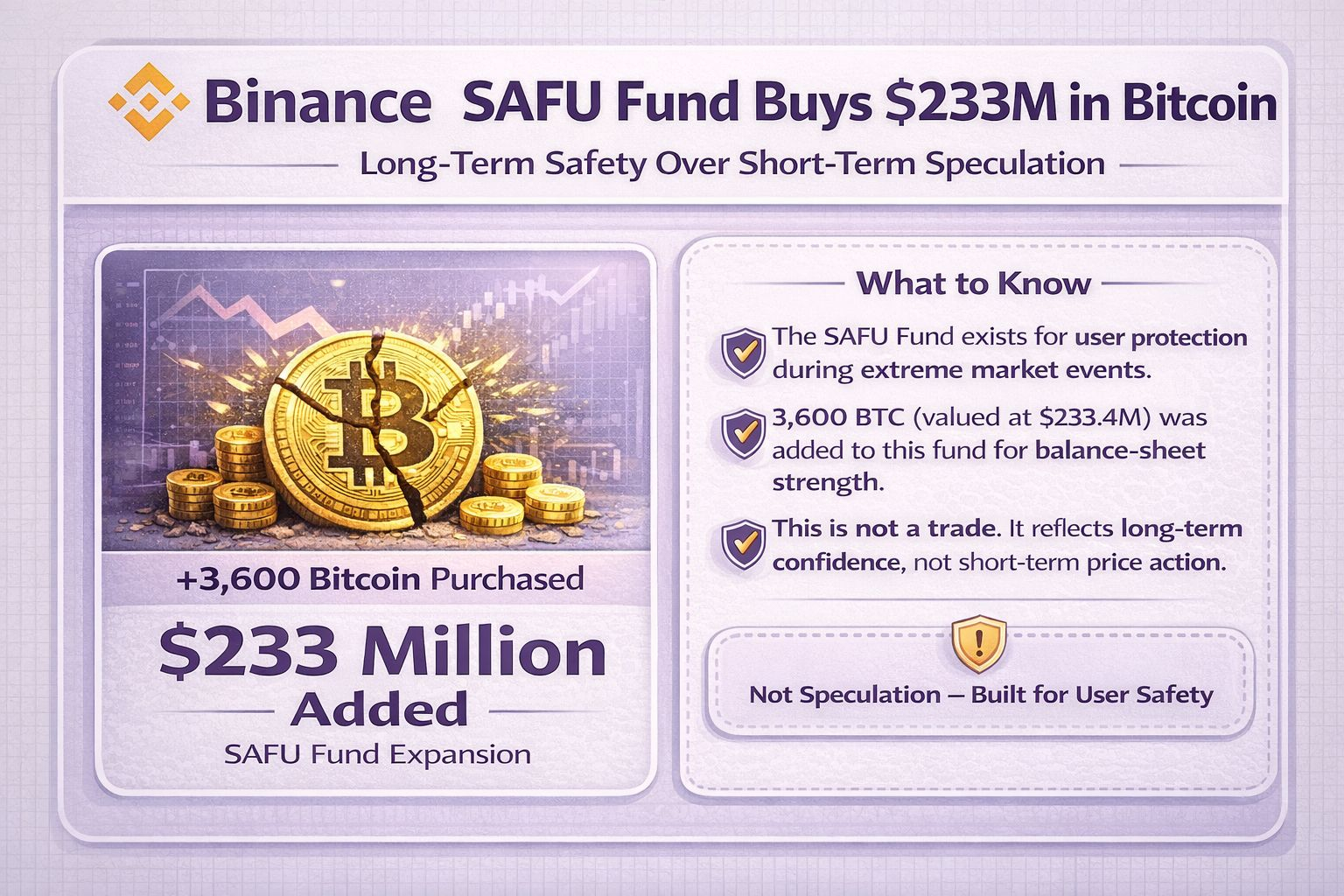

Binance has just made another major move. The SAFU Fund has purchased 3,600 Bitcoin, worth approximately $233.4 million at current prices. This isn’t a trade. It’s not speculation. It’s a balance-sheet decision and those matter more than headlines.

The SAFU Fund exists for one reason: user protection during extreme market events. When Binance adds Bitcoin to this fund, it’s reinforcing a long-term safety buffer, not chasing short-term price action. That distinction is important, especially in a market where confidence has been fragile.

What stands out is the timing. Crypto prices remain under pressure, sentiment is cautious, and many players are still in risk-off mode. Yet Binance is increasing its Bitcoin exposure anyway. Historically, large reserve additions tend to happen when institutions believe prices are closer to value than excess.

This also sends a quiet message to the market. While traders argue over charts and narratives, infrastructure players are focused on resilience. Strengthening the SAFU Fund during uncertain conditions suggests Binance is preparing for durability, not volatility.

It doesn’t mean prices instantly go up. It doesn’t mean the bottom is guaranteed. But it does show confidence at the system level, where decisions are slower, more conservative, and more deliberate.

In a market full of noise, this is the kind of signal that deserves attention not because it’s loud, but because it’s intentional.

Do you see this as a defensive move or a long-term accumulation signal? Share your take smart money moves are worth discussing.