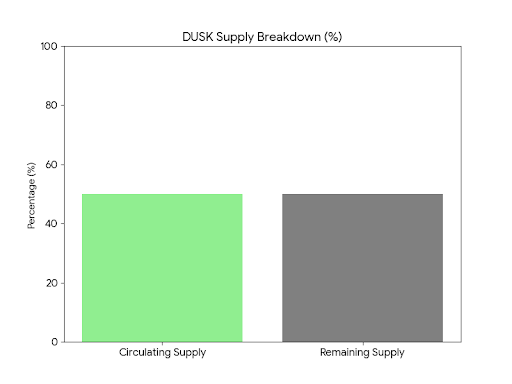

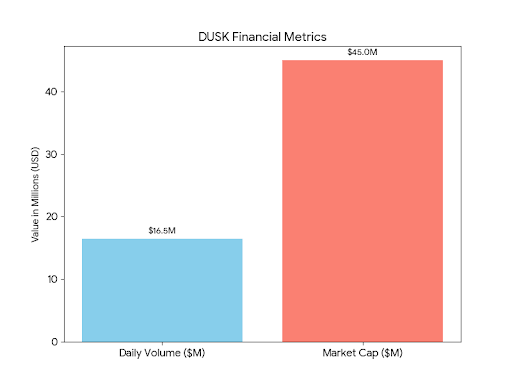

DUSK is sitting around $0.09 right now, doing about $16–17M in daily volume, with a circulating market cap somewhere near $40–50M. Roughly half the supply is out, with the rest emitted slowly over time. That already tells you what kind of asset this is: small enough to move if something real happens, but not so tiny that it’s purely illiquid noise.

What’s interesting about Dusk isn’t that it’s chasing whatever the latest narrative is. It’s been quietly building toward one specific goal for years: being a blockchain that regulated financial institutions can actually use without violating privacy rules or exposing sensitive data. In a market that’s now obsessed with AI, data ownership, and real-world assets, that suddenly feels more relevant than it did in 2021.

At a high level, Dusk is trying to solve a simple problem that most blockchains ignore: how do you put financial assets on-chain without turning everything into a public spreadsheet? Their answer is privacy by default, but with cryptographic proof that rules are being followed. You don’t see the balances or the trade details, but you can verify that settlement happened correctly. It’s less “open bazaar” and more “regulated exchange with a transparent clearing layer.”

That design choice makes Dusk slower to explain, but easier to sell to institutions. Features like selective disclosure, built-in compliance logic, and permissioned participation aren’t exciting to retail traders, but they’re exactly what banks, exchanges, and issuers care about. This is where Dusk’s work with NPEX and Chainlink actually matters — not as hype announcements, but as signals that the project is trying to plug into real financial workflows instead of reinventing them.

Of course, partnerships don’t pay the bills by themselves. Regulated finance moves at a glacial pace, and it’s entirely possible that these integrations take longer than the market has patience for. That’s the main risk here. Dusk can do everything “right” technically and still struggle if adoption doesn’t show up in the form of real transactions and real fees.

The token side is fairly clean. Supply emissions are spread out over decades, so there isn’t a constant flood of new tokens hitting the market. But that also means the token needs actual usage to justify its value. If Dusk ends up processing meaningful volumes of tokenized securities or compliant DeFi, the fee demand could support a much higher valuation. If it doesn’t, the token likely just drifts with the rest of the small-cap market.

It helps to think in plain scenarios. If the chain is only doing a couple million dollars a year in fees, today’s price probably isn’t cheap. If it’s doing ten or twenty million in recurring fees tied to real assets, suddenly this looks underappreciated. If it ever reaches serious institutional scale, the upside is obvious — but that’s a big “if,” not a base case.

For me, Dusk is less about speculation and more about watching execution. Are regulated assets actually live on-chain? Are fees and transactions slowly but consistently rising? Are validators and long-term stakers growing without incentives doing all the work? Those are the tells. If those metrics stay flat, the story doesn’t matter. If they start climbing, this becomes one of those projects people wish they’d paid attention to earlier.

Not a hype trade. More like a patience test.