a strategy product that others are willing to pay for?

If the answer is yes —

Then you are no longer just a trader but a producer of information assets.

AIW3 simply opens this door for you.

Platform Entry

Website : https://aiw3.ai/

X : https://x.com/AIW3_ai

Docs :https://aiw3.ai/docs

Telegram community: https://t.me/AIW3_ai