If you’ve spent time in crypto, you’ve seen it before.

An influencer predicts a massive pump.

The market does the opposite.

This isn’t because influencers are useless, it’s because market timing is extremely hard, and the incentives in crypto don’t reward accuracy.

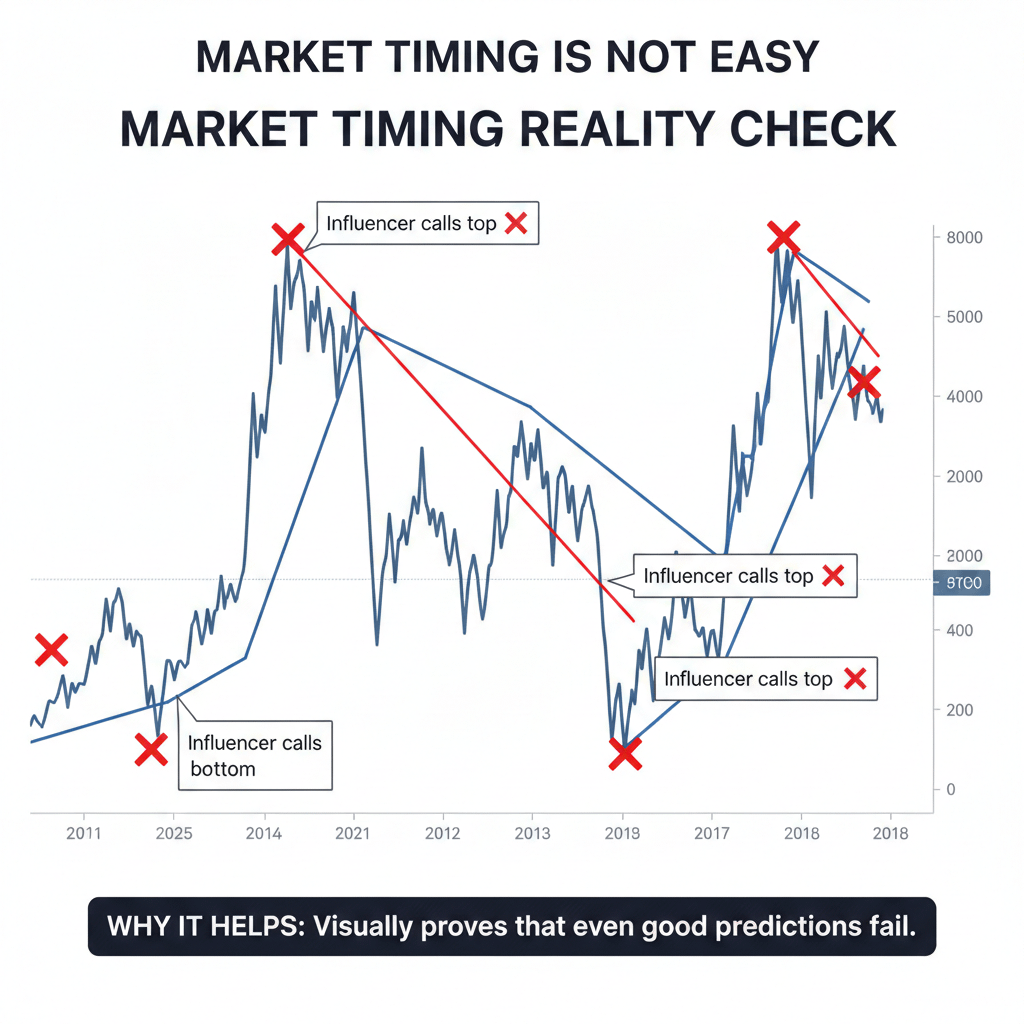

Market Timing Is Not Easy

Even professional traders and institutions miss tops and bottoms.

Crypto prices move based on liquidity, leverage, sentiment, macro news, and whale activity, not just charts.

