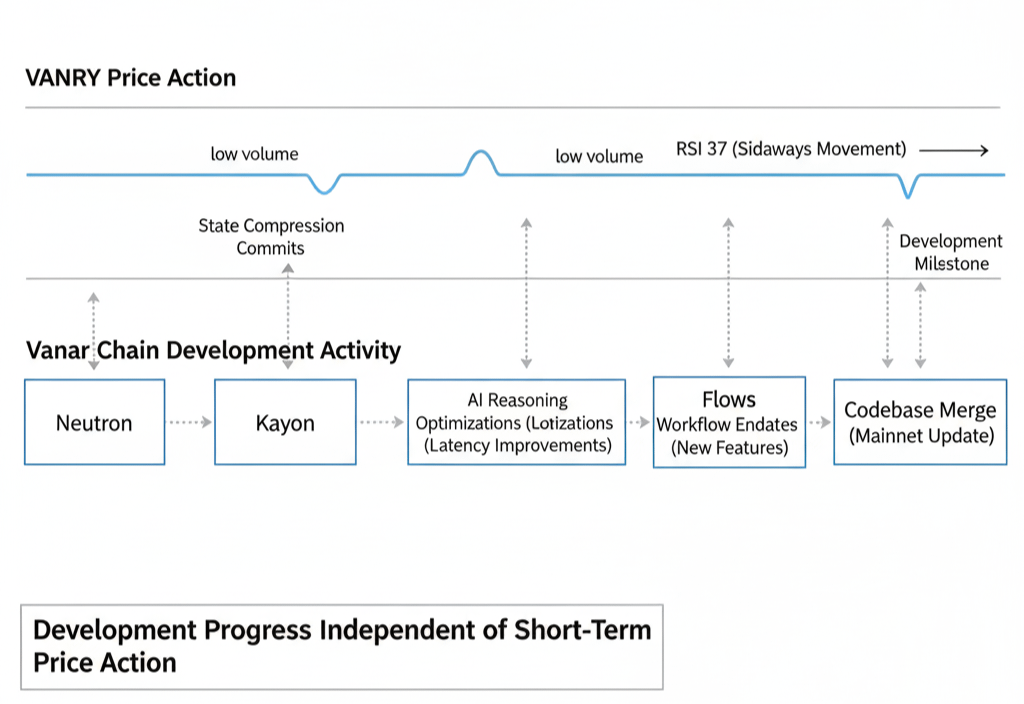

I was checking Vanar Chain's GitHub activity late one evening when I noticed something that didn't match the chart I'd just closed. VANRY was sitting at $0.006120, grinding sideways with an RSI around 37—still weak from the recent selloff. Volume had dropped to $466,984 USDT, barely half of yesterday's already-low activity. The 24-hour range between $0.005972 and $0.006374 was tight, directionless. By every market signal, this looked like a project losing momentum.

But Vanar Chain's development activity told a different story.

Commits kept landing. Issues were being closed. Developer discussions in public channels stayed active focused on Neutron compression optimizations and Kayon query performance improvements. None of it was announced. No marketing pushes. No "major update incoming" tweets to pump engagement. Just steady technical work happening regardless of whether VANRY price rewarded it.

That disconnect felt worth investigating.

Most projects couple development pace to market conditions, whether they admit it or not. When tokens pump, suddenly roadmaps accelerate. Features get fast-tracked. Updates drop with coordinated announcement campaigns. When prices dump and volume dies development quietly slows. Teams shift focus to "strategic planning" or "community building," which usually means waiting for better market conditions before shipping anything meaningful.

Vanar Chain operators weren't doing that.

I started tracking the pattern over several days. Neutron Personal got a backend update improving how semantic memory persists across AI platform switches. No announcement. Kayon reasoning engine had latency optimizations merged that reduced query response times by roughly 15% under certain load conditions. Mentioned briefly in a developer channel, not promoted. Flows automation added better error handling for cross-chain execution failures. Documented in commit messages, ignored everywhere else.

