Social data indicate the likelihood of market overheating

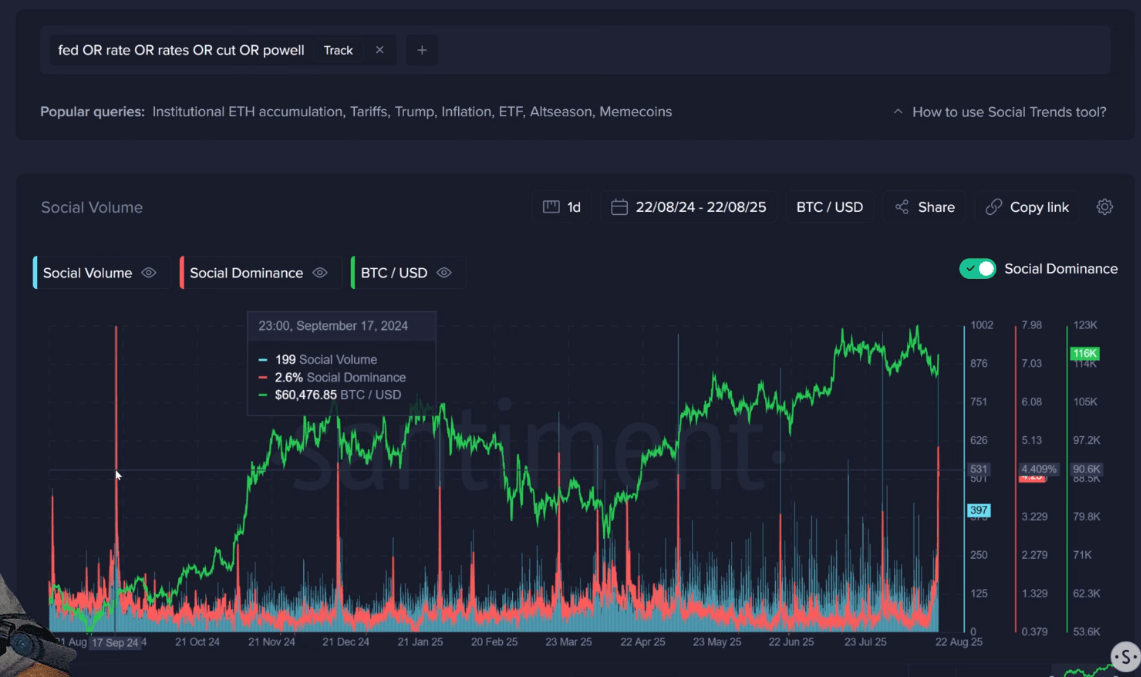

The increase in mentions of a possible decrease in the key interest rate of the US Federal Reserve on social media may be a warning signal for the crypto market. This was reported by analysts from the Santiment platform.

According to them, the main catalyst for the recent rally was the 'dovish' tone in the speech of Fed Chair Jerome Powell, which created an atmosphere of 'buy the rumor'. Against the backdrop of his statements, the S&P 500 index updated its historical high, moving up alongside Bitcoin and gold.

'While optimism about a rate decrease fuels the market, social data indicates the need for caution,' noted Santiment experts.

A spike in social media is a signal of a local maximum

Mentions of the keywords 'Fed', 'rate', and 'decrease' on social media reached an 11-month peak. Analysts reminded that a sharp increase in discussions around one optimistic narrative often indicates the formation of euphoria in the market and may signal the achievement of a local maximum.

BTC in focus, ETH in the shadows

Experts also noted that the number of predictions regarding new Bitcoin highs is increasing, while discussions around Ethereum remain relatively neutral.

At Santiment, they emphasized: a sharp increase in messages about ETH price predictions after breaking the ATH may indicate a peak of FOMO among retail investors. This, in turn, could become a potential marker of market overheating.

#BNBATH900 #HEMIBinanceTGE #FamilyOfficeCryptoas #AKEBinanceTGEb