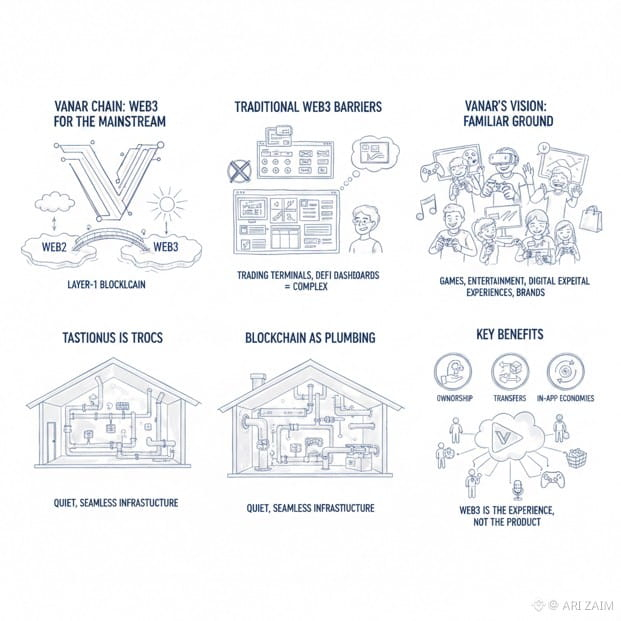

Vanar Chain presents itself as a Layer-1 built with a very specific belief about how Web3 actually becomes mainstream, because instead of assuming the next wave of users will arrive through trading terminals and DeFi dashboards, it assumes they will arrive through things they already understand and already spend time in, like games, entertainment, digital experiences, and brand communities, where blockchain is not the product but the plumbing that quietly makes ownership, transfers, and in-app economies work without friction.

That framing explains why Vanar keeps circling back to “real-world adoption” and the “next 3 billion consumers,” since the project is essentially trying to solve the parts of crypto that most normal users bounce off of, which are unpredictable fees, slow or inconsistent transaction experiences, awkward onboarding, and interfaces that feel like financial software rather than consumer products, so Vanar’s direction is to make costs and performance feel stable enough that a developer can design a mainstream user journey without worrying that one busy day on a network will turn a simple in-game purchase into something expensive, confusing, or slow.

Under the hood, Vanar leans into a pragmatic approach rather than a fully experimental one, because its public materials describe an EVM-compatible architecture that aims to keep developer migration simple and tooling familiar, while also pushing for a fast, consumer-friendly rhythm that feels more like an app platform than a “blockchain you must adapt to,” and the emphasis on predictable, low transaction costs is not just marketing but a product decision that matters most in high-frequency consumer contexts like gaming, where tiny actions happen constantly and the economics collapse if fees are volatile.

What makes Vanar different from many chains that only talk about “ecosystem” in abstract terms is that it tries to anchor the story around recognizable consumer verticals, since it repeatedly associates itself with gaming infrastructure through the VGN games network and with metaverse and collectible-style experiences through Virtua, which is important because those are exactly the kinds of environments where users can interact with tokens and digital ownership without feeling like they are “using crypto,” and in that sense Vanar is less about being the best chain for every use case and more about being the chain that is reliable and inexpensive enough to sit underneath consumer products that can actually bring volume, retention, and real usage instead of short bursts of speculative attention.

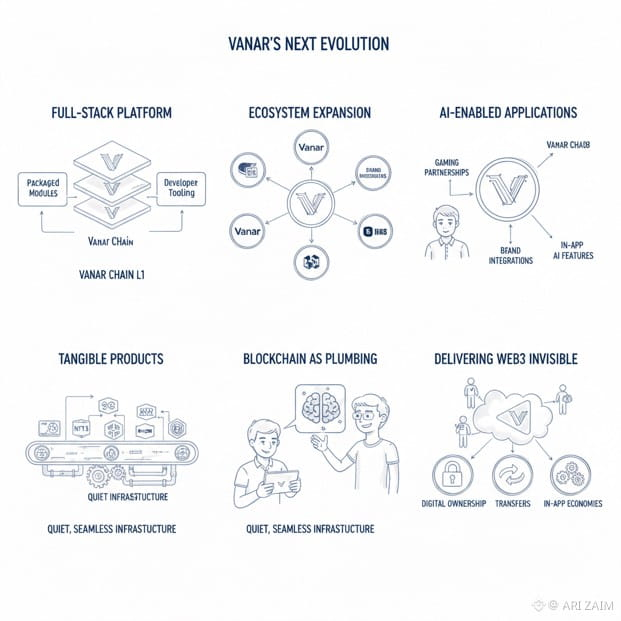

More recently, Vanar has also started to speak in an “AI-native” voice, positioning the chain and surrounding platform as infrastructure for Web3 applications that want to integrate AI features through SDKs and APIs, which reads like an attempt to extend its consumer-platform identity into the next mainstream narrative, because if gaming and entertainment are distribution channels, then AI becomes a feature layer that can make products feel modern, personalized, and interactive, and the important part here is not whether “AI” is a buzzword but whether the platform packaging becomes genuinely useful for builders who want to ship consumer apps quickly without stitching together ten separate services.

The VANRY token sits at the center of this architecture as the economic rail that the network is designed to run on, and while many people first encounter VANRY as an ERC-20 on Ethereum through the contract you shared, the broader intent described by the project is that the token is meant to power activity on the Vanar ecosystem, particularly through transaction fees and network participation mechanisms such as staking and incentives, and the token transition narrative also matters, because Vanar publicly described the evolution from the earlier TVK identity into VANRY on a 1:1 swap basis, which signals that the current branding and ecosystem direction is a continuation and consolidation rather than a totally new start.

In practical terms, the “benefits” of VANRY are only meaningful if the network’s consumer thesis succeeds, since the strongest version of the story is that predictable low fees and fast confirmations enable high-frequency consumer use cases at scale, while the ecosystem products provide the demand engine that turns the chain from a technical asset into a lived platform, and if Vanar keeps expanding the surface area of real applications that normal users actually touch, then VANRY becomes less of a narrative token and more of a utility token whose value is tied to usage, incentives, and participation across that consumer stack.

What comes next for Vanar, at least from what the project itself signals through how it structures its platform and messaging, is continued expansion of the “full-stack” feel, meaning more packaged modules, more developer-ready tooling, more ecosystem distribution through gaming and brand partnerships, and a clearer story around AI-enabled applications that run on top of the chain, because the project’s success will be decided less by abstract claims about being an L1 and more by whether it can keep shipping tangible products and integrations that make blockchain invisible while still delivering the ownership and economic features that Web3 promises.

My takeaway is that Vanar is best understood as a consumer adoption play that is trying to win through product design choices—especially predictability, speed, and onboarding—combined with an ecosystem that already speaks the language of gaming and entertainment, and if they execute well, the upside is that they can grow usage organically through real products rather than relying on hype cycles, but if they fail to convert those verticals into sustained users and transactions, then the chain risks blending into the crowd of L1s that sound ready for mass adoption but never actually become a place where mainstream consumers spend time.