September is destined to be a bustling month in the crypto circle — tokens worth $1 billion are about to unlock one after another! This means some high-risk tokens may bring short-term volatility, but for major blue chips like #BTC and #solana , the impact can be almost negligible. 📈💥

So, what does this wave of unlocking really mean? How should traders strategize in advance? Let's break it down.

📅 This month's small unlock, September welcomes the big wave

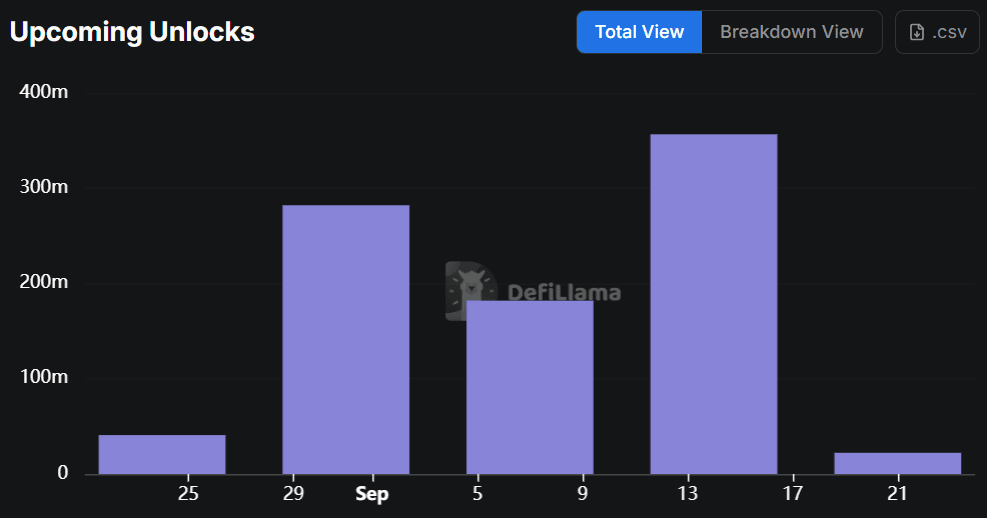

According to the latest data from DefiLlama, the unlock schedule distribution is quite interesting:

August 25: First small-scale unlock, about 40 million tokens flowed into the market;

August 29: A small climax arrives, with the unlock amount surging to 280 million tokens;

September: The real supply tide has come — at the beginning of the month, 180 million tokens, mid-month the largest batch of 350 million tokens, gradually decreasing to below 50 million tokens by September 21.

In the short term, the weekly unlock amount is approximately $227.8 million, and market pressure remains manageable. But don't forget, the total unlock in the next 30 days will reach $838.5 million, and if holders choose to sell at that time, volatility could be significant. 💸

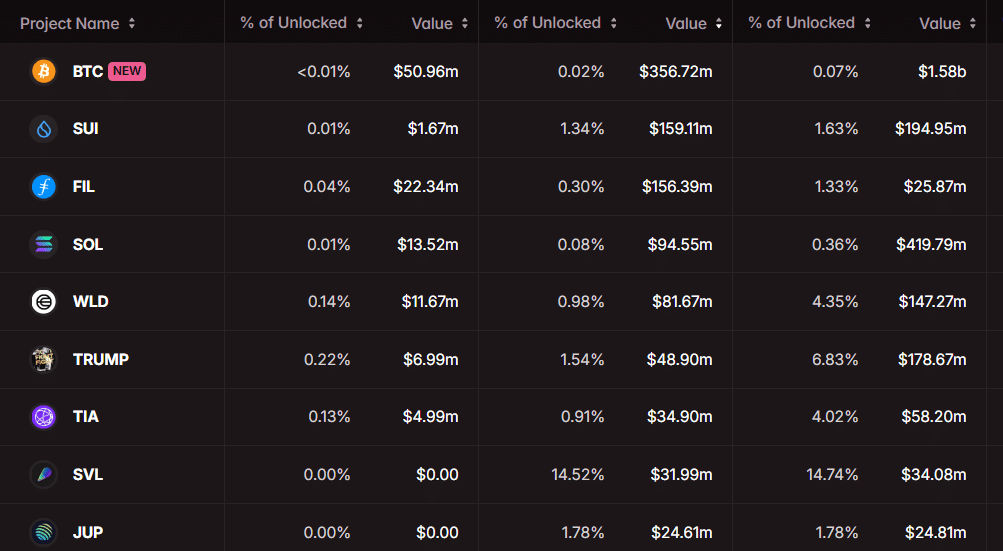

⚠️ High-risk tokens to watch: TRUMP and SVL

In this wave of unlocking, the highest risk lies with #TRUMP and #SVL :

TRUMP: Unlock ratio 6.83%, worth about $178.67 million; if holders concentrate on liquidation, the market may face short-term selling pressure;

SVL: Also belongs to a high-risk supply event and is worth monitoring;

In comparison, BTC and SOL are relatively stable:

Although the unlock amount for BTC reaches an absolute value of $1.58 billion, it only accounts for 0.07% of the total supply;

The unlock amount for SOL is only 0.36%.

In other words, large blue chips have limited short-term volatility, but high-risk tokens may become a small episode or 'surprise' in the market. 😎

💡 Key points for traders to note

Time window: Large-scale unlocks are concentrated in mid-September, and the short-term market may reprice;

Liquidity pressure: Currently, the weekly unlocks are manageable, but the cumulative effect cannot be ignored;

Major events overlapping: The FOMC meeting and Powell's speech also occur during the same period, which may enhance risk-averse sentiment and increase volatility;

Strategy reference: Maintain a neutral to slightly bullish outlook on BTC and SOL, while being cautious of short-term selling pressure on TRUMP and SVL.

In simple terms, major blue chips are stable, while high-risk tokens require more attention; strategizing in advance or controlling positions would be safer. ⚖️

🔮 Summary

This round of token unlocks can be seen as a 'liquidity experiment':

BTC and SOL have stable structures, with controllable short-term volatility;

TRUMP and SVL may bring short-term shocks, but the overall market can still digest it;

For traders, the period around mid-September will be a key window, grasping the rhythm may reveal opportunities;

Market volatility is inevitable, but understanding the supply situation in advance can help avoid being 'harvested.'

Crypto friends, stay tuned, don't be scared by the numbers, layout reasonably, and following the trend is the hard truth. 💪🔥

✍️ Remember to DYOR, manage risk well, and wish everyone smooth sailing in the crypto world! 🌊

Many understand the trend, but few follow the right rhythm.

Like 👍 and share, follow me, I will help you catch more market opportunities and laugh together at the ups and downs of the bull and bear markets! Let's work hard together!

In the current market environment, short-term operations are indeed necessary. If you keep waiting for spot recovery, you might feel the agony of time. I have been fully engaged in secondary short-term operations and primary 'shitcoin' operations recently, with good results. Friends who want to join can follow me!