Anyone claiming to predict price perfectly is oversimplifying a complex market.

Attention Pays More Than Accuracy

Most influencers are rewarded for:

Engagement

Clicks

Referrals

Hype

Bold predictions spread faster than careful analysis.

“Bitcoin might range” doesn’t go viral , “Bitcoin to $100k soon” does.

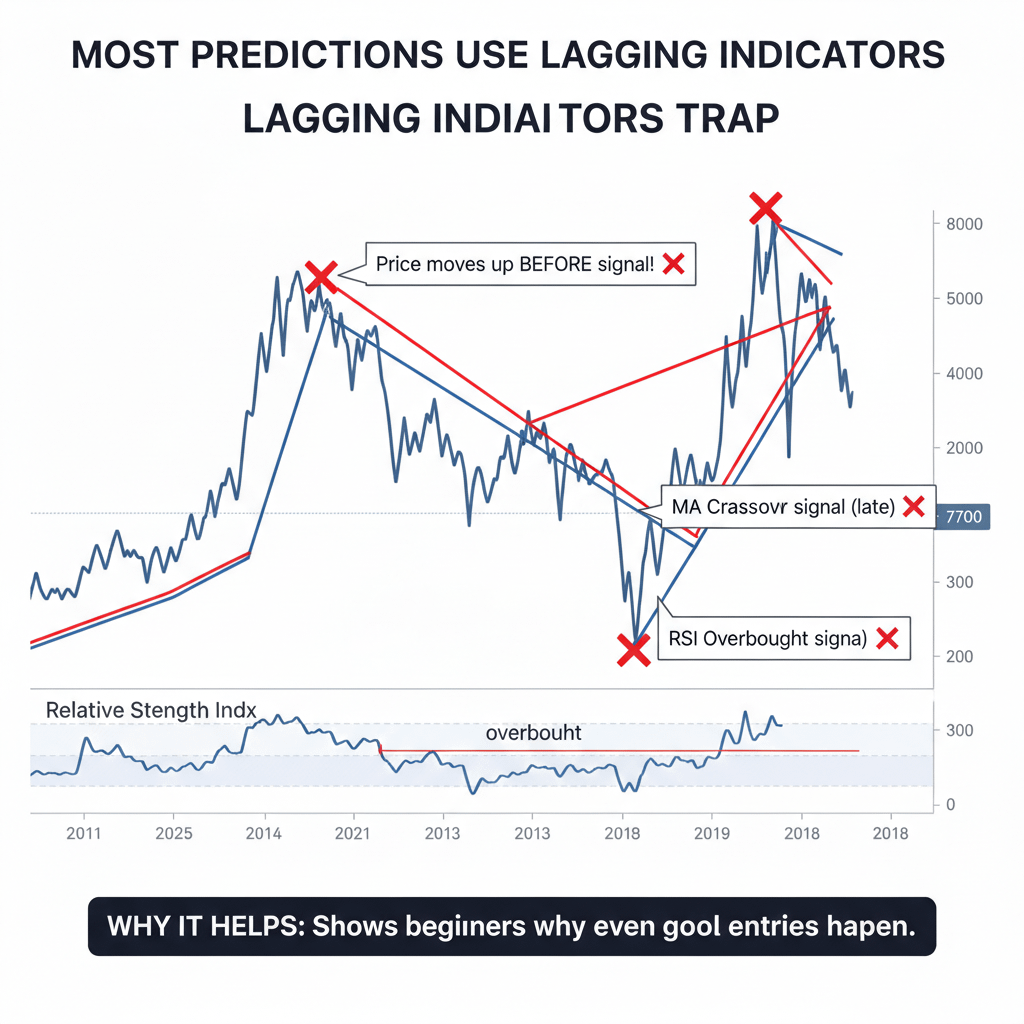

Most Predictions Use Lagging Indicators

Common tools like RSI, MACD, and moving averages react after price moves.

