Bitcoin's Fear Index Just Hit Levels We Haven't Seen Since 2019 and What Happens Next?

A $30,000 wipeout in under ten days will do things to market psychology. $BTC went from sitting comfortably above $90,000 on January 28th to touching $60,000 by Friday morning, and the sentiment numbers reflect exactly how much that hurt.$BTC

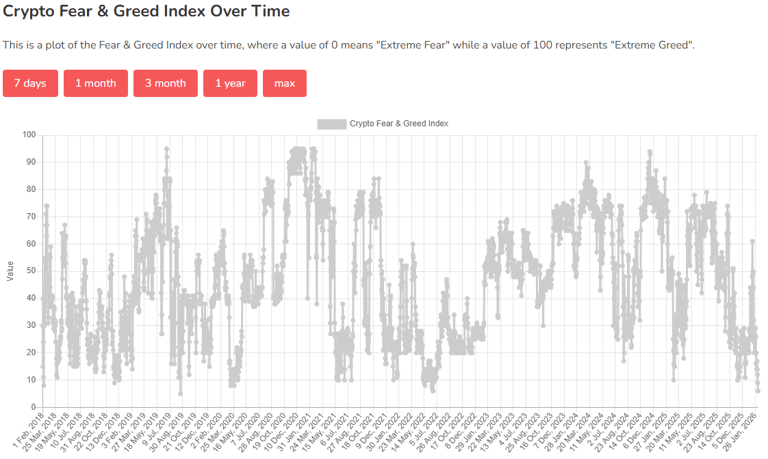

The Fear and Greed Index crashed to 6. For context, we haven't seen a reading that low since August 2019. The index runs from zero (pure panic) to 100 (peak euphoria), with market momentum and volatility driving about half the score. A reading of 6 basically means the market is curled up in the fetal position.

Bitcoin clawed back to around $69,000 at last check, but that bounce hasn't done much to calm nerves. The index kept sliding even as price stabilized, which tells you something about how deeply this selloff rattled people. When prices were pushing $95,000 in mid-January, nobody saw this coming. That's partly what makes it sting so much the speed of the decline left almost no room to react.

Now here's where it gets interesting. The Buffett crowd will tell you extreme fear is where opportunities live. Buy when there's blood in the streets and all that. And historically, there's some truth to it sharp drops in this index have occasionally marked turning points where sellers finally run out of steam and buyers step in.

But before loading up the truck, it's worth remembering what actually happened the last time this index was this low. Back in 2019, Bitcoin had already bounced significantly off the $3,500 bear market bottom and was trading two to three times higher. Sentiment was still terrible though. And what followed wasn't some explosive recovery BTC spent months grinding sideways, repeatedly failing to break through $10,000. The fear reading was right that the worst was over, but it didn't mean the good times were about to roll immediately.

That's the uncomfortable reality right now. Could $60,000 end up being the bottom? Absolutely possible. But a bottom doesn't automatically mean a V-shaped recovery. It could just as easily mean weeks or months of choppy, frustrating price action while the market rebuilds confidence.

The real question isn't whether sentiment can get worse at 6, there's barely any room left to fall. It's whether buyers have enough conviction to absorb whatever selling pressure is still out there. Until that gets answered, the fear isn't going anywhere fast.$BTC #MarketRally #WhenWillBTCRebound