A Founder’s Wake-Up Call to the Ecosystem

Imagine building a skyscraper only to realize the foundation is shifting beneath your feet. That’s the vibe rippling through the Ethereum community after co-founder Vitalik Buterin’s recent bombshell: the original vision of Layer 2 (L2) networks as “branded shards” of Ethereum “no longer makes sense.” In a pointed X post, Buterin highlighted how L2s have stalled on decentralization while Ethereum’s base layer (L1) scales faster than expected. This isn’t just insider drama—it’s a pivotal moment that could redefine how we think about blockchain efficiency, security, and innovation.

Layer 2 solutions emerged as Ethereum’s lifeline against congestion, high fees, and slow speeds, bundling transactions off-chain before settling them on the main network. They’ve powered everything from DeFi explosions to NFT booms, attracting billions in value. But with Ethereum’s Dencun upgrade slashing costs and Vitalik calling for a rethink, is this the end of L2s as we know them? Or a call to evolve? This article unpacks the fundamentals, mechanics, real-world examples, challenges, and future implications, using clear analogies and data to guide beginners and intermediates alike. We’ll explore why L2s matter, where they’ve faltered, and how they might reinvent themselves in a maturing ecosystem.

The Foundations: How Ethereum Layer 2s Work and Why They Exist

Ethereum’s journey to scalability is a tale as old as blockchain itself. Launched in 2015, Ethereum revolutionized the space with smart contracts—self-executing code that powers decentralized apps (dApps). But success bred problems: as adoption surged during the 2017 ICO craze and 2021 DeFi summer, the network buckled under demand. Transactions crawled at 15-30 per second, fees spiked to $50+, and users fled to faster rivals like Solana or Binance Smart Chain.

Enter Layer 2: protocols built atop Ethereum (L1) to handle the heavy lifting off-chain while inheriting its security. Think of L1 as a bustling city center—secure but overcrowded. L2s are like suburbs connected by high-speed trains: they process transactions cheaply and quickly, then “roll up” batches back to the city for final approval.

From Plasma to Rollups

The quest for scaling predates Ethereum 2.0 (now just “Ethereum upgrades”). Early ideas like state channels (e.g., Raiden Network, 2017) allowed off-chain interactions for specific use cases, like payments. Plasma (proposed by Joseph Poon and Vitalik Buterin in 2017) aimed for child chains that periodically synced with Ethereum, but fraud proofs and data availability issues limited adoption.

By 2020, rollups stole the show. These bundle (or “roll up”) hundreds of transactions into one, posting minimal data to L1. Two flavors dominate:

Optimistic Rollups: Assume transactions are valid unless challenged. A “fraud proof” window (usually 7 days) allows disputes. Analogy: A teacher grades homework on trust but spot-checks if suspicions arise. Pros: Easier EVM compatibility, lower computation costs. Cons: Withdrawal delays for security.

ZK-Rollups (Zero-Knowledge): Use cryptographic proofs (zk-SNARKs or zk-STARKs) to verify batches instantly. Analogy: Proving you solved a puzzle without showing the steps—math guarantees correctness. Pros: Instant finality, enhanced privacy. Cons: Higher upfront computation, trickier for complex smart contracts.

Vitalik’s 2020 “rollup-centric roadmap” positioned these as Ethereum’s scaling endgame, with L1 focusing on security and data availability.

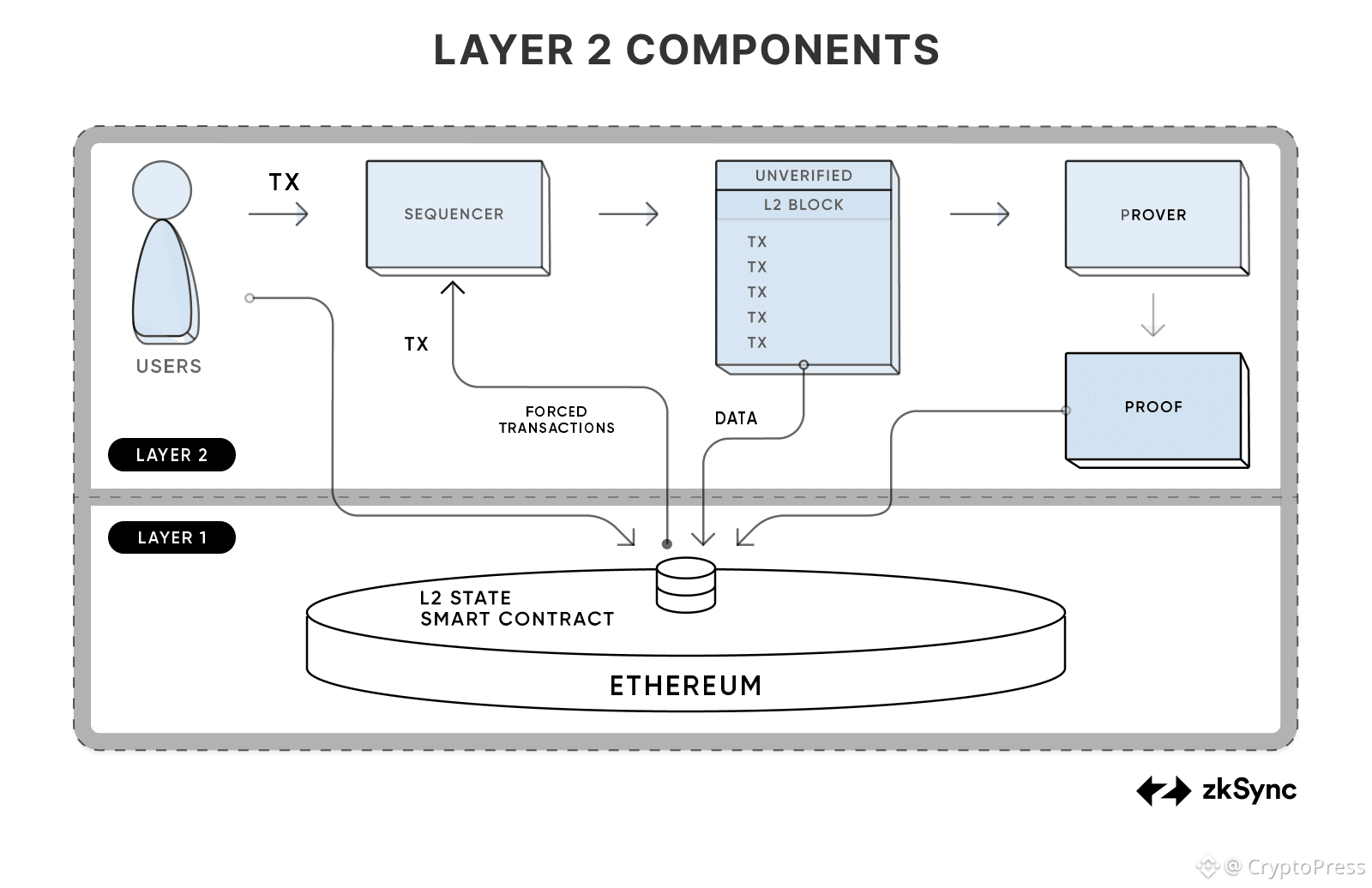

Technical Breakdown: Sequencers, Stages, and Settlement

At the heart of rollups is the sequencer: a node (or network) that orders and executes L2 transactions. In centralized setups (common today), one entity runs it for speed. Decentralized sequencers distribute this via proof-of-stake or leader election, reducing censorship risks.

L2Beat defines maturity in stages:

Stage 0: Basic rollup with training wheels—upgrades via multisig, potential for operator override.

Stage 1: Fraud/validity proofs enforced; security council can intervene in emergencies.

Stage 2: Fully decentralized—no overrides, L1 governance only.

As of early 2026, only a handful of L2s have reached Stage 2, with many lingering at Stage 0 or 1, per L2Beat data. Transactions settle on L1 via data blobs (post-Dencun upgrade, March 2024), slashing posting costs by 90%+.

Here’s an updated comparison based on recent L2Beat insights and market data:

L2 Project Type Stage (L2Beat) TVL (as of early 2026) Sequencer Status Key Feature Arbitrum Optimistic 1 ~$12.5B Centralized High DeFi TVL, EVM-compatible Optimism Optimistic 1 ~$4.1B Centralized Superchain vision for interoperability Base Optimistic 1 ~$11.1B Centralized Coinbase integration, low fees zkSync Era ZK 0 ~$700M Centralized Native account abstraction Starknet ZK 0 ~$550M Centralized Cairo language for custom logic

This structure keeps Ethereum decentralized while scaling to thousands of TPS.

Ethereum Layer 2 Solutions: Rollup Technologies

Ethereum Layer 2 Solutions: Rollup Technologies

As shown in the comparison table above from recent L2Beat data, most projects remain at lower stages with centralized sequencers.

Leading L2 Projects

L2s aren’t theoretical—they’re battle-tested in DeFi, NFTs, and beyond. Let’s examine four heavyweights.

Arbitrum: The DeFi Powerhouse

Launched in 2021 by Offchain Labs, Arbitrum uses optimistic rollups for near-instant, low-cost transactions. It reached Stage 1 by 2025, with fraud proofs live.

Success Story: During the 2023 inscription craze, Arbitrum handled surges without buckling, unlike some L1s. Its TVL stands around $12.5B, hosting dApps like GMX (perpetual trading) and Radiant Capital (lending). Fees averaged under $0.01 post-Dencun.

Impact: Reduced Ethereum congestion; bridged billions in assets. But outages in 2025 highlighted centralization risks.

Analogy: Arbitrum is like a express lane on a highway—fast for commuters but reliant on the main road’s tollbooth.

Optimism: Building the Superchain

Optimism, live since 2021, pioneered the OP Stack—a modular toolkit for custom L2s. At Stage 1, it emphasizes governance via the Optimism Collective.

Case Study: The Superchain integrates chains like Base and Zora, sharing security and revenue. By 2026, it processes millions of transactions weekly, with TVL around $4.1B. RetroPGF (retroactive public goods funding) has distributed over $100M in grants, fostering ecosystem growth.

Societal Angle: By funding open-source tools, Optimism boosts developer retention, countering brain drain to other chains.

Base: Coinbase’s Gateway to Mass Adoption

Built on OP Stack and launched in 2023, Base leverages Coinbase’s user base for seamless onboarding. TVL: around $11.1B.

Implementation: Integrated with Coinbase Wallet, it saw explosive growth in NFTs and social dApps. Infrastructure dependencies remain a concern.

Economic Impact: Captures low-value transactions post-Dencun, but critics note sequencer centralization funnels fees to Coinbase.

Analogy: Base is Ethereum’s user-friendly app store—accessible but tied to a corporate ecosystem.

zkSync Era: Privacy and Speed with ZK Tech

Matter Labs’ zkSync, a ZK-rollup since 2023, offers account abstraction (e.g., pay fees in any token). Still at Stage 0.

Failure Lesson: Early EVM compatibility issues delayed adoption, but upgrades boosted TVL to around $700M. It powers privacy-focused apps.

Forward-Looking: As a ZK leader, it exemplifies Vitalik’s push for proofs over assumptions.

These cases show L2s driving adoption, but centralization lingers.

A Guide Understanding Blockchain Rollups: ZK vs Optimistic Rollups

A Guide Understanding Blockchain Rollups: ZK vs Optimistic Rollups

The diagram above illustrates the rollup transaction flow, showing user transactions batched and proven before settlement on Ethereum L1.

The Cracks in the L2 Foundation

L2s aren’t perfect. Vitalik’s critique stems from two realities: slow decentralization and L1’s rapid scaling.

Centralization Woes: Sequencers Under Scrutiny

Most sequencers are centralized for performance—near-instant confirmations and low latency.

Pros: Efficiency (e.g., sub-second tx), cost savings.

Cons: Single points of failure, censorship potential, MEV extraction (sequencers reorder tx for profit).

Decentralized alternatives (e.g., shared sequencers like Espresso) promise resilience but add complexity and costs.

Economic and Societal Implications

Post-Dencun, L1 gas fees dropped from around 72 gwei to 2.7 gwei, a 95% reduction, with transaction costs like swaps falling from $86 to $0.39. This erodes L2s’ cost edge. L2s siphon activity from L1, reducing ETH burns (via EIP-1559) and potentially deflating its value. Societally, fragmented liquidity across L2s creates “chain silos,” hindering seamless DeFi.

Risks include regulatory pressures—some L2s stay centralized for compliance—and technical hurdles to Stage 2 (e.g., safe ZK-EVMs). By early 2026, only a few L2s have reached Stage 2.

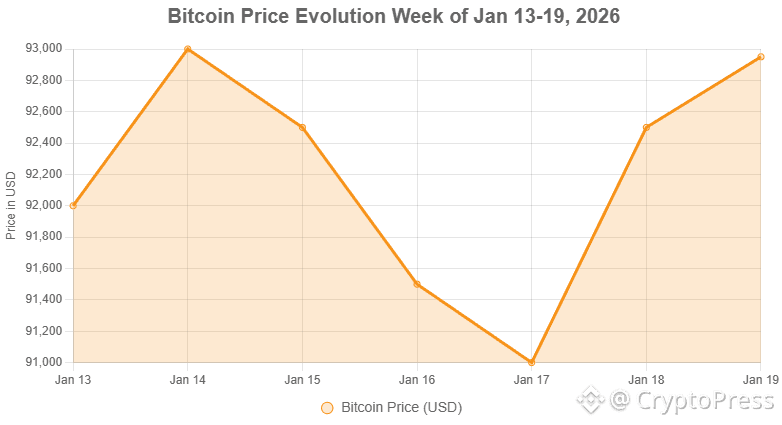

Ethereum Worries: L1 Revenue Drops 99% Post Dencun Upgrade

As shown in the graph, Ethereum L1 gas fees have plummeted to multi-year lows post-Dencun, impacting the need for generic L2 scaling.

As shown in the graph, Ethereum L1 gas fees have plummeted to multi-year lows post-Dencun, impacting the need for generic L2 scaling.

Future Outlook: Specialization Over Generic Scaling

Vitalik’s “new path” urges L2s to specialize: privacy (e.g., Aztec), ultra-low latency (gaming), or non-financial apps (AI, social). With upcoming upgrades like Pectra boosting gas limits, L1 could handle more, making generic L2s redundant.

Consolidation Ahead: Analysts predict only 5-10 L2s survive by 2030. Winners: Those at Stage 2 with unique value.

Innovations: Native rollups, interop standards (like IBC). Forecasts suggest $1T L2 valuation if niches are captured.

Ethereum’s ecosystem could mirror Cosmos: specialized chains linked securely.

Conclusion: Embracing Change for a Resilient Ethereum

Ethereum’s L2 saga isn’t ending—it’s evolving. From humble scaling fixes to potential specialized hubs, they’ve proven blockchain’s adaptability. Vitalik’s words aren’t a death knell but a challenge: prioritize substance over branding, decentralization over convenience. For users, this means cheaper, faster experiences; for builders, a push toward innovation.

As Ethereum marches toward full scalability, stay informed—explore L2s like Arbitrum or zkSync today. Subscribe to Cryptopress.site for more timeless crypto insights, or dive into related articles on blockchain fundamentals. The future is decentralized, but only if we build it right.

The post Scaling Ethereum: Is this the end of Layer 2s? appeared first on Cryptopress.