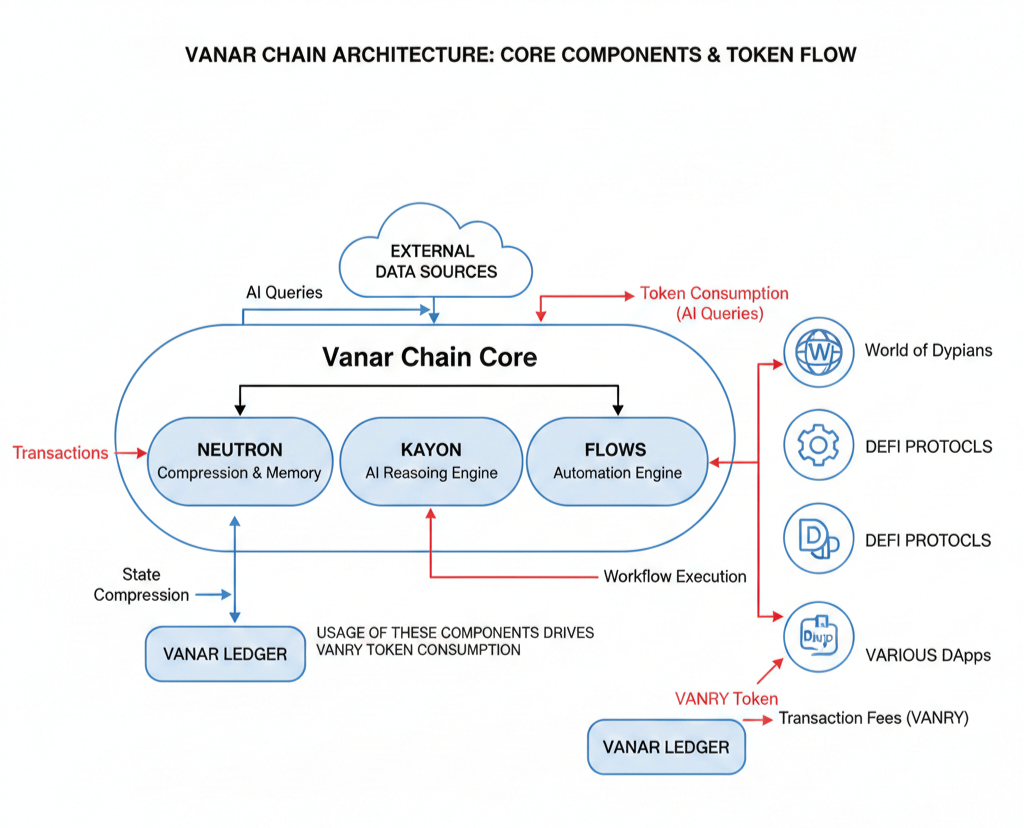

This wasn't vaporware development where GitHub activity exists to create the appearance of progress. These were functional improvements to live infrastructure that applications were already using. World of Dypians running 30,000+ players relies on Vanar Chain's AI stack working consistently. When Neutron compression gets optimized, that game benefits directly. When Kayon queries get faster, the on-chain reasoning those players trigger becomes more responsive.

The improvements shipped because they had to, not because market conditions made it convenient.

What stood out was the lack of coordination between development milestones and VANRY price support attempts. Most projects time releases around token dynamics. Major update drops when RSI is oversold, hoping to spark a reversal. Partnership announcements get saved for when volume is dying, trying to inject momentum. Vanar Chain infrastructure improvements just landed whenever they were ready, regardless of whether the timing helped the token.

That suggests something about priorities.

If you're optimizing for token appreciation, you use development as a marketing tool. Updates become catalysts. Releases get staged for maximum price impact. Everything feeds back into creating buying pressure. If you're optimizing for infrastructure that actually works, development happens on technical timelines. Features ship when they're ready. Improvements deploy when testing completes. The token reflects usage over time not announcement driven hype cycles.

Vanar Chain clearly picked the second approach.

I kept thinking about what that means for VANRY long-term. Short-term, it's probably worse for price action. No coordinated pumps. No roadmap hype creating speculative runs. Just slow, unglamorous infrastructure improvements that don't photograph well or create viral moments. Markets reward narratives and timing. Vanar Chain is delivering neither.

But if AI infrastructure adoption actually happens, this approach might age better.

Applications building on Vanar Chain need the stack to work reliably, not generate hype. When a developer chooses Vanar for AI-native capabilities—myNeutron for persistent memory, Kayon for explainable reasoning, Flows for safe automation—they're betting on technical execution, not marketing momentum. If Vanar Chain development stalled every time VANRY price looked weak, those developers would leave for more reliable infrastructure.

They haven't left.

World of Dypians still runs. Enterprise partners like NVIDIA and VIVA Games still build. Operators still process transactions. None of that stopped when volume dropped to $466K USDT or when RSI got stuck below 40. The infrastructure kept functioning because Vanar Chain development velocity stayed decoupled from market sentiment.

VANRY movement during this period reflected actual usage, not speculation. Every Neutron seed creation still required VANRY. Every Kayon query still consumed VANRY. Every Flow execution still burned VANRY. Those transactions happened because applications needed the infrastructure, not because traders were betting on announcements.

That creates different token dynamics than most projects.

When development couples to price tokens pump on announcements and dump on delivery. The pattern repeats until credibility erodes. When development decouples from price, tokens track actual infrastructure usage over time. Growth is slower, less dramatic, harder to time. But it also doesn't collapse the moment hype fades because the demand wasn't hype-driven to begin with.

Vanar Chain is betting on the second dynamic. With 93% of VANRY supply already circulating and no unlock cliffs creating artificial scarcity the token can't rely on supply games. It needs demand from real usage—AI agents querying Kayon, applications storing memory through Neutron, automated workflows executing via Flows. That demand grows as adoption compounds, not as narratives rotate.

Whether that bet works depends on whether AI infrastructure actually becomes necessary rather than optional. If most applications decide centralized solutions are good enough, Vanar Chain's technical improvements won't matter. The market won't reward infrastructure nobody uses, regardless of how well it's built.

But if the subset of applications requiring AI-native blockchain capabilities grows large enough, development velocity that ignores price action starts looking like conviction rather than stubbornness.

For now, Vanar Chain keeps shipping. VANRY keeps trading weakly. Volume keeps declining. And the disconnect between technical progress and market enthusiasm stays wide. That's uncomfortable if you're holding the token hoping for a quick recovery. It's also exactly what you'd expect from infrastructure being built for long-term utility rather than short-term speculation.

Time will tell which approach the market eventually rewards. For now, the development keeps happening whether VANRY price validates it or not. That's either confidence in what's being built, or optimism that will prove expensive. But it's definitely not typical behavior for a project at this stage of market weakness.