By the time a setup looks obvious:

Smart money may already be exiting

Retail is often entering late

This creates false confidence and late entries.

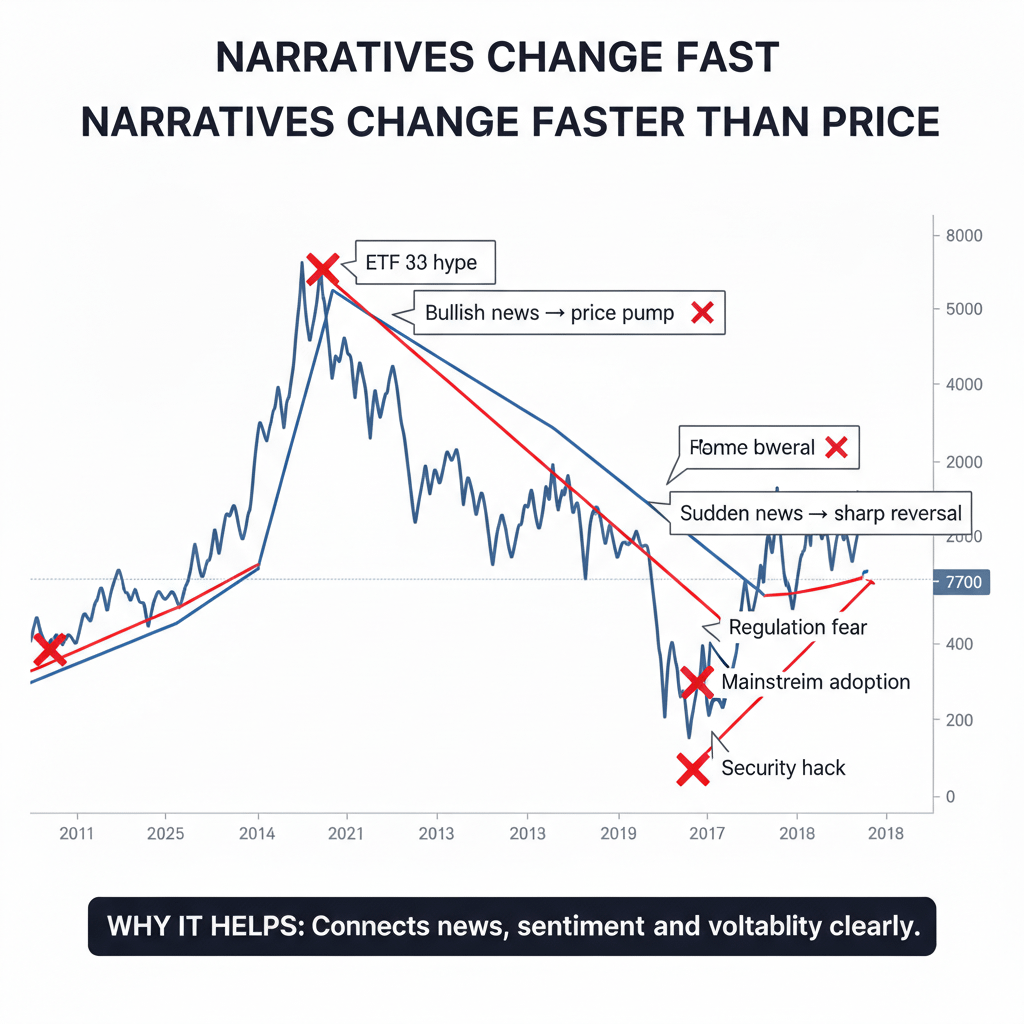

Narratives Change Fast

Crypto is driven by narratives, and narratives can flip overnight due to:

Regulation

Macroeconomic news

Funding imbalance

Sudden liquidity shifts

Influencers often stick to one bias instead of adapting.

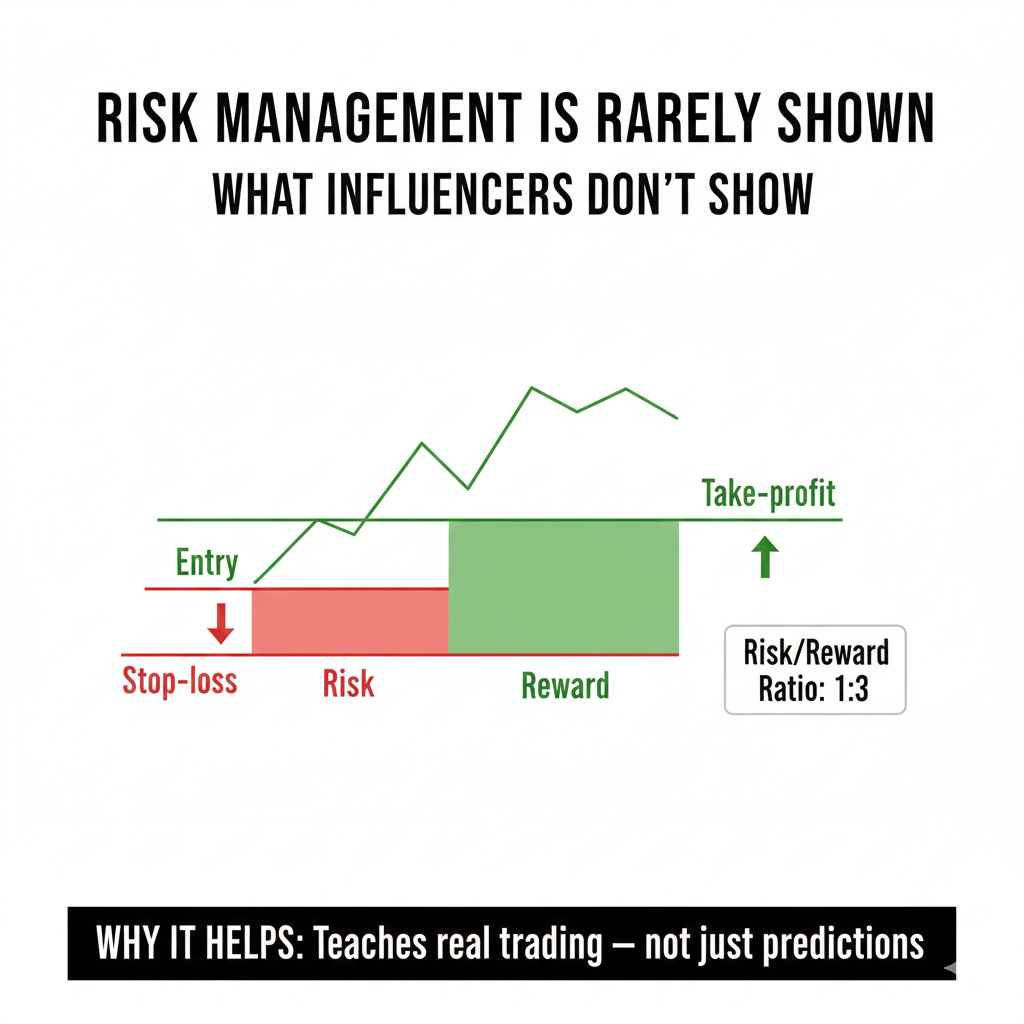

Risk Management Is Rarely Shown

Influencers share:

Entries

Targets

But rarely:

Stop losses

Position sizing

Invalidation levels

Yet risk management matters more than being right.

What Actually Works

Successful traders focus on:

Positioning, not prediction

Risk/reward, not certainty

Patience, not hype

You don’t need perfect timing to make money, you need discipline.

Final Thought

Influencers aren’t the problem.

Blindly following predictions is.

Use influencers to gauge sentiment, not direction.

The market rewards risk control, not follower count.

💬 Question:

Do you trade influencer predictions, or your own strategy?

Let’s discuss